FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

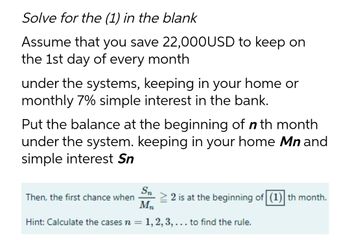

Transcribed Image Text:Solve for the (1) in the blank

Assume that you save 22,000USD to keep on

the 1st day of every month

under the systems, keeping in your home or

monthly 7% simple interest in the bank.

Put the balance at the beginning of n th month

under the system. keeping in your home Mn and

simple interest Sn

Sn

Then, the first chance when

≥ 2 is at the beginning of (1) th month.

Mn

Hint: Calculate the cases n = 1, 2, 3, ... to find the rule.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Please answer asap and don’t use excelarrow_forwardYou owe $2,500 in 5 months and $4,750 in 15 months. Your creditor has agreed to let you make one interest rate and a Focal Point Now. What single cash payment will make? single cash payment NOW using a 4% simple Round Each calculation to the nearest penny (even if zero), USE dollar signs, USE commas if and where needed Iarrow_forwardCOMPARING INTEREST COST. You currently have a credit card that charges 18.99% interest. You receive an offer for a new credit card with a teaser rate of 9.99% for the first 6 month...after that the rate goes up to 24.99%. 14a) What is the total annual interest on the current credit card? 14b) What will be the interest in the first year after you switch? 14C) Should you switch? why?arrow_forward

- Saving Later Plan 2: Invest $350 at the end of each month into an account paying 7.5% compounded monthly for 15 years then leave the money in the account earning interest until retirement (making no additional withdrawals or investments until retirement). Using the assumptions above, write down your answer to each of the following questions. 19. Create the following table of values for this investment plan. Saving Later Plan 2, tuho table should be handwritten) to find the amount available after 15 years. Write N/A next to any variable that does not apply and write Solve next to the appropriate varlable. P%3D r = A = M = n = 20. Indicate the best formula to use to compute the amount available after 15 years. 21. Substitute the values into the formula and compute how much money will be available after 15 years.arrow_forwardHelp me fastarrow_forwardSaving Later Plan 2: Invest $350 at the end of each month into an account paying 7.5% compounded monthly for 15 years then leave the money in the account earning interest until retirement (making no additional withdrawals or investments until retirement). Using the assumptions above, write down your answer to each of the following questions: 19. Create the following table of values for this investment plan, Saving Later Plan 2, (the table should be handwritten) to find the amount available after 15 years. Write N/A next to any variable that does not apply and write Solve next to the appropriate variable. P = A = t 3D M =arrow_forward

- John takes out a loan for $9600 at 10% interest compounded monthly and is making payments of $136 a month. Calculate his remaining balance after 12 months. John's balance due after 12 months will be $ Time Value of Money Solver Enter the given values. N: = 0 Number of Payment Periods 1:%= 0 Annual Interest Rate as a Percent PV: = Present Value. 0 PMT: = 0 Payment FV: == Future Value P/Y: 12 O Payments per Year C/Y: 0 12 0 Compounding Periods per Year PMT: = END Solve Solve Solve Solve Solvearrow_forwardGive me right solution according to the question options also given A person deposits $150 per month into a savings account for 2 years. if $75 is withdrawn in months 5,7 and 8 (in addition to the deposits), construct the cash flow diagram to determine how much will be in the account after 2 years at i=8% per year, compound quarterly. Assume there is no interperiod interest. A. $ 2,045 B. $3609 C. $3090 D. $4050arrow_forwardSuppose you secure a home improvement loan in the amount of $5,000 from a local bank. The loan officer gives you the following loan terms:• Contract amount = $5,000• Contract period = 24 months• Annual percentage rate = 12%• Monthly installment = $235 .37Shown is the cash flow diagram for this loan. Construct the loan payment schedule by showing the remaining balance, interest payment, and principal payment at the end of each period over the life of the loan.arrow_forward

- Find the interest paid on a loan of $2,600 for three years at a simple interest rate of 10% per year. .... The interest on the loan is $ st Help Me Solve This Calculator Get More Help - Cle JDecimals & Percents.6 J Decimals & Percents-7 / Decimals & Percents-8 ype here to search DELL prt sc F10 F2 F3 F4 F5 F6 F7 FB F9 %23 %24 & 4. 7. R. * CO 5arrow_forwardA bank offers two alternative interest schedules for a savings account of $100,000 locked in for 3 years: (a) a monthly rate of 1% and (b) an annually, continuously compounded rate of 12%. Which alternative should you choose? Hint: convert APR to EAR, then compare the two optionsarrow_forwardSuppose you invest $25 per week into an account that earns 2% compounded weekly. You make the deposits at the beginning of each week. If you continue to make these deposits for 40 years, how much will you save? Group of answer choices $73,443.56 $79,668.54 $53,040.00 $79,637.91arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education