FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Check my

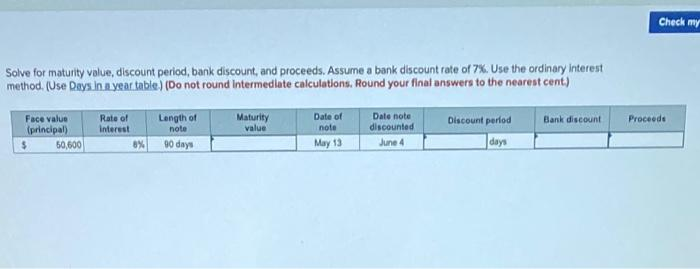

Solve for maturity value, discount period, bank discount, and proceeds. Assume a bank discount rate of 7%. Use the ordinary interest

method. (Use Days in.a year table) (Do not round Intermediate calculations. Round your final answers to the nearest cent.)

Maturity

value

Date of

Rate of

Interest

Length of

note

Date note

discounted

Proceede

Face value

(principal)

60,600

Discount perlod

Bank discount

note

90 days

May 13

|days

June 4

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Compute the principal (in $) for the loan. Use ordinary interest when time is stated in days. Principal Rate (%) Time Interest $ 9 6 months $1,575arrow_forwardMaturity Dates of Notes Receivable Determine the maturity date and compute the interest for each of the following notes: (Round to the nearest dollar.)\table[[,\table[[Date of], [Note]], Interest,], [a., August 5, $12,000,9%, 120 days], [b., May 10, 33,600,7%, 90 days ], [c., October 20, 48,000, 12%, 45 days], [d., July 16,9,000, 10%, 60 days], [e., September 15, 19,000,7%,75 days]]arrow_forwardRaghubhaiarrow_forward

- Calculate the due date, interest due, and maturity value of the following notes: Date of Note Face Amount Interest Rate Term of Note Due Date Interest Due Maturity Value a. 24-Apr $70,000 3% 60 days b. 13-Jul 30,000 5% 120 days c. 9-Aug 40,000 4% 45 days d. 12-Sep 60,000 8% 90 days e. 5-Nov 50,000 6% 30 daysarrow_forwardNonearrow_forwardCheck my wor Solve for maturity value, discount period, bank discount, and proceeds. Assume a bank discount rate of 9%. Use the ordinary interest method. (Use Days in a year table.) (Do not round intermediate calculations. Round your final answers to the nearest cent.) Face value Rate of Length of note Date note (principal) $26, 300 interest Maturity value Date of note discounted 9% 65 days Discount period Bank discount Proceeds March 17 April 20 days 24 $4 hparrow_forward

- Calculate the due date, interest due, and maturity value of the following notes: Date of Note Face Amount Interest Rate Term of Note Due Date Interest Due Maturity Value a. 24-Apr $70,000 3% 60 days b. 13-Jul 30,000 5% 120 days c. 9-Aug 40,000 4% 45 days d. 12-Sep 60,000 8% 90 days e. 5-Nov 50,000 6% 30 daysarrow_forwardCompute bank discount using (A) ordinary interest, (B) proceeds, and (C) effective interest rate to the nearest hundredth. Do not round denominator in your calculation. Face Value Discount Rate Time in Days $9,000 14% 110arrow_forwardAmortize Discount by Interest Method On the first day of its fiscal year, Ebert Company issued $23,000,000 of 5-year, 10% bonds to finance its operations. Interest is payable semiannually. The bonds were issued at a market (effective) interest rate of 12%, resulting in Ebert receiving cash of $21,307,304. The company uses the interest method. a. Journalize the entries to record the following: 1. Sale of the bonds. Round to the nearest dollar. If an amount box does not require an entry, leave it blank. Cash 21,307,304 Discount on Bonds Payable 1,692,696 Bonds Payable v 23,000,000 Feedback Check My Work 2. First semiannual interest payment, including amortization of discount. Round to the nearest dollar. If an amount box does not require an entry, leave it blank. Interest Expense v Discount on Bonds Payable v Cash v Feedback Check My Workarrow_forward

- Determine the due date and the amount of interest due at maturity on the following notes: Date of Note Face Amount Interest Rate Term of Note a. January 10* $40,000 5% 90 days b. March 19 18,000 8 180 days c. June 5 90,000 7 30 days d. September 8 36,000 3 90 days e. November 20 27,000 4 60 days *Assume that February has 28 days. Assume 360-days in a year when computing the interest. Note Due Date Interest a. $fill in the blank 2 b. fill in the blank 4 c. fill in the blank 6 d. fill in the blank 8 e. fill in the blank 10arrow_forwardThe following interest-bearing promissory note was discounted at a bank by the payee before maturity. Use the ordinary interest method, 360 days, to calculate the missing information. (Round dollars to the nearest cent.) Face Value Interest Rate (%) Date of Note Term of Note (days) Maturity Date Maturity Value (in $) $750 141 June 9 135 ---Select--- * $ 794.96 2 Date of Discount Discount Period (days) Sept. 5 × Discount Rate (%) 15.5 $ tA Proceeds (in $)arrow_forward25. The following interest-bearing promissory note was discounted at a bank by the payee before maturity. Use the ordinary interest method, 360 days, to calculate the missing information. (Round dollars to the nearest cent.) FaceValue InterestRate (%) Date ofNote Term ofNote (days) MaturityDate MaturityValue(in $) $2,200 12 Mar. 7 80 $ Date ofDiscount DiscountPeriod (days) DiscountRate (%) Proceeds(in $) Apr. 15 19 $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education