FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

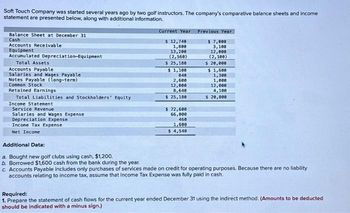

Transcribed Image Text:Soft Touch Company was started several years ago by two golf instructors. The company's comparative balance sheets and income

statement are presented below, along with additional information.

Balance Sheet at December 31

Cash

Accounts Receivable

Equipment

Accumulated Depreciation-Equipment

Total Assets

Accounts Payable

Salaries and Wages Payable

Notes Payable (long-term)

Common Stock

Retained Earnings

Total Liabilities and Stockholders' Equity

Income Statement

Service Revenue

Salaries and Wages Expense

Depreciation Expense

Income Tax Expense

Net Income

Current Year

$ 12,740

1,808

13,200

(2,560)

$ 25,188

$ 1,100

848

2,600

12,000

8,648

$ 25,180

$ 72,600

66,000

460

1,600

$ 4,540

Previous Year

$ 7,000

3,100

12,000

(2,100)

$ 20,000

$ 1,600

1,300

1,000

12,000

4,100

$ 20,000

Additional Data:

a Bought new golf clubs using cash, $1,200.

b. Borrowed $1,600 cash from the bank during the year.

c. Accounts Payable includes only purchases of services made on credit for operating purposes. Because there are no liability

accounts relating to income tax, assume that Income Tax Expense was fully paid in cash.

Required:

1. Prepare the statement of cash flows for the current year ended December 31 using the indirect method. (Amounts to be deducted

should be indicated with a minus sign.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- You are given the two financial statements (the photo below). The owner, Mr. Howell, has asked you to give recommendations as to how he can improve the working capital of the shop. Enumerate what he can do to improve his operations. State the basis of your claim and any supporting computation.arrow_forwardPharoah Service Shop started the year with total assets of $ 326000 and total liabilities of $ 238000. During the year, the business recorded $ 630000 in revenues, $ 441000 in expenses, and owner drawings of $ 60400.The net income reported by Pharoah Service Shop for the year was $ 216600. $ 128600. $ 238000. $ 189000.arrow_forwardDuring the year, the Flight Company experienced the following accounting transactions: 1. Issued common stock in the amount of $150,0002. Paid a $30,000 cash dividend3. Borrowed $25,000 from a bank4. Made a principal payment of $3,500 on an outstanding bank loan5. Made an interest payment of $1,200 on an outstanding bank loan Using the accounting equation, record each of the transactions in columnar format using the following template:Use negative signs with answers, when appropriate.arrow_forward

- please provide correct answerarrow_forwardMarriott International, Inc., and Hyatt Hotels Corporation are two major owners and managers of lodging and resort properties in the United States. Abstracted income statement information for the two companies is as follows for a recent year (in millions):Please see the attachment for details:1. Determine the following ratios for both companies, rounding ratios and percentages to one decimal place:a. Return on total assetsb. Return on stockholders’ equityc. Times interest earnedd. Ratio of total liabilities to stockholders’ equity2. Based on the information in (1), analyze and compare the two companies’ solvency and profitability.arrow_forwardPrepare general journal entries for the following transactions of Sustain Company. Use the following (partial) chart of accounts: Cash; Prepaid Insurance; Accounts Receivable; Furniture; Accounts Payable; Unearned Revenue; Fees Earned; and T. James, Capital. June 1 T. James, owner, invested $11,000 cash in Sustain Company. 2 The company purchased $4,000 of furniture made from reclaimed wood on credit. 3 The company paid $600 cash for a 12-month insurance policy on the reclaimed furniture. 4 The company billed a customer $3,000 in fees earned from preparing a sustainability report. 12 The company paid $4,000 cash toward the payable from the June 2 furniture purchase. 20 The company collected $3,000 cash for fees billed on June 4. 21 T. James invested an additional $10,000 cash in Sustain Company. 30 The company received $5,000 cash from a client for sustainability services for the next 3 months.arrow_forward

- Rudy Gandolfi owns and operates Rudy's Furniture Emporium Incorporated. The balance sheet totals for assets, liabilities, and stockholders' equity at August 1, 2022, are as indicated. Described here are several transactions entered into by the company throughout the month of August. Required: a. Indicate the amount and effect of each transaction on total assets, total liabilities, and total stockholders' equity, and then compute the new totals for each category. The first transaction is provided as an illustration. b. What was the amount of net income (or loss) during August? How much were total revenues and total expenses during August? c. What were the net changes during the month of August in total assets, total liabilities, and total stockholders' equity? d. Which of the following statement(s) is/are true?arrow_forwardCanyon Canoe Company is a company that rents canoes for use on local lakes and rivers. Owner Amber decided that she will create a new corporation, Canyon Canoe Company. The business began operations on January 1, 2020. Use the attached excel file for this exercise. Use the following accounts for this exercise: 1100 Cash; 1200 Accounts Receivable; 1400 Office Supplies; 1700 Canoes; 2100 Accounts Payable; 3100 Amber Wilson, Capital; 3200 Amber Wilson, Withdrawals; 4000 Canoe Rental Revenue; 5100 Rent Expense; 5200 Salaries Expense; 5300 Utility Expense; and 5400 Telephone Expense. 1. Record the Following Transactions for Canyon Canoe Company for the month of January 2020 in the Transaction Journal: January 1 Amber Wilson invested $16,000 cash in the business by opening a bank account in the name of Canyon Canoe Company. 2 The company leased a building and paid $1,200 for the first month's rent. 3 The company purchased canoes for $4,800 on account. 4 The company purchased office supplies…arrow_forwardSee the answer Decision-Making Across the Organization Kathy and James Mohr, local golf stars, opened the Chip-Shot Driving Range Company on March 1, 2017. They invested $25,000 cash and received common stock in exchange for their investment. A caddy shack was constructed for cash at a cost of $8,000, and $800 was spent on golf balls and golf clubs. The Mohrs leased five acres of land at a cost of $1,000 per month and paid the first month's rent. During the first month, advertising costs totaled $750, of which $150 was unpaid at March 31, and $400 was paid to members of the high-school golf team for retrieving golf balls. All revenues from customers were deposited in the company's bank account. On March 15, Kathy and James received a dividend of $1,000. A $100 utility bill was received on March 31 but was not paid. On March 31, the balance in the company's bank account was $18,900. Kathy and James thought they had a pretty good first month of operations. But, their estimates of…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education