ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

is my part (c) correct?

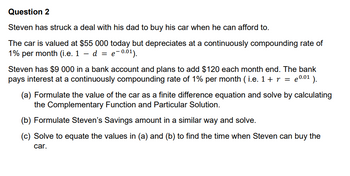

Transcribed Image Text:Question 2

Steven has struck a deal with his dad to buy his car when he can afford to.

The car is valued at $55 000 today but depreciates at a continuously compounding rate of

1% per month (i.e. 1 — d = e−0.01).

Steven has $9 000 in a bank account and plans to add $120 each month end. The bank

pays interest at a continuously compounding rate of 1% per month (i.e. 1 + r = 0.0¹).

(a) Formulate the value of the car as a finite difference equation and solve by calculating

the Complementary Function and Particular Solution.

(b) Formulate Steven's Savings amount in a similar way and solve.

(c) Solve to equate the values in (a) and (b) to find the time when Steven can buy the

car.

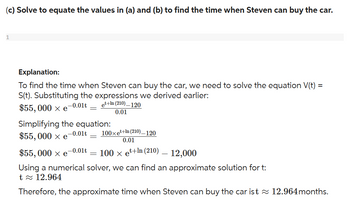

Transcribed Image Text:(c) Solve to equate the values in (a) and (b) to find the time when Steven can buy the car.

1

Explanation:

To find the time when Steven can buy the car, we need to solve the equation V(t) =

S(t). Substituting the expressions we derived earlier:

-0.01t

$55,000 × e

Simplifying the equation:

-0.01t 100xet+In (210)_120

$55,000 × e =

et+In (210)_120

0.01

0.01

$55, 000 × e

100 × et+In (210)

12,000

Using a numerical solver, we can find an approximate solution for t:

t≈ 12.964

Therefore, the approximate time when Steven can buy the car ist≈ 12.964 months.

-0.01t

=

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

I heard that t = 66 months, is this true or false?

Solution

by Bartleby Expert

Follow-up Question

So my t = 12.964 is wrong? How can I be sure that t = 90? Greatly Appreciated!!

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

I heard that t = 66 months, is this true or false?

Solution

by Bartleby Expert

Follow-up Question

So my t = 12.964 is wrong? How can I be sure that t = 90? Greatly Appreciated!!

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardWhen performing engineering economic analysis, why should the appropriate price indices be selected?arrow_forwardSubject: Engineering Economics An earth compactor costs Rs. 2,00,000 and has an economic life of 9 years. However, the purchaser needs it for only one project that will be completed in 3 years. At the end of the project, it can be sold for one-half its purchase price. What is the annual cost to the owner, if the required rate of return is 12 percent.arrow_forward

- The capital share in Peru is a = 2/3. Relative to last year, capital in- creased by 20%, labor hours increased by 10%, and total output increased by 25%. Which is the closest approximation number for the growth in Total Factor Productivity, A? (a) -5% (b) 11.6% (c) 8.3% (d) 0%arrow_forward1.28 Use economic equivalence to determine the amount of money or value of i that makes the following statements correct. (a) $5000 today is equivalent to $4275 exactly 1 year ago at i =% per year. (b) A car that costs $28,000 today will a year from now at i = cost $ 4% per year. (c) At i = 4% per year, a car that costs $28,000 now, would have cost $ one year ago.arrow_forwardSubject: Engineering Economics A person is just 30 years old. He plans to invest an equal sum of Rs. 20,000 every year for the next 30 years from the end of next year. The bank gives 10% interest compounded annually. Find the maturity value of his account when he is 60 years old.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education