FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

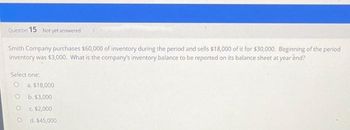

Transcribed Image Text:Question 15 Not yet answered

Smith Company purchases $60,000 of inventory during the period and sells $18,000 of it for $30,000. Beginning of the period

inventory was $3,000. What is the company's inventory balance to be reported on its balance sheet at year end?

Select one:

O a. $18,000

b. $3,000

c. $2,000

O d. $45,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The records of Cordova Corp. showed the following transactions, in the order given, relating to the major inventory item: Unit Cost Units 4,800 $7.80 9,600 8.10 6,700 8,600 8.40 14,400 16,400 8.56 14,400 9,600 8.70 1. 2. 3. 4. 5. 6. 7. Sale (at $19.80) 8. Purchase Inventory Purchase Sale (at $16.80) Purchase Sale (at $16.80) Purchase Required: Complete the following schedule for each independent assumption. (Round unit costs to the nearest cent.) Independent Assumptions a. FIFO b. Weighted average, periodic inventory system c. Moving average, perpetual inventory system Ending Inventory Units and Amounts Cost of Goods Sold Gross Marginarrow_forwardJC Manufacturing purchased inventory for $4,400 and also paid a $320 freight bill. JC Manufacturing returned 45% of the goods to the seller and later took a 1% purchase discount. Assume JC Manufacturing uses a perpetual inventory system. What is JC Manufacturing's final cost of the inventory that it kept? (Round your answer to the nearest whole number.) OA. $1,960 OB. $2,716 OC. $2,570 OD. $2,396arrow_forwardWynn started the period with 80 units in beginning inventory that costs $7.50 each. During the period, the company purchased inventory items as follows: Purchase - no. Of items - cost 1 - 200 - $9.00 2 - 150 - $9.30 3 - 50 - $10.50 Wynn sold 220 units after purchase 3 for $17.00 each. What is Wynn's ending inventory under weighted average (round)? A. $2,361 B. $1,998 C. $1,980 D.$ 2,340arrow_forward

- Company "A" started the period with 85 units in beginning inventory that cost $2.60 each. During the period, the company purchased inventory items as follows. Company sold 315 units after purchase 3 for $10.80 each. Purchase, No. of Items, Cost1 290 $ 3.102 195 $ 3.203 50 $ 3.60Companies cost of goods sold under FIFO would bearrow_forwardLux had net purchases of $50,000, ending inventory of $25,000, net sales of $100,000, and gross profit of $32,000. How much was Lux's beginning inventory? O $7,000 O $43,000 O $93,000 O $143,000arrow_forwardNiles Co. has the following data related to an item of inventory: Inventory, March 1 400 units @ $2.10 Purchase, March 7 1,400 units @ $2.20 Purchase, March 16 280 units @ $2.25 March 31 520 units The value assigned to cost of goods sold if Niles uses FIFO is: A) $3,448. B) $3,392. C) $1,160. D) $1,104. 2. Emley Company has been using the LIFO method of inventory valuation for 10 years since it began operations. Its 2020 ending inventory was $60,000, but it would have been $90,000 if FIFO had been used. Thus, if FIFO had been used, Emley’s income before income taxes would have been: A) $30,000 less in 2020. B) $30,000 greater in 2020. C) $30,000 greater over the 10-year period. 3. Nichols Company had 500 units of “SIO” in its inventory at a cost of $5 each. It purchased, for $2,400, more units of “SIO”. Nichols then sold 600 units at a selling price of $10 each, resulting in a gross profit of $2,100. The cost flow assumption used by Nichols: A) is FIFO. B) is weighted average. C) is…arrow_forward

- On June 1, Delaware Co. had one unit in beginning inventory that cost $10.00. During June, Delaware paid cash to purchase two additional inventory items. Delaware purchased the first item for cash at a cost of $10.00, and the second at a cost of $12.00. Delaware Co. sold two inventory items for $24.00 each, receiving cash. Based on this information alone, indicate whether each of the following items is true or false. a) The amount of ending inventory will be $10 assuming the LIFO cost flow was used. b) Cost of goods sold would be $24 assuming the weighted average cost flow was used. c) Cash flow from operating activities in June would be $28 assuming a FIFO cost flow was used. d) Cash flow from operating activities in June would be $26 independent of what cost flow assumption was used. e) The amount of gross margin would be $26 assuming the FIFO cost flow was used.arrow_forwardPeterson Manufacturing purchased inventory for $5,900 and also paid a $330 freight bill. Peterson Manufacturing returned 40% of the goods to the seller and later took a 1% purchase discount. Assume Peterson Manufacturing uses a perpetual inventory system. What is Peterson Manufacturing's final cost of the inventory that it kept? (Round your answer to the nearest whole number.) OA. $3,505 OB. $3,835 OC. $3,701 OD. $2,336 RECORarrow_forwardA company had inventory, on November 1 of 22 units at a cost of $26 each. On November 2, they purchased 27 units at $27 each. On November 6, they purchased 23 units at $29 each. On November 8, 25 units were sold for $38 each. Using the FIFO perpetual inventory method, what was the value of the inventory on November 8 after the sale? Multiple Choice о $1,315 $1,269 $1,222 $1,247 $1,271arrow_forward

- Falkenberg Company uses the periodic method. They had the following inventory transactions throughout the period. (Assume these are the only transactions for the period). Additionally, Falkenberg had $13,200 of Operating Expenses, $4,500 of Interest Revenue and $3,300 of Interest Expense for the period. March 3: Purchased $160,000 of merchandise from Lin Company under terms 2/10, n/30. March 4: Paid $900 in freight charges to ship goods from Lin Company. March 7: Returned $10,000 of goods to Lin Company that were deemed defective. March 13: Paid the balance due to Lin Company. March 20: Sold goods costing $120,000 to Renner company for $156,000 under terms 1/15, n/30. March 25: Renner returned $14,300 of goods to Falkenberg. The goods cost Falkenberg $11,000. April 4 – Renner paid Falkenberg the balance due. 1.What is Falkenberg’s Net Purchases? What is Falkenberg’s Cost of Goods Purchased? What is Falkenberg’s Cost of Goods Available for sale, assuming that beginning inventory is…arrow_forwardThe inventory accounting records for Lee Enterprises contained the following data: Beginning inventory 400 units at $13 each Purchase 1, Feb. 26 2,300 units at $14 each Sale 1, March 9 2,500 units at $27 each Purchase 2, June 14 2,200 units at $15 each Sale 2, Sept. 22 2,100 units at $29 each Required: Calculate the cost of ending inventory and the cost of goods sold using the FIFO, LIFO, and average cost methods. (Note: Use four decimal places for per-unit calculations and round all other numbers to the nearest dollar.) FIFO LIFO Average cost Cost of ending inventory Cost of goods soldarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education