Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

I don't need ai answer general accounting question

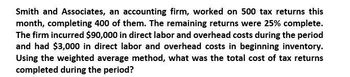

Transcribed Image Text:Smith and Associates, an accounting firm, worked on 500 tax returns this

month, completing 400 of them. The remaining returns were 25% complete.

The firm incurred $90,000 in direct labor and overhead costs during the period

and had $3,000 in direct labor and overhead costs in beginning inventory.

Using the weighted average method, what was the total cost of tax returns

completed during the period?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- For the past year, Momsen, Ltd., had sales of $46,577, interest expense of $3,932, cost of goods sold of $16,834, selling and administrative expense of $11,861, and depreciation of $6,560. If the tax rate was 38 percent, what was the company's net income?arrow_forwardWhat was Carter electronics income from operations on these general accounting question?arrow_forwardFor the past year, shame ltd., had sales of $45,002, interest expense of $4,306, cost of goods sold of $18,349, selling and administrative expense of $12,146, and depreciation of $6,995. If the tax rate was 33 percent, what was the company's net income?arrow_forward

- AJ Manufacturing Company incurred $50,500 of fixed product cost and $40,400 of variable product cost during its first year of operation. Also during its first year, AJ incurred $16,150 of fixed and $13,100 of variable selling and administrative costs. The company sold all of the units it produced for $162,000. Required a. Prepare an income statement using the format required by generally accepted accounting Principles (GAAP). b. Prepare an income statement using the contribution margin approach. Complete this question by entering your answers in the tabs below. Required A Required B Prepare an income statement using the format required by generally accepted accounting Principles (GAAP). AJ MANUFACTURING COMPANY Income Statementarrow_forwardDiamond, Inc. had the following Income Statement at the end of the year. Compute Diamond's federal income tax expense given the tax rate of 21%. What is the company's net income?arrow_forwardAJ Manufacturing Company Incurred $55,500 of fixed product cost and $44,400 of variable product cost during its first year of operation. Also during its first year, AJ incurred $17.650 of fixed and $14.100 of variable selling and administrative costs. The company sold all of the units it produced for $182.000. Required a. Prepare an income statement using the format required by generally accepted accounting Principles (GAAP) b. Prepare an income statement using the contribution margin approach. Complete this question by entering your answers in the tabs below. Required A Required B Prepare an income statement using the format required by generally accepted accounting Principles (GAAP). AJ MANUFACTURING COMPANY Income Statementarrow_forward

- AJ Manufacturing Company incurred $55,000 of fixed product cost and $44,000 of variable product cost during its first year of operation. Also during its first year, AJ incurred $17,500 of fixed and $14,000 of variable selling and administrative costs. The company sold all of the units it produced for $180,000. Required a. Prepare an income statement using the format required by generally accepted accounting Principles (GAAP). b. Prepare an income statement using the contribution margin approach.arrow_forwardAJ Manufacturing Company incurred $50,500 of fixed product cost and $40.400 of variable product cost during its first year of operation. Also during its first year, AJ incurred $16,150 of fixed and $13,100 of variable selling and administrative costs. The company sold all of the units it produced for $162,000. Required a. Prepare an income statement using the format required by generally accepted accounting Principles (GAAP). b. Prepare an income statement using the contribution margin approach. Complete this question by entering your answers in the tabs below. Required A Required B Prepare an income statement using the format required by generally accepted accounting Principles (GAAP). AJ MANUFACTURING COMPANY Income Statement Required B > Mc Graw Hillarrow_forwardWhat is the net income of this general accounting question?arrow_forward

- XYZ Co has disclosed the following financial information for the period ending 12/31/19: sales of $1,522,982, cost of goods sold of $825,220, depreciation expenses of $101,083, and interest expenses of $80,341. Assume that the firm has an average tax rate of 35 percent. What is the company's net income?( Please round your answer for the Tax and Net income line to the whole number, for example 5. ) Sales COGS ( ? ) Deprecation ( ? ) Interest exp ( ? ) Pre-Tax Income ? Tax ( ? ) Net Income ?arrow_forwardDuring its first year of operations, Silverman Company paid $10,285 for direct materials and $9,800 for production workers' wages. Lease payments and utilities on the production facilities amounted to $8,800 while general, selling, and administrative expenses totaled $4,300. The company produced 5,450 units and sold 3,300 units at a price of $7.80 a unit. What is the amount of finished goods Inventory on the balance sheet at year-end? Multiple Choice O O O O $11,395 $5,698 $2,150 $8,250arrow_forwardAll products at Luke Corp. are allocated a portion of corporate overhead costs, which is computed as a percent of product revenue. The percentage rate is based on the level of corporate costs as a percentage of revenues. Data on corporate costs and revenues for the past two years were stated as: Corporate Revenue Corporate Overhead Costs Most recent year $ 112,750,000 $ 10,237,500 Previous year $ 76,200,000 $ 7,921,000 Using the data in the table apply the high low method (based on revenues) to determine the variable corporate overhead costs per sales dollar. Round to the nearest 0.001.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning  Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning