FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

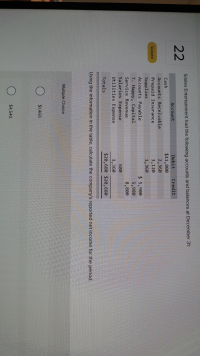

Transcribed Image Text:Smiles Entertainment had the following accounts and balances at December 31:

22

Account

Debit

Credit

Cash

$11,800

Accounts Receivable

2,360

Prepaid Insurance

Supplies

Accounts Payable

Skipped

3,120

1,360

$ 5,900

T. Happy, Capital

5,980

Service Revenue

8,800

Salaries Expense

680

Utilities Expense

1,360

Totals

$20,680 $20,680

Using the information in the table, calculate the company's reported net income for the period.

Multiple Choice

$1,460.

$4,540.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Estimating Uncollectible Accounts and Reporting Accounts Receivable LaFond Company analyzes its accounts receivable at December 31, and arrives at the age categories below along with the percentages that are estimated as uncollectible. Accounts Estimated Receivable Loss % $ 90,000 20,000 11,000 6,000 Over 180 days past due 4,000 Total accounts receivable $ 131,000 Age Group 0-30 days past due 31-60 days past due 61-120 days past due 121-180 296 4 The balance of the allowance for uncollectible accounts is $520 on December 31, before any adjustments. Transaction Record bad debts expense 5 10 25 (a) What amount of bad debts expense will LaFond report in its income statement for the year? $0 Cash Asset (b) Use the financial statement effects template to record LaFond's bad debts expense for the year. Use negative signs with your answers, when appropriate. Noncash Assets Balance Sheet Liabilities Contributed Capital (c) What is the balance of accounts receivable on it December 31 balance…arrow_forwardThe following data (in millions) were adapted from recent financial statements of CVS Health Corporation (CVS). Year 2 Year 1 Sales $256,776 $194,579 Operating income 12,467 10,170 Average accounts receivable 18,624 15,406 1. Compute the accounts receivable turnover for Years 1 and 2. Round to one decimal place. Accounts Receivable Turnover Year 2 fill in the blank 1 Year 1 fill in the blank 2 2. Compute the days' sales in receivables for Years 1 and 2. Assume there are 365 days in the year, and round to the nearest day. Number of Days' Salesin Receivables Year 2 fill in the blank 3 days Year 1 fill in the blank 4 days 3. Compute the return on sales for Years 1 and 2. Round to one decimal place. Return on Sales Year 2 fill in the blank 5 % Year 1 fill in the blank 6 % 4. Based on the results in parts 1, 2, and 3, all the following are true except: The change in accounts receivable turnover from Year 1 to…arrow_forwardAccounts receivable turnover and days’ sales in receivables Financial statement data for years ending December 31 for Schultze-Solutions Company follow: 20Y2 20Y1 Sales $1,848,000 $1,881,000 Accounts receivable: Beginning of year 195,300 184,700 End of year 224,700 195,300 a. Determine the accounts receivable turnover for 20Y2 and 20Y1. If required, round the final answers to one decimal place. AccountsReceivableTurnover 20Y2 fill in the blank 1 20Y1 fill in the blank 2 b. Determine the days’ sales in receivables for 20Y2 and 20Y1. Use 365 days, if required round the final answers to one decimal place. Days’ Salesin Receivables 20Y2 fill in the blank 3 days 20Y1 fill in the blank 4 days c. Does the change in accounts receivable turnover and the days’ sales in receivables from 20Y1 to 20Y2 indicate a favorable or unfavorable changearrow_forward

- Below are amounts (in millions) from three companies' annual reports. WalCo TarMart CostGet Required: Beginning Accounts Receivable $1,805 6,116 619 Ending Accounts Receivable $2,752 6,644 655 Net Sales $321,427 66,878 67,963 1. Calculate the receivables turnover ratio and the average collection period for WalCo, TarMart and CostGet. 2. Which company appears most efficient in collecting cash from sales?arrow_forwardThe following is information related to Blossom Company for its first month of operations. Jan, 7- 15 23 Credit Sales Austin Co. Diaz Co. Noble Co. $11,800 7,300 11,100 Balance of Accounts Receivable Jan. 17 24 Austin Co. 29 Cash Collections Austin Co. Diaz Co. Noble Co. $7,900 4,900 Identify the balances that appear in the accounts receivable subsidiary ledger and the accounts receivable balance that appears in the general ledger at the end of January. 11.100 Subsidary Ledger Diaz Co, $ Noble Co. General Ledarrow_forwardes Vail Company recorded the following transactions during November. Date General Journal Debit Credit November 5 Accounts Receivable-Ski Shop 5,775 Sales 5,775 November 10 Accounts Receivable-Welcome Incorporated Sales 1,706 1,706 November 13 Accounts Receivable-Zia Company Sales 1,000 1,000 November 21 Sales Returns and Allowances 258 November 30 Accounts Receivable-Zia Company Accounts Receivable-Ski Shop 258 3,557 Sales 3,557 1. Post these entries to both the general ledger accounts and the accounts receivable ledger subsidiary ledger accounts. 2. Prepare a schedule of accounts receivable. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Post these entries to both the general ledger accounts and the accounts receivable ledger subsidiary ledger accounts. General Ledger Accounts Receivable Accounts Receivable Subsidiary Ledger Ski Shop Ending Balance 0 0 Sales Ending Balance 0 0 Zia Company Ending Balance 0 0arrow_forward

- 1. The following account balances were extracted from the accounting records of Macy Corporation at the end of the year:Accounts Receivable $1,100,000Allowance for Uncollectible Accounts (Credit) $37,000Uncollectible-Account Expense $63,000What is the net realizable value of the accounts receivable? Select one:A. $1,163,000B. $1,137,000C. $1,100,000D. $1,063,000 Please show all steps.arrow_forwardMifflin Company reported the following for the current year: Net sales $ 60,000 Cost of goods sold 38,000 Beginning balance in accounts receivable 14,000 Ending balance in accounts receivable 6,000 Compute (a) accounts receivable turnover and (b) days’ sales uncollected. Compute the accounts receivable turnover. Accounts Receivable Turnover Numerator: / Denominator: = Accounts Receivable Turnover / = Accounts receivable turnover / = times Compute the days’ sales uncollected. Days' Sales Uncollected Numerator: / Denominator: × Days = Days' Sales Uncollected / × = Days' sales uncollected / × = daysarrow_forwardFollowing is information from Jesper Company for its first month of business. 1. Identify the balances listed in the accounts payable subsidiary ledger. 2. Identify the Accounts Payable balance listed in the general ledger at month’s end.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education