ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Dear hero expert bro hand written not allowed.

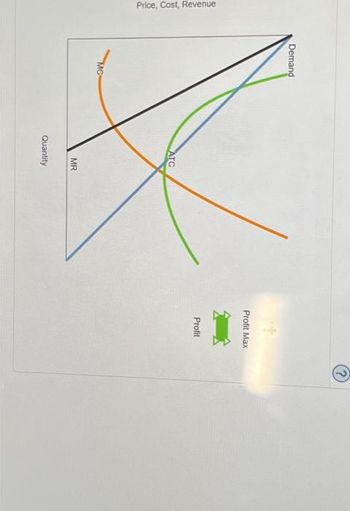

Transcribed Image Text:Sleek Sneakers Co. is one of many firms in the market for shoes.

Assume that Sleek is currently earning short-run economic profits. The following graph shows the demand and marginal-revenue (MR) curves faced by

Sleek in the short run, as well as its marginal-cost (MC) curve and average-total-cost (ATC) curve.

On the following graph, use the black point (plus symbol) to show the profit-maximizing output and price for a typical firm operating in a

monopolistically competitive environment. Then use the green rectangle (triangle symbols) to show the area representing profit.

Price, Cost, Revenue

STEP: 1 of 3

Demand

ATC

Profit Max

Profit

Transcribed Image Text:Price, Cost, Revenue

Demand

MC

Profit

K

ATC

MR

Quantity

Profit Max

?)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- IMF loan condition and challenges in Bangladesh. Please write this in 1500 word. Also include the referencearrow_forwardMaria takes out a 30-year mortgage at 5.5% to buy a house that costs $280,000. She must have a down payment of 3% of the purchase price.arrow_forwardTyped plz and Asap Please give me a quality solution thanksarrow_forward

- riginal price 3. Five years ago, Mary opened a savings account for a condo on the beach that earns 2.6% simple interest each year. She started the account with $550 and has not touched the account since. How much money is in the account now?arrow_forwardAnswer quick please. Do not need full workarrow_forwardIMF loan condition and challenges in Bangladesh. Please write this at least 1500 word. Must write this in 1500 word please and also provide the referencesarrow_forward

- You can earn 10% a year on your savings. Your dad offers you a Holiday Gift of $1000 this year, $2000 next Holiday, $3000 Holiday 2021. If instead he offered you $6,000 Holiday 2020 (next year). Which should you pick, the single payment or the 3 payments. SHOW YOUR WORK Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardWhat is the AVC and MC?arrow_forwardYou are in the market to buy a used car. Your monthly budget allows for a $300 per month car payment and you want to finance for 4 years. The current APR for a used car is 3%. a) Calculate the amount of loan you can afford. b) Complete the table below. Year 0 After 1 month After 2 months After 6 months After 1 year Loan Balance Interest Paidarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education