FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

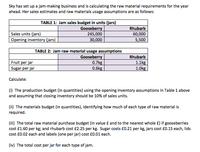

Transcribed Image Text:Sky has set up a jam-making business and is calculating the raw material requirements for the year

ahead. Her sales estimates and raw materials usage assumptions are as follows:

TABLE 1: Jam sales budget in units (jars)

Gooseberry

245,000

Rhubarb

Sales units (jars)

Opening inventory (jars)

60,000

5,500

30,000

TABLE 2: Jam raw material usage assumptions

Gooseberry

0.7kg

0.6kg

Rhubarb

Fruit per jar

Sugar per jar

1.1kg

1.0kg

Calculate:

(i) The production budget (in quantities) using the opening inventory assumptions in Table 1 above

and assuming that closing inventory should be 10% of sales units.

(ii) The materials budget (in quantities), identifying how much of each type of raw material is

required.

(iii) The total raw material purchase budget (in value £ and to the nearest whole £) if gooseberries

cost £1.60 per kg; and rhubarb cost £2.25 per kg. Sugar costs £0.21 per kg, jars cost £0.15 each, lids

cost £0.02 each and labels (one per jar) cost £0.01 each.

(iv) The total cost per jar for each type of jam.

Expert Solution

arrow_forward

Step 1

Note: Since you have posted a question with multiple sub-parts, we will solve first three subparts for you. To get remaining sub-part solved please repost the complete question and mention the sub-parts to be solved.

The production budget refers to the budget where the quantity to be produced in the particular future period is estimated by the entity.

Step by stepSolved in 4 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Edward Food Processing Company is a wholesale distributor of biscuits in Holborn.The Company has achieved steady growth over the past few years while Biscuitprices have been on the increase. The Company is planning its budget for the nextfinancial year. Presented below are the data used to project the current year’s aftertax income of £110,400. £Average Sales Price per Box 4.00Average variable costs per Box Cost of Biscuits 2.00 Profit on sale 0.40 Total 2.40Annual fixed cost Selling 160,000 Administrative 280,000 Total 440.000Expected annual sales volume (390,000 boxes) £1,560,000Tax rate 20%Biscuit manufacturers have announced that they will increase prices of theirproducts by an average of 15% in the coming year due to increase in material andlabour costs. Edward Food Processing expects same rates or levels as the currentyear Required: (b) Calculate the Sales price per box that the company must charge to cover the15% increase in the costs of biscuits and still maintain the…arrow_forwardEdward Food Processing Company is a wholesale distributor of biscuits in Holborn.The Company has achieved steady growth over the past few years while Biscuitprices have been on the increase. The Company is planning its budget for the nextfinancial year. Presented below are the data used to project the current year’s aftertax income of £110,400. Average Sales Price per Box 4.00Average variable costs per Box Cost of Biscuits 2.00 Profit on sale 0.40 Total 2.40Annual fixed cost Selling 160,000 Administrative 280,000 Total 440.000Expected annual sales volume (390,000 boxes) £1,560,000Tax rate 20%Biscuit manufacturers have announced that they will increase prices of theirproducts by an average of 15% in the coming year due to increase in material andlabour costs. Edward Food Processing expects same rates or levels as the currentyear. (a) Calculate Break-even point in boxes of biscuits for the current year. (b) Calculate the Sales price per box that the company must charge to cover the15%…arrow_forwardRequired information [The following information applies to the questions displayed below.] Black Diamond Company produces snowboards. Each snowboard requires 2 pounds of carbon fiber. Management reports that 6,400 snowboards and 7,400 pounds of carbon fiber are in inventory at the beginning of the third quarter, and that 164,000 snowboards are budgeted to be sold during the third quarter. Management wants to end the third quarter with 4,900 snowboards and 5,400 pounds of carbon fiber in inventory. Carbon fiber costs $13 per pound. Each snowboard requires 0.5 hour of direct labor at $18 per hour. Variable overhead is budgeted at the rate of $8 per direct labor hour. The company budgets fixed overhead of $1,796,000 for the quarter. 4. Prepare the factory overhead budget for the third quarter. BLACK DIAMOND COMPANY Factory Overhead Budget Third Quarter Direct labor hours needed Budgeted variable overhead Budgeted total factory overheadarrow_forward

- Great Bubbles, Inc. produces multicolored bubble solution used for weddings and other events. The company sold 70,000 bubble kits during December, and its actual operating income was as follows: (Click the icon to view the actual income statement.) The company's flexible budget income statement for December follows: (Click the icon to view the flexible budget income statement.) Read the requirements. Output units Sales revenue Variable expenses: Cost of goods sold Sales commissions expense Utility expense Fixed expenses: Salary expense Depreciation expense Rent expense Utility expense Income Statement Performance Report For the month ended December 31 The Actual Flexible Budget Variance Flexible Budget These variances suggest that the marketing department did a Volume Variance job by selling Question 1 of 4 > Master Budget ▼kits than expected, at a Data table sale price than expected. Great Bubbles, Inc. Income Statement Month Ended December 31 $ Sales revenue.. Variable expenses: Cost…arrow_forwardParisian Cosmetics Company is planning a one-month campaign for September to promote sales of one of its two cosmetics products. A total of $135,539 has been budgeted for advertising, contests, redeemable coupons, and other promotional activities. The following data have been assembled for their possible usefulness in deciding which of the products to select for the campaign: Moisturizer Perfume Unit selling price $55.23 $59.67 Unit production costs: Direct materials $ 9.01 $13.94 Direct labor 3.02 5.00 Variable factory overhead 3.07 4.94 Fixed factory overhead 6.00 3.98 Total unit production costs $21.10 $27.86 Unit variable selling expenses 16.02 14.94 Unit fixed selling expenses 12.07 5.93 Total unit costs $49.19 $48.73 Operating income per unit $ 6.04 $10.94 No increase in facilities would be necessary to produce and sell the increased output. It is anticipated that 22,000 additional units of moisturizer or 20,000 additional units of perfume…arrow_forwardMargot's Ice Cream operates several stores in a major metropolitan city and its suburbs. Its budget and operating data for the current year follow: Budgeted Data Selling Price per Actual Operating Results Selling Price per Variable Variable Costs per Costs per Flavor Gallons Gallon Gallon Gallons Gallon Gallon $ 1.35 $ 0.65 $ 1.20 $ 0.55 252,000 315,000 210,000 63,000 192,000 285,000 340,000 183,000 Vanilla Chocolate 1.70 0.80 1.55 0.70 Strawberry Anchovy 1.90 0.80 2.10 0.85 2.70 1.20 3.20 1.40 Required: 1. Compute these variances for the individual flavors and total quantity sold. (Use the Contribution Margin in your calculations and do not round intermediate calculations.) a. b. C. Flavor Sales Volume Variance Sales Mix Variance Sales Quantity Variance Vanilla Chocolate Strawberry Anchovy Totalarrow_forward

- Parisian Cosmetics Company is planning a one-month campaign for September to promote sales of one of its two cosmetics products. A total of $140,000 has been budgeted for advertising, contests, redeemable coupons, and other promotional activities. The following data have been assembled for their possible usefulness in deciding which of the products to select for the campaign: Moisturizer Perfume Unit selling price $55 $60 Unit production costs: Direct materials $ 9 $14 Direct labor 3 5 Variable factory overhead 3 5 Fixed factory overhead 6 4 Total unit production costs $21 $28 Unit variable selling expenses 16 15 Unit fixed selling expenses 12 6 Total unit costs $49 $49 Operating income per unit $ 6 $11 No increase in facilities would be necessary to produce and sell the increased output. It is anticipated that 22,000 additional units of moisturizer or 20,000 additional units of perfume could be sold from the campaign without changing the unit…arrow_forwardIguana, Inc., manufactures bamboo picture frames that sell for $25 each. Each frame requires 4 linear feet of bamboo, which costs $2.00 per foot. Each frame takes approximately 30 minutes to build, and the labor rate averages $12.00 per hour. Iguana has the following inventory policies: Ending finished goods inventory should be 40 percent of next month’s sales. Ending direct materials inventory should be 30 percent of next month’s production. Expected unit sales (frames) for the upcoming months follow: March 275 April 250 May 300 June 400 July 375 August 425 Variable manufacturing overhead is incurred at a rate of $0.30 per unit produced. Annual fixed manufacturing overhead is estimated to be $7,200 ($600 per month) for expected production of 4,000 units for the year. Selling and administrative expenses are estimated at $650 per month plus $0.60 per unit sold.Iguana, Inc., had $10,800 cash on hand on April 1. Of its sales, 80 percent is in cash. Of the…arrow_forwardthis is an excel style practice problemarrow_forward

- Required information [The following information applies to the questions displayed below.] Black Diamond Company produces snowboards. Each snowboard requires 2 pounds of carbon fiber. Management reports that 6,900 snowboards and 7,900 pounds of carbon fiber are in inventory at the beginning of the third quarter, and that 169,000 snowboards are budgeted to be sold during the third quarter. Management wants to end the third quarter with 5,400 snowboards and 5,900 pounds of carbon fiber in inventory. Carbon fiber costs $18 per pound. Each snowboard requires 0.5 hour of direct labor at $23 per hour. Variable overhead is budgeted at the rate of $13 per direct labor hour. The company budgets fixed overhead of $1,801,000 for the quarter. 2. Prepare the direct materials budget for the third quarter. BLACK DIAMOND COMPANY Direct Materials Budget Units to produce Budgeted units sales for month Materials needed for production (pounds) Add: Desired ending materials inventory (pounds) Total…arrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image) Peggy's Pillows produces and sells a decorative pillow for $75.00 per unit. In the first month of operation, 2,000 units were produced and 1,750 units were sold. Actual fixed costs are the same as the amount budgeted for the month. Budgeted monthly production is 2,500 units. The production volume variance is written off to the cost of goods sold account. Other information for the month includes: Variable manufacturing costs $20.00 per unit Variable marketing costs $ 3.00 per unit Fixed manufacturing costs per month $ 17,500 Administrative expenses, all fixed $15.00 per unit 1. What is cost of goods sold using absorption costing?arrow_forwardUse the image below to answer the following question. The blue box represents the VAnswer the following question The Lebanese Bakery Inc. also allocates FMOH to products on the basis of standard direct manufacturing labor - hours. For the year, FMOH was budgeted at $4.00 per DMLH. Actual FMOH incurred during the year was $272,000. Baguettes are baked in batches of 100 loaves. Following are some pertinent data for Lebanese Bakery Inc: Direct manufacturing labor use: 2.00 DMLH per batch Fixed manufacturing overhead: $4.00 per DMLH Lebanese Bakery Inc. recorded the following additional data for the year ended December 31: Planned (budgeted) output 3, 840,000 baguettes Actual production 3, 360, 000 baguettes Direct manufacturing labor 50, 400 DMLH Actual fixed MOH $272,000 Question: 1) Why do we use these headings in specific? Explain each heading. 2) How do you know whether the rate variance ($35200 F) and production volume - variance ($38400 U) are favourable or unfavourable? Is there a…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education