Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

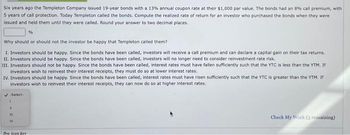

Transcribed Image Text:Six years ago the Templeton Company issued 19-year bonds with a 13% annual coupon rate at their $1,000 par value. The bonds had an 8% call premium, with

5 years of call protection. Today Templeton called the bonds. Compute the realized rate of return for an investor who purchased the bonds when they were

issued and held them until they were called. Round your answer to two decimal places.

%

Why should or should not the investor be happy that Templeton called them?

1. Investors should be happy. Since the bonds have been called, investors will receive a call premium and can declare a capital gain on their tax returns.

II. Investors should be happy. Since the bonds have been called, investors will no longer need to consider reinvestment rate risk.

III. Investors should not be happy. Since the bonds have been called, interest rates must have fallen sufficiently such that the YTC is less than the YTM. If

investors wish to reinvest their interest receipts, they must do so at lower interest rates.

IV. Investors should be happy. Since the bonds have been called, interest rates must have risen sufficiently such that the YTC is greater than the YTM. If

investors wish to reinvest their interest receipts, they can now do so at higher interest rates.

✔-Select-

11

111

IV

Icon Kry

Check My Work (3 remaining)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Six years ago the Templeton Company issued 25-year bonds with a 15% annual coupon rate at their $1,000 par value. The bonds had a 9% call premium, with 5 years of call protection. Today Templeton called the bonds. Compute the realized rate of return for an investor who purchased the bonds when they were issued and held them until they were called. Round your answer to two decimal places. % Why should or should not the investor be happy that Templeton called them? I. Investors should not be happy. Since the bonds have been called, interest rates must have fallen sufficiently such that the YTC is less than the YTM. If investors wish to reinvest their interest receipts, they must do so at lower interest rates. II. Investors should be happy. Since the bonds have been called, interest rates must have risen sufficiently such that the YTC is greater than the YTM. If investors wish to reinvest their interest receipts, they can now do so at higher interest rates. III. Investors should be happy.…arrow_forwardA client owns a $1,000 10-year bond. The coupon rate is 6 percent. The client acquired the bond three years ago at a discount. What is knwon about the interest rates three years ago? A. The stated rate was less than 6 percent. B. The stated rate was more than 6 percent. C The market rate was less than 6 percent. D. The market rate was more than 6 percent.arrow_forwardLast year, Kevin Thomas purchased a $1000 Campbell Manufacturing corporate bond with an annual interest rate of 7.25%. The bond's current market price is $770. Calculate the following. If necessary, round all answers to two decimal places. If necessary, refer to the list of financial formulas. 1. Annual interest: 2. Current yield: $0 0% X Sarrow_forward

- Help me pleasearrow_forwardAssume that Beach Inc. has an issue of 20-year $1,000 par value bonds that pay 7% interest, annually. Further assume that today's required rate of return on these bonds is 5%. How much would these bonds sell for today?arrow_forwardPlease show complete steps thanks and explain everything. All parts or skip plsarrow_forward

- A few years ago, Zabar Technology issued an annual bond that has a face value equal to $1,000 and pays investors $40 interest semiannually. The bond has four years remaining until maturity. If an investor requires a 5% rate of return to invest in this bond, what is the maximum price he or she should be willing to pay to purchase the bond today? O $1,106.38 O $964.54 O $1,107.55 $935.37arrow_forwardSeven years ago the Templeton Company issued 16-year bonds with an 11% annual coupon rate at their $1,000 par value. The bonds had a 5% call premium, with 5 years of call protection. Today Templeton called the bonds. Compute the realized rate of return for an investor who purchased the bonds when they were issued and held them until they were called. Round your answer to two decimal places. % Why the investor should or should not be happy that Templeton called them. Since the bonds have been called, interest rates must have risen sufficiently such that the YTC is greater than the YTM. If investors wish to reinvest their interest receipts, they can now do so at higher interest rates. Since the bonds have been called, interest rates must have risen sufficiently such that the YTC is greater than the YTM. If investors wish to reinvest their interest receipts, they must do so at lower interest rates. Since the bonds have been called, investors will receive a call premium and can declare…arrow_forwardBright Sun, Inc. sold an issue of 30-year $1,000 par value bonds to the public. The bonds had a 7.61 percent coupon rate and paid interest annually. It is now 12 years later. The current market rate of interest on the Bright Sun bonds is 11.08 percent. What is the current market price (intrinsic value) of the bonds? Round the answer to two decimal places.arrow_forward

- BankMart Inc. recently issued bonds that mature in 11 years. They have a par value of $1,000 and an annual coupon of 6%. The current market interest rate is 8%. What is the bond's value?arrow_forward7.06 Seven years ago the Templeton Company issued 20-year bonds with a 12% annual coupon rate at their $1,000 par value. The bonds had a 7% call premium, with 5 years of call protection. Today Templeton called the bonds. Compute the realized rate of return for an investor who purchased the bonds when they were issued and held them until they were called. Round your answer to two decimal places. % Why the investor should or should not be happy that Templeton called them. Since the bonds have been called, interest rates must have risen sufficiently such that the YTC is greater than the YTM. If investors wish to reinvest their interest receipts, they can now do so at higher interest rates. Since the bonds have been called, interest rates must have risen sufficiently such that the YTC is greater than the YTM. If investors wish to reinvest their interest receipts, they must do so at lower interest rates. Since the bonds have been called, investors will receive a call premium and can…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education