FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

![### Six Flags Entertainment Corp. Revenue Data Analysis

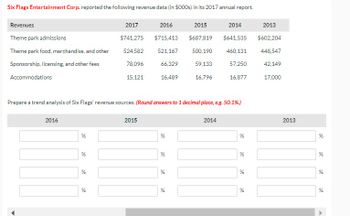

**Six Flags Entertainment Corp.** reported the following revenue data (in $000s) in its 2017 annual report:

| Revenues | 2017 | 2016 | 2015 | 2014 | 2013 |

|------------------------------------------------|-----------|-----------|-----------|-----------|-----------|

| Theme park admissions | $741,275 | $715,413 | $687,819 | $641,535 | $602,204 |

| Theme park food, merchandise, and other | 524,582 | 521,167 | 500,190 | 460,131 | 448,547 |

| Sponsorship, licensing, and other fees | 78,096 | 66,329 | 59,133 | 57,250 | 42,149 |

| Accommodations | 15,121 | 16,489 | 16,796 | 16,877 | 17,000 |

**Analysis Task:**

Prepare a trend analysis of Six Flags' revenue sources. *(Round answers to 1 decimal place, e.g. 50.1%.)*

#### Trend Analysis (Percentage Change Calculation Template)

| Revenues | 2017 | 2016 | 2015 |

|------------------------------------------------|-----------|-----------|-----------|

| Theme park admissions | _____ % | _____ % | ______ % |

| Theme park food, merchandise and other | _____ % | _____ % | ______ % |

| Sponsorship, licensing, and other fees | _____ % | _____ % | ______ % |

| Accommodations | _____ % | _____ % | ______ % |

**Explanation of Trend Analysis Calculation:**

1. **Percentage Change Formula:**

\[

\text{Percentage Change} = \left( \frac{\text{Value in Current Year} - \text{Value in Previous Year}}{\text{Value in Previous Year}} \right) \times 100

\]

2. **Example Calculation for Theme Park Admissions (2016 to 2017):**

\[

\text{Percentage Change} = \left( \frac{741,275 - 715,413}{715](https://content.bartleby.com/qna-images/question/9c9e2dde-1c19-44ed-a9d3-170191d095c3/0606246f-5cf5-4f1a-a83d-6f5f82820398/ze043g_thumbnail.jpeg)

Transcribed Image Text:### Six Flags Entertainment Corp. Revenue Data Analysis

**Six Flags Entertainment Corp.** reported the following revenue data (in $000s) in its 2017 annual report:

| Revenues | 2017 | 2016 | 2015 | 2014 | 2013 |

|------------------------------------------------|-----------|-----------|-----------|-----------|-----------|

| Theme park admissions | $741,275 | $715,413 | $687,819 | $641,535 | $602,204 |

| Theme park food, merchandise, and other | 524,582 | 521,167 | 500,190 | 460,131 | 448,547 |

| Sponsorship, licensing, and other fees | 78,096 | 66,329 | 59,133 | 57,250 | 42,149 |

| Accommodations | 15,121 | 16,489 | 16,796 | 16,877 | 17,000 |

**Analysis Task:**

Prepare a trend analysis of Six Flags' revenue sources. *(Round answers to 1 decimal place, e.g. 50.1%.)*

#### Trend Analysis (Percentage Change Calculation Template)

| Revenues | 2017 | 2016 | 2015 |

|------------------------------------------------|-----------|-----------|-----------|

| Theme park admissions | _____ % | _____ % | ______ % |

| Theme park food, merchandise and other | _____ % | _____ % | ______ % |

| Sponsorship, licensing, and other fees | _____ % | _____ % | ______ % |

| Accommodations | _____ % | _____ % | ______ % |

**Explanation of Trend Analysis Calculation:**

1. **Percentage Change Formula:**

\[

\text{Percentage Change} = \left( \frac{\text{Value in Current Year} - \text{Value in Previous Year}}{\text{Value in Previous Year}} \right) \times 100

\]

2. **Example Calculation for Theme Park Admissions (2016 to 2017):**

\[

\text{Percentage Change} = \left( \frac{741,275 - 715,413}{715

Transcribed Image Text:### Six Flags Entertainment Corp. Revenue Analysis (2013-2017)

**Six Flags Entertainment Corp.** reported the following revenue data (in $000s) in its 2017 annual report. The table below displays the revenue from various sources over five years, from 2013 to 2017.

#### Revenues Breakdown (in $000s):

| | 2017 | 2016 | 2015 | 2014 | 2013 |

|-----------------------|-----------|-----------|-----------|-----------|-----------|

| Theme park admissions | $741,275 | $715,413 | $687,819 | $641,535 | $602,204 |

| Theme park food, merchandise, and other | $524,582 | $521,167 | $500,190 | $460,131 | $448,547 |

| Sponsorship, licensing, and other fees | $78,096 | $66,329 | $59,133 | $57,250 | $42,149 |

| Accommodations | $15,121 | $16,489 | $16,796 | $16,877 | $17,000 |

### Instructions

Prepare a trend analysis of Six Flags’ revenue sources. Round answers to one decimal place, e.g. 50.1%.

#### Percentage Change Table

The table below is for calculating the percentage change for each category between consecutive years.

| | 2016 | 2015 | 2014 | 2013 |

|-----------------------|----------|----------|----------|----------|

| Theme park admissions | _______ | _______ | _______ | _______ |

| Theme park food, merchandise, and other | _______ | _______ | _______ | _______ |

| Sponsorship, licensing, and other fees | _______ | _______ | _______ | _______ |

| Accommodations | _______ | _______ | _______ | _______ |

### Example for Calculating Percentage Change

To compute the percentage change from 2016 to 2017 for theme park admissions:

\[ \text{Percentage Change} = \left( \frac{\text{Revenue in 2017} - \

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Chipotle Mexican Grill began with a single location in 1993 and now operates more than 2,450 restaurants. Adapted versions of the company's income statements (in $000s) are as follows: 2017 2016 Revenue $4,476,412 $3,904,384 Restaurant operating costs Food, beverage, and packaging 1,535,428 1,365,580 Labor 1,205,992 1,105,001 Occupancy 327,132 293,636 Other operating costs 651,644 641,953 General and administrative expenses 296,388 276,240 Depreciation and amortization 163,348 146,368 Pre-opening costs 12,341 17,162 Loss on disposal of assets 13,345 23,877 Total operating expenses 4,205,618 3,869,817 Income from operations 270,794 34,567 Interest and other income (expense), net 4,949 4,172 Income before income taxes 275,743 38,739 Provision for income taxes 99,490 15,801 Net income $176,253 $22,938arrow_forwardSpace Tech Inc. total annual sales in 2020 were $ 40,000,000 The year ending 12/31/20 account balance for Accounts Receivable (prior to any adjustments) is $ 9,500,000 The year ending 12/31/20 account balance for Allowance for Doubtful Accounts (prior to any adjustme nts) is $ 350,000 The C.F.O. (Chief Finandal Officer) has informe d the accounting departme nt that the year ending 12/31/20 All owance for Doubtful Accounts balance should be 2.5% of annual sales. Required: 1Prepare the necessary year-end adjusting journalentry necessary to reflect the balance expected by the C.F.O. 2 Calculate the Net Accounts Receivable balance (after adjustment).arrow_forwardA Taste of Akerley has the following financial information. Calculate its gross profit and gross profit margin. 2016 Revenue $500,000 Cost of Sales $350,000arrow_forward

- Manero Company included the following information in its annual report: 2019 2018 Sales $178,400 $162,500 102,500 Cost of goods sold 115,000 Operating expenses 50,000 50,000 Operating income 13,400 10,000 In a trend income statement for 2017, where 2017 is the base year, sales are expressed as: Multiple Choice 150.5% O100.0% 84,4% 92.6% 2017 $155,500 100,000 45,000 10,500arrow_forwardEXHIBIT 1: YALLA MOMOS INCOME STATEMENT FOR THE YEAR ENDING 2015 (IN AED) Net Revenue 504,000 Expenses Cost of food sales 151,200 Rent 68,000 Salaries 54,000 Administrative costs 23,000 Depreciation 30,200 Utilities 13,000 Miscellaneous expenses 15,800 Advertising costs 0 Interest 13,000 Net Profit 135,800 EXHIBIT 2: YALLA MOMOS PROJECTIONS FOR THE YEAR 2016 (IN AED) Without expansion With expansion Rent 75,000 88,000 Salaries 61,400 75,000 Administrative costs 26,000 34,000 Depreciation 34,720 38,360 Utilities 14,000 19,000 Miscellaneous expenses 17,060 19,180 Advertising costs 8,000 12,000…arrow_forwardPandora Corporation operates several factories in the Midwest that manufacture consumer electronics. TheDecember 31, 2018, year-end trial balance contained the following income statement items:Account Title Debits CreditsSales revenue 12,500,000Interest revenue 50,000Loss on sale of investments 100,000Cost of goods sold 6,200,000Selling expenses 620,000General and administrative expenses 1,520,000Interest expense 40,000Research and development expense 1,200,000Income tax expense 900,000Required:Calculate the company’s operating income for the yeararrow_forward

- Compare Income Statements and Balance Sheets of Competitors a. Following are selected income statements from two pharmaceutical companies, Pfizer and Dr. Reddy's, for their respective 2018 fiscal years. Express each income statement amount as a percentage of sales. Note: Round percentage to one decimal point (for example, round 18.566% to 18.6%). Income Statement ($ millions) Sales Pfizer Dr. Reddy's $46,136 0% $1,876 09 Cost of goods sold 11,248 0% 1,009 0% Gross profit 34,888 0% 867 0% Total expenses Net income 26,841 $8,047 0% 0% 878 $(11) 0% 0% b. Following are selected balance sheets from two pharmaceutical companies, Pfizer and Dr. Reddy's, for their respective 2018 fiscal years. Express each balance sheet amount as a percentage of total assets. Note: Round percentage to one decimal point (for example, round 18.566% to 18.6%). Balance Sheet ($ millions) Pfizer Dr. Reddy's Current assets $42,936 0% $1,448 0% Long-term assets Total assets 109,496 $152,432 0% 1,781 096 0% $3,229 09…arrow_forwardThe following is an income statement from the financial records of Peace, Love and Joy Company for the year ended December 31, 2015: Income Statement Sales (net) $ 245,675 Cost of Goods Sold (67,500) Gross Profit $ 178,175 Operating expenses (125,000) Operating Income $ 53,175 Interest revenue 5,600 Interest expense (8,750) Income before taxes $ 50,025 Income tax expense (15,008) Net Income $ 35,017 Refer to Exhibit 5-2. Compute earnings-based interest coverage for Peace, Love, and Joy Company. 6.72 times 5.72 times 16.88 times 6.08 timesarrow_forwardRevenue and expense data for Innovation Quarter Inc. for two recent years are as follows: Current Year Previous YearSales $4,000,000 $3,600,000Cost of goods sold 2,280,000 1,872,000Selling expenses 600,000 648,000Administrative expenses 520,000 360,000Income tax expense 240,000 216,000a. Prepare an income statement in comparative form, stating each item for both years as a percent of sales. Round to the nearest whole percentage.b. Comment on the significant changes disclosed by the comparative income statement.arrow_forward

- 16 )arrow_forwardEXHIBIT 1: YALLA MOMOS INCOME STATEMENT FOR THE YEAR ENDING 2015 (IN AED) Net Revenue 504,000 Expenses Cost of food sales 151,200 Rent 68,000 Salaries 54,000 Administrative costs 23,000 Depreciation 30,200 Utilities 13,000 Miscellaneous expenses 15,800 Advertising costs 0 Interest 13,000 Net Profit 135,800 EXHIBIT 2: YALLA MOMOS PROJECTIONS FOR THE YEAR 2016 (IN AED) Without expansion With expansion Rent 75,000 88,000 Salaries 61,400 75,000 Administrative costs 26,000 34,000 Depreciation 34,720 38,360 Utilities 14,000 19,000 Miscellaneous expenses 17,060 19,180 Advertising costs 8,000 12,000…arrow_forwardThe following information is taken from the financial statements of Down Home Deli for the last three years. The owner, John Walton is quite pleased to see that his sales are growing steadily. 2018 2017 2016 Sales $ 61,500 $ 50,400 $ 42,000 Cost of goods sold 27,670 21,170 16,800 Operating income 7,530 6,050 4,620 Net income 3,075 4,030 2,940 Instructions: (a) Calculate gross profit margin, profit margin, and profit margin using operating income. (b) Comment on whether the Deli is, in fact, doing better over the three years as John believes.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education