ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Note:-

- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism.

- Answer completely.

- You will get up vote for sure.

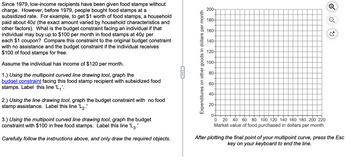

Transcribed Image Text:Since 1979, low-income recipients have been given food stamps without

charge. However, before 1979, people bought food stamps at a

subsidized rate. For example, to get $1 worth of food stamps, a household

paid about 40¢ (the exact amount varied by household characteristics and

other factors). What is the budget constraint facing an individual if that

individual may buy up to $100 per month in food stamps at 40¢ per

each $1 coupon? Compare this constraint to the original budget constraint

with no assistance and the budget constraint if the individual receives

$100 of food stamps for free.

Assume the individual has income of $120 per month.

1.) Using the multipoint curved line drawing tool, graph the

budget constraint facing this food stamp recipient with subsidized food

stamps. Label this line 'L₁'.

2.) Using the line drawing tool, graph the budget constraint with no food

stamp assistance. Label this line 'L₂.'

3.) Using the multipoint curved line drawing tool, graph the budget

constraint with $100 in free food stamps. Label this line 'L3.'

Carefully follow the instructions above, and only draw the required objects.

←

Expenditures on other goods in dollars per month

200-

180-

160-

140-

120-

100-

80-

60-

40-

20-

0-

0

20 40 60 80 100 120 140 160 180 200 220

Market value of food purchased in dollars per month

After plotting the final point of your multipoint curve, press the Esc

key on your keyboard to end the line.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism.Answer completely.You will get up vote for sure.arrow_forwardAccordingtothetextbook,whichofthefollowingstatementsis(are)correct? (x) When a taxpayer attempts to legally reduce her tax liability, she is engaging in “tax evasion” and when an individual fraudulently avoids paying taxing, she is engaging in “tax avoidance”. (y) One tax system is considered more efficient than another if it raises the same amount of tax revenue at a lower cost to taxpayers. (z) Part of the administrative burden of a tax is associated with the headache of filling out tax forms imposed on taxpayers who comply with the tax. (x), (y) and (z) (x) and (y) only (x) and (z) only (y) and (z) only (x) onlyarrow_forward

- what are the numbers that go in the cost table A through L Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardAn investor is considering the following two investments.•Investment 1 has an expected rate of return (profit) of 8% and costs $40 per share.•Investment 2 has an expected rate of return (profit) of 5% and costs $30 per share.The investor has $100 to invest to maximize her total expected rate of return, and shemust buy whole shares (not partial/factional shares) of the investments.(a) Formulate the investor’s integer programming problem.(b) Solve the investor’s problem using branch and bound and explain youranswer. How much of each investment does the investor purchase?arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

- (J) Everyone living in Isolation, Alaska works at one of two fish canneries for their entire life. Over a career at Placid Cannery a worker is paid $1 million and the risk of death by canning machine is 1%. At Megadeath Cannery a worker is paid $1.2 million and the risk of death is 5%. What is the value of a statistical life in Isolation? Show your work.arrow_forwardA doctor's office staff studied the waiting times for patients who arrive at the office with a request for emergency service. The following data with waiting times in minutes were collected over a one- month period. a. Fill in the frequency values below. Waiting Time Frequency 49 11 16 4 2 3 18 11 7 9 8 12 24 7 8 7 13 19 5 4 0-4 5-9 8 4 10-14 15-19 3 20-24 1 Total 20 b. Fill in the relative frequency (2 decimals) values below. Waiting Time Relative Frequency 0.2 0-4 5-9 0.4 0.2 10-14 15-19 0.15 20-24 0.05 Total 1arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

- Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardRevenue and Costs ($) TC P61 Given TFC = $40.00 Q1 = 30.00 Q2 = 40.00 TR P6 P5 Q3 = 50.00 Q4 = 80.00 Q5 = 86.00 P4. P1 = $40.00 P2 = $50.00 P3 = $60.0o P4 = $150.00 P5 = $200.00 P6 = $210.00 P61 = $320.00 P3 P2 P1 Q1 Q2 Q4 Q5 Q3 Exhibit TR-TC Output (Q) Refer to Exhibit TR-TC for a typical competitive firm. At an output level of Q5, the firm's losses is about O $100.00 O $90.00 O $110.00 O $120.00arrow_forwardTyeped plz and asap please provide a quality solution for better ratings and take Care of plagiarismarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education