Advanced Engineering Mathematics

10th Edition

ISBN: 9780470458365

Author: Erwin Kreyszig

Publisher: Wiley, John & Sons, Incorporated

expand_more

expand_more

format_list_bulleted

Question

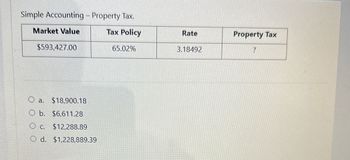

Transcribed Image Text:Simple Accounting - Property Tax.

Market Value

Tax Policy

$593,427.00

O a. $18,900.18

O b. $6,611.28

Oc. $12,288.89

O d. $1,228,889.39

65.02%

Rate

3.18492

Property Tax

?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- a. What is our monthly income? b. Lending agencies usually require that no more than 28% of the borrower's monthly income be spent on housing. How much does that represent in our case?arrow_forward4. A different car loan is advertised with a 3.25% APR for $23,000 a car. What is the monthly rate?arrow_forward1. Help Rico determine what his deduction amount is. Rico is entitled to a $6,250 standard deduction because he is single. Rico had the following tax deductible expenses last year: $500 donation to charity, $1200 in unreimbursed business expenses, $1800 in state and local taxes, and $900 in school supplies. First step: What is the total amount of Rico's tax deductible expenses? 2. Rico is entitled to a $6,250 standard deduction because he is single. Rico had the following tax deductible expenses last year: $500 donation to charity, $1200 in unreimbursed business expenses, $1800 in state and local taxes, and $900 in school supplies. Rico has to choose between his standard deduction and his itemized deduction, and he knows it is best to use the larger deduction. How much of a deduction will Rico take?arrow_forward

- Based on the federal tax chart what are the taxes owed in the following situation Taxable income $45,000arrow_forwardA patient’s insurance policy states:Annual deductible: $300.00Coinsurance: 70-30This year the patient has made payments totaling $533 to all providers. Today the patient has an office visit (fee: $80). The patient presents a credit card for payment of today’s bill. What is the amount that the patient should pay?arrow_forward3. Janet is retiring after working for a major department store for 20 years. The company offered her a flat retirement benefit of $50 per year for each year of service. a. What was her monthly income in the first year after retirement? b. What was her annual income for the first year of retirement? c. After 1 year of retirement, she received a 1.54% cost of living adjustment to her monthly pension benefit. What was her new monthly benefit?arrow_forward

- 6. Dewayne opened a savings account 4 years ago with a $1400 deposit. He has left the account alone since then, and the savings account has earned 6.5% simple interest each year. How much money is in Dewayne savings account now? A. $910 B. $1491 C.$1764 D. $2310arrow_forwardCalculate the Social Security and Medicare deductions for the following employee (assume a tax rate of 6.2% on $128,400 for Social Security and 1.45% for Medicare): (Round your answers to the nearest cent.) Employee Cumulative earnings before this pay period Pay amount this period Social Security Medicare Logan $128,300 $3,000 Social Security _________ ? Medicare _____________ ?arrow_forward1. A iPad originally cost $757.99. It is on sale for 15% off. A tax of 6% is then added to the sale price. What is the cost of the phone on sale including tax? Round your answer to the nearest penny. $ 2. "Company B is laying off 11% of their employees in New Jersey. That will be a loss of 104 jobs." determine Employees before layoffs: Employees still employed after layoffs:arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Advanced Engineering MathematicsAdvanced MathISBN:9780470458365Author:Erwin KreyszigPublisher:Wiley, John & Sons, Incorporated

Advanced Engineering MathematicsAdvanced MathISBN:9780470458365Author:Erwin KreyszigPublisher:Wiley, John & Sons, Incorporated Numerical Methods for EngineersAdvanced MathISBN:9780073397924Author:Steven C. Chapra Dr., Raymond P. CanalePublisher:McGraw-Hill Education

Numerical Methods for EngineersAdvanced MathISBN:9780073397924Author:Steven C. Chapra Dr., Raymond P. CanalePublisher:McGraw-Hill Education Introductory Mathematics for Engineering Applicat...Advanced MathISBN:9781118141809Author:Nathan KlingbeilPublisher:WILEY

Introductory Mathematics for Engineering Applicat...Advanced MathISBN:9781118141809Author:Nathan KlingbeilPublisher:WILEY Mathematics For Machine TechnologyAdvanced MathISBN:9781337798310Author:Peterson, John.Publisher:Cengage Learning,

Mathematics For Machine TechnologyAdvanced MathISBN:9781337798310Author:Peterson, John.Publisher:Cengage Learning,

Advanced Engineering Mathematics

Advanced Math

ISBN:9780470458365

Author:Erwin Kreyszig

Publisher:Wiley, John & Sons, Incorporated

Numerical Methods for Engineers

Advanced Math

ISBN:9780073397924

Author:Steven C. Chapra Dr., Raymond P. Canale

Publisher:McGraw-Hill Education

Introductory Mathematics for Engineering Applicat...

Advanced Math

ISBN:9781118141809

Author:Nathan Klingbeil

Publisher:WILEY

Mathematics For Machine Technology

Advanced Math

ISBN:9781337798310

Author:Peterson, John.

Publisher:Cengage Learning,