FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Please provide calculation step by step

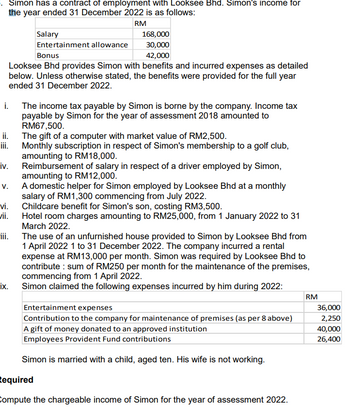

Transcribed Image Text:Simon has a contract of employment with Looksee Bhd. Simon's income for

the year ended 31 December 2022 is as follows:

RM

i.

168,000

30,000

Bonus

42,000

Looksee Bhd provides Simon with benefits and incurred expenses as detailed

below. Unless otherwise stated, the benefits were provided for the full year

ended 31 December 2022.

ii.

iv.

V.

vi.

vii.

iii.

ix.

Salary

Entertainment allowance

The income tax payable by Simon is borne by the company. Income tax

payable by Simon for the year of assessment 2018 amounted to

RM67,500.

The gift of a computer with market value of RM2,500.

Monthly subscription in respect of Simon's membership to a golf club,

amounting to RM18,000.

Reimbursement of salary in respect of a driver employed by Simon,

amounting to RM12,000.

A domestic helper for Simon employed by Looksee Bhd at a monthly

salary of RM1,300 commencing from July 2022.

Childcare benefit for Simon's son, costing RM3,500.

Hotel room charges amounting to RM25,000, from 1 January 2022 to 31

March 2022.

The use of an unfurnished house provided to Simon by Looksee Bhd from

1 April 2022 1 to 31 December 2022. The company incurred a rental

expense at RM13,000 per month. Simon was required by Looksee Bhd to

contribute: sum of RM250 per month for the maintenance of the premises,

commencing from 1 April 2022.

Simon claimed the following expenses incurred by him during 2022:

Entertainment expenses

Contribution to the company for maintenance of premises (as per 8 above)

A gift of money donated to an approved institution

Employees Provident Fund contributions

Simon is married with a child, aged ten. His wife is not working.

Required

Compute the chargeable income of Simon for the year of assessment 2022.

RM

36,000

2,250

40,000

26,400

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education