Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

![[The following information applies to the questions displayed below.]

Simon Company's year-end balance sheets follow.

At December 31

Assets

Cash

Accounts receivable, net

Merchandise inventory

Prepaid expenses

Plant assets, net

Total assets

Current Year

$ 27,970

80, 264

100,917

9,097

251, 134

$ 469,382

$ 116,876

90,891

163,500

98,115

$ 469,382

1 Year Ago

$ 31,400

58,349

77,104

8,412

229,375

$ 404, 640

Liabilities and Equity

Accounts payable

Long-term notes payable

Common stock, $10 par value

Retained earnings

Total liabilities and equity

For both the current year and one year ago, compute the following ratios:

Exercise 13-7 (Algo) Analyzing liquidity LO P3

2 Years Ago

$ 33,717

45,401

48,361

3,635

206,086

$ 337,200

$ 70,436

$ 45,846

92,137

73,776

163,500

163,500

54,078

78,567

$ 404,640 $ 337,200

(1-a) Compute the current ratio for each of the three years.

(1-b) Did the current ratio improve or worsen over the three-year period?

(2-a) Compute the acid-test ratio for each of the three years.

(2-b) Did the acid-test ratio improve or worsen over the three-year period?](https://content.bartleby.com/qna-images/question/b3995f9f-fece-4aba-9bec-7f0200bb676d/030a5554-152a-4c41-974c-0713b1c2afc1/psdp7yl_thumbnail.png)

Transcribed Image Text:[The following information applies to the questions displayed below.]

Simon Company's year-end balance sheets follow.

At December 31

Assets

Cash

Accounts receivable, net

Merchandise inventory

Prepaid expenses

Plant assets, net

Total assets

Current Year

$ 27,970

80, 264

100,917

9,097

251, 134

$ 469,382

$ 116,876

90,891

163,500

98,115

$ 469,382

1 Year Ago

$ 31,400

58,349

77,104

8,412

229,375

$ 404, 640

Liabilities and Equity

Accounts payable

Long-term notes payable

Common stock, $10 par value

Retained earnings

Total liabilities and equity

For both the current year and one year ago, compute the following ratios:

Exercise 13-7 (Algo) Analyzing liquidity LO P3

2 Years Ago

$ 33,717

45,401

48,361

3,635

206,086

$ 337,200

$ 70,436

$ 45,846

92,137

73,776

163,500

163,500

54,078

78,567

$ 404,640 $ 337,200

(1-a) Compute the current ratio for each of the three years.

(1-b) Did the current ratio improve or worsen over the three-year period?

(2-a) Compute the acid-test ratio for each of the three years.

(2-b) Did the acid-test ratio improve or worsen over the three-year period?

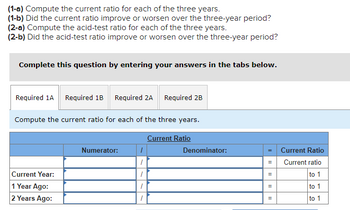

Transcribed Image Text:(1-a) Compute the current ratio for each of the three years.

(1-b) Did the current ratio improve or worsen over the three-year period?

(2-a) Compute the acid-test ratio for each of the three years.

(2-b) Did the acid-test ratio improve or worsen over the three-year period?

Complete this question by entering your answers in the tabs below.

Required 1A Required 1B Required 2A Required 2B

Compute the current ratio for each of the three years.

Current Year:

1 Year Ago:

2 Years Ago:

Numerator:

I

/

/

1

/

Current Ratio

Denominator:

=

=

=

=

Current Ratio

Current ratio

to 1

to 1

to 1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Required information [The following information applies to the questions displayed below.] Simon Company's year-end balance sheets follow. At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable Common stock, $10 par value Retained earnings Total liabilities and equity Current Year Interest expense Income tax expense Total costs and expenses Net income Earnings per share $ 26,605 89, 200 114,500 8,568 221, 258 $ 460,131 $ 112,281 84,775 162,500 100,575 1 Year Ago $ 65,696 89,408 162,500 79,061 $ 460, 131 $ 396,665 Current Year $ 31,099 62,900 85,000 8,163 209,503 $ 396,665 $364,884 185,433 10,169 7,776 The company's income statements for the current year and one year ago follow. Assume that all sales are on credit: For Year Ended December 31 Sales Cost of goods sold Other operating expenses $ 598,170 2 Years Ago $ 32,725 50,800 58,000 3,636 192, 139 $…arrow_forwardRequired information [The following information applies to the questions displayed below.] Simon Company's year-end balance sheets follow. At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable Common stock, $10 par value Retained earnings Total liabilities and equity Current Year Interest expense Income tax expense Total costs and expenses Net income Earnings per share $ 31,800 89,500 112,500 10,700 278,500 $ 523,000 $ 129,900 98,500 163,500 131, 100 $ 523,000 Current Year 1 Year Ago $ 411,225 209,550 12,100 9,525 $ 35,625 62,500 82,500 9,375 255,000 $ 445,000 $ 75,250 101,500 163,500 104,750 $ 445,000 The company's income statements for the current year and one year ago, follow. For Year Ended December 31 Sales Cost of goods sold Other operating expenses $ 673,500 2 Years Ago $ 37,800 50, 200 54,000 5,000 230,500 $ 377,500 642,400 $ 31,100 $ 1.90 $ 51,250…arrow_forwardPrepare the income statements and balance sheets for years 2018 and 2019 for Thompson Company using the following information. The balance sheet numbers are at the end of year figures.Item20182019Accounts Payable120.0150.0Accounts Receivable150.0180.0Accumulated Depreciation330.0360.0Cash & Cash Equivalents10.012.0Common Stock150.0200.0Cost of Goods Sold750.0850.0Depreciation25.030.0Interest Expense30.033.0Inventory200.0180.0Long-term Debt150.0150.0Gross Plant & Equipment650.0780.0Retained Earnings208.5225.0Sales1,500.01,700.0SG&A Expenses500.0570.0Notes Payable51.567.0Tax Rate21%21%(2) Answer the following questions:(a) How much did Thompson Company spend in acquiring fixed assets in 2019?(b) How much dividend did Thompson Company pay out during 2019?(c) Using the end of year numbers, did the long-term solvency ratios improve or deteriorate from 2018 to 2019? Answer this question using at least two long-term solvency ratios.(d) Using the end of year numbers, did the asset…arrow_forward

- help mearrow_forwardSimon Company's year-end balance sheets follow. At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable Common stock, $10 par value Retained earnings Total liabilities and equity Interest expense Income tax expense Total costs and expenses Net income Current Year $ 35,467 102,794 127,925 11,888 335,329 $ 613,403 For both the current year and one year ago, compute the following ratios: ه له مه له :. .: له The company's income statements for the Current Year and 1 Year Ago, follow. For Year Ended December 31 Sales Cost of goods sold Other operating expenses $ 149,683 117,626 162,500 183,594 $ 613,403 $ 486,429 247,201 Current Year 13,556 10,367 Vanu $ 797,424 Earnings per share Additional information about the company follows. Common stock market price, December 31, Current Year Common stock market price, December 31, 1 Year Ago Annual cash dividends per share…arrow_forwardThe comparative balance sheets for 2021 and 2020 and the statement of income for 2021 are given below for Dux Company. Additional information from Dux’s accounting records is provided also. DUX COMPANYComparative Balance SheetsDecember 31, 2021 and 2020($ in thousands) 2021 2020 Assets Cash $ 111.0 $ 33.0 Accounts receivable 61.0 63.0 Less: Allowance for uncollectible accounts (6.0 ) (5.0 ) Dividends receivable 16.0 15.0 Inventory 68.0 63.0 Long-term investment 28.0 23.0 Land 83.0 40.0 Buildings and equipment 173.0 263.0 Less: Accumulated depreciation (9.0 ) (115.0 ) $ 525.0 $ 380.0 Liabilities Accounts payable $ 26.0 $ 33.0 Salaries payable 15.0 18.0 Interest payable 17.0 15.0 Income tax payable 20.0 21.0 Notes payable 43.0 0 Bonds payable 94.0…arrow_forward

- Use the following information for the Exercises below. (Algo) [The following information applies to the questions displayed below.] Simon Company's year-end balance sheets follow. At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable Common stock, $10 par value Retained earnings Total liabilities and equity Current Year $ 26,536 73,177 92,006 8,463 236,486 $ 436,668 $ 110,905 83,735 163,500 78,528 $ 436,668 1 Year Ago Exercise 13-6 (Algo) Common-size percents LO P2 $ 30,416 52,701 71,730 8,063 213,528 $ 376,438 $ 64,254 86,581 163,500 62,103 $ 376,438 For both the current year and one year ago, compute the following ratios: 2 Years Ago $ 32,337 42,689 45,004 3,629 199,741 $ 323,400 $ 43,543 70,757 163,500 45,600 $ 323,400 1. Express the balance sheets in common-size percents. 2. Assuming annual sales have not changed in the last three years, is the change…arrow_forwardThe following information is available from the annualreport of Frixell, Inc.: Currentliabilities . . . . $300,000Operatingincome . . . . . 240,000Net income . . . . 80,000 Currentassets . . . . $ 480,000Average totalassets . . . . 2,000,000Average totalequity . . . . 800,000Which of the following statements are correct? (More thanone statement may be correct.)a. The return on equity exceeds the return on assets.b. The current ratio is 0.625 to 1.arrow_forwardSimon Company's year-end balance sheets follow. At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable Common stock, $10 par value Retained earnings Total liabilities and equity Current Year $ 27,970 80, 264 100,917 9,097 251, 134 $ 469,382 $ 116,876 90,891 163,500 98,115 $ 469,382 $ 372,220 189,161 10,373 7,933 For both the current year and one year ago, compute the following ratios: Current Year 1 Year Ago $ 31,400 58,349 77,104 8,412 229,375 $ 404,640 Exercise 13-9 (Algo) Analyzing risk and capital structure LO P3 $ 70,436 92,137 163,500 78,567 $ 404,640 The company's income statements for the current year and one year ago, follow. For Year Ended December 31 Sales Cost of goods sold Other operating expenses Interest expense Income tax expense Total costs and expenses Net income Earnings per share $ 610,197 579,687 $ 30,510 $1.88 2 Years Ago $ 312,989…arrow_forward

- Simon Company's year-end balance sheets follow. At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable Common stock, $10 par value Retained earnings. Total liabilities and equity Current Year Interest expense Income tax expense Total costs and expenses Net income Earnings per share $ 25,693 75,195 91,790 7,868 226,383 $426,929 $ 106,305 81,065 162,500 77,059 For both the current year and one year ago, compute the following ratios: $ 338,555 172,052 The company's income statements for the current year and 1 year ago, follow. For Year Ended December 31 Sales Cost of goods sold Other operating expenses 9,435 7,215 Exercise 17-10 (Algo) Analyzing efficiency and profitability LO P3 Current Year 1 Year Ago $ 40,894 $ 60,955 86,343 66,412 163,500 163,500 57,244 38,994 $426,929 $ 368,042 $ 309,800 $ 30,032 51,526 68,088 7,729 210,667 $ 368,042 $ 555,008 527,257 $…arrow_forwardThe following information is from the accounts of Neway Ltd for the years 2018 and 2019 Neway Ltd Summary of the statement of comprehensive income 2019 2018 $m $m Sales revenue 650 615 COGS 305 295 Gross profit Interest expense Other expenses (including depreciation) Profit 320 (13) (100) 345 (15) (120) 210 207 63 Depreciation expense Accounts payable at the end of the period Accounts receivable at the end of the period |Inventory held at the end of the period 85 30 25 34 46 65 57 Required: a) Prepare a statement of cash flows from operations for Neway Ltd. b) Prepare a statement that reconciles the profit with the cash flows from operations.arrow_forward(1) Debt and equity ratios. (2-a) Compute debt-to-equity ratio for the current year and one year ago. (2-b) Based on debt-to-equity ratio, does the company have more or less debt in the current year versus one year ago? (3-a) Times interest earned. (3-b) Based on times interest earned, is the company more or less risky for creditors in the Current Year versus 1 Year Ago? Complete this question by entering your answers in the tabs below. Required 1 Required 2A Required 2B Required 3A Required 3B Compute debt and equity ratio for the current year and one year ago. Current Year: 1 Year Ago: Current Year: 1 Year Ago: Numerator: Numerator: Debt Ratio 1 1 Equity Ratio 1 1 1 1 Required 1 Denominator: Denominator: = = = Required 2A > Debt Ratio Debt ratio % % Equity Ratio Equity ratio % %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub