CONCEPTS IN FED.TAX.,2020-W/ACCESS

20th Edition

ISBN: 9780357110362

Author: Murphy

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Question

Need answer the accounting question please answer do fast and correct

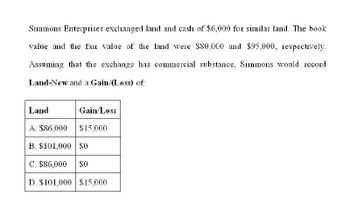

Transcribed Image Text:Simmons Enterprises exchanged land and cash of $6,000 for similar land. The book

value and the fair value of the land were $80,000 and $95,000, respectively.

Assuming that the exchange has commercial substance, Simmons would record

Land-New and a Gain/(Loss) of:

Land

Gain/Loss

A. $86,000

$15,000

B. $101,000 $0

C. $86,000

$0

D. $101,000 $15,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Horton Stores exchanged land and cash of $5,000 for similar land. The book value and the fair value of the land were $90,000 and $100,000, respectively. Assuming that the exchange has commercial substance, Horton would record land—new and a gain/(loss) on exchange of assets in the amounts of: Land Gain/(loss) a. $ 105,000 $ 0 b. $ 105,000 $ 10,000 c. $ 95,000 $ 0 d. $ 95,000 $ 10,000 Multiple Choice Option A Option B Option C Option Darrow_forwardA company exchanged land and cash of $4,000 for similar land. The book value and the fair value of the land were $89,900 and $100,600, respectively. Assuming that the exchange has commercial substance, the company would record land-new and a gain on exchange of assets in the amounts of: a. b. C. d. Land $ 104,600 $ 104,600 $ 93,900 $ 93,900 Multiple Choice O O Option a. Option b. Option d. Option c. Gain $10,700 $ 10,700arrow_forwardBloomington Inc. exchanged land for equipment and $2,600 in cash. The book value and the fair value of the land were $105,500 and $89,100, respectively.Assuming that the exchange has commercial substance, Bloomington would record equipment and a gain/(loss)on exchange of assets in the amounts of: Equipment Gain/(loss) a. $ 86,500 $ 2,600 b. $ 105,500 $ (2,600 ) c. $ 86,500 $ (16,400 ) d. None of these answer choices are correct. Option C Option D Option A Option Barrow_forward

- Que Horton Stores exchanged land and cash of $4,400 for similar land. The book value and the fair value of the land were $90,000 and $100,400, respectively. Assuming that the exchange has commercial substance, Horton would record land-new and a gain/(loss) of: Table 1-59 Land Gain/Loss A. $ 94,400 $ 10,400 B. $1,04,800 $0 C. $ 94,400 $0 D. $1,04,800 $ 10,400 Captionarrow_forwardProvide solution for this problemarrow_forwardI want correct answerarrow_forward

- amount of P650,000 and a fair value P500,000. any exchanged a delivery truck costing Bronze Co P1.000,000 for a parcel of land. The truck had a carrying a The entity gave P600,000 in cash in addition to the truck as part of this transaction. It is expected that the cash flows from the assets will be significantly different. The previous owner of the land had listed the land for sale at P1,200,000. At what amount should Bronze record the land? a. 1,100,000 b. 1,250,000 c. 1,150,000 d. 1,200,000arrow_forwardgeneral accountingarrow_forwardOCD exchanged old realty for new like-kind realty. OCD’s adjusted basis in the old realty was $31,700 ($60,000 initial cost − $28,300 accumulated depreciation), and its FMV was $48,000. Because the new realty was worth only $45,000, OCD received $3,000 cash in addition to the new realty. Required: a-1. Compute OCD's realized gain. a-2. Determine the amount and character of any recognized gain. b. Compute OCD’s basis in its new realty.arrow_forward

- A Ltd purchases the B Ltd for the following consideration of: Cash : $150 00 Land: carrying amount of the land is $120 000; fair value is $195 000. The statement of financial position of the B Ltd as at the date of acquisition shows assets of $390 000 and liabilities of $195 000. All assets are fairly valued except the B Ltd's building, which is in the accounts at $70 000 but has a fair value of $95 000. There are no contingent liabilities. Required: Calculate the value of goodwill? Note: Provide all workings. Do not just write the final answer.arrow_forwardThe Bronco Corporation exchanged land for equipment. The land had a book value of $138,000 and a fair value of $186,000. Bronco pald the owner of the equipment $28,000 to complete the exchange whlch has commercial substance. Required: 1. What Is the falr value of the equipment? 2. Prepere the Journal entry to record the exchange. Answer Is complete but not entirely correct. Complete thls question by entering your answers In the tabs below. Required 1 Required 2 Prepare the journal entry to record the exchange. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) No Transaction General Journal Debit Credit Equipment - new Land - new 1 214,000 138,000 Cash 28,000 Gain on exchange of assets 48,000arrow_forwardA Ltd purchases the B Ltd for the following consideration of: Cash : $150 000 Land: carrying amount of the land is $120 000; fair value is $195 000. The statement of financial position of the B Ltd as at the date of acquisition shows assets of $390 000 and liabilities of $195 000. All assets are fairly valued except the B Ltd's building, which is in the accounts at $70 000 but has a fair value of $95 000. There are no contingent liabilities. Required: Calculate the value of goodwill?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you