FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

1

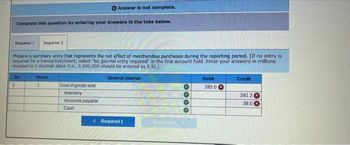

Transcribed Image Text:Answer is not complete.

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Prepare a summary entry that represents the net effect of merchandise purchases during the reporting period. (If no entry is

required for a transaction/event, select "No journal entry required in the first account field. Enter your answers in millions

rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5).)

General Journal

No

1

Event

1

Cost of goods sold

Inventory

Accounts payable

Cash

< Required 1

0.00

Debit

285.0

Credit

281.2 x

38.0 x

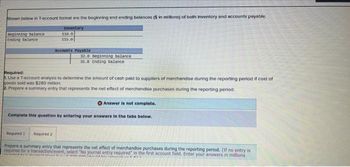

Transcribed Image Text:Shown below in T-account format are the beginning and ending balances ($ in millions) of both inventory and accounts payable.

Inventory

110.0

115.0

Beginning balance

Ending balance

Accounts Payable

32.0 Beginning balance

35.8 Ending balance

Required:

1. Use a T-account analysis to determine the amount of cash paid to suppliers of merchandise during the reporting period if cost of

goods sold was $280 million.

2. Prepare a summary entry that represents the net effect of merchandise purchases during the reporting period.

Answer is not complete.

Complete this question by entering your answers in the tabs below.

detal

Required 1 Required 2

Prepare a summary entry that represents the net effect of merchandise purchases during the reporting period. (If no entry is

required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Problem 9-25 Fudge factors An oil company executive is considering investing $10.1 million in one or both of two wells: well 1 is expected to produce oil worth $3.01 million a year for 10 years; well 2 is expected to produce $2.01 million for 15 years. These are real (inflation-adjusted) cash flows. The beta for producing wells is 0.91. The market risk premium is 9%, the nominal risk-free interest rate is 7%, and expected inflation is 3%. The two wells are intended to develop a previously discovered oil field. Unfortunately there is still a 21% chance of a dry hole in each case. A dry hole means zero cash flows and a complete loss of the $10.1 million investment. Ignore taxes and make further assumptions as necessary. a. What is the correct real discount rate for cash flows from developed wells? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Real discount rate b. The oil company executive proposes to add 20 percentage points to the…arrow_forwardPlease answer G part with explanationarrow_forwardA. For what values of x is f(x) NOT y 00 6 4 2 X -3-2-10 1 2 3 4 5arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education