FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

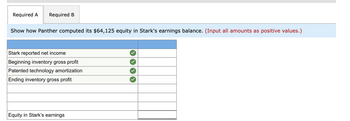

Transcribed Image Text:**How Panther Computed Its $64,125 Equity in Stark's Earnings Balance**

This table outlines the components used by Panther to determine its $64,125 equity in Stark's earnings balance. All amounts should be input as positive values.

| Description | Amount |

|-----------------------------------------|--------------|

| Stark reported net income | ✔️ |

| Beginning inventory gross profit | ✔️ |

| Patented technology amortization | ✔️ |

| Ending inventory gross profit | ✔️ |

| **Equity in Stark’s earnings** | |

Please ensure all calculations adhere to these guidelines to accurately reflect equity.

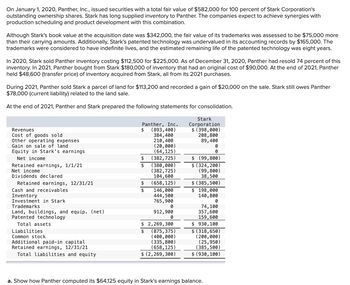

Transcribed Image Text:**Acquisition and Consolidation Details**

**Background:**

On January 1, 2020, Panther, Inc., acquired all outstanding shares of Stark Corporation for $582,000. Stark's book value was $342,000, but its trademarks and patented technology were assessed to be worth more than their recorded values. The patents had a remaining life of eight years.

**Inventory Transactions:**

- In 2020, Stark sold inventory costing $112,500 to Panther for $225,000.

- By December 31, 2020, Panther had sold 74% of this inventory.

- In 2021, Panther bought $180,000 worth of inventory (original cost $90,000) from Stark.

- At the end of 2021, Panther had $48,600 of inventory from its 2021 purchases.

**Land Sale:**

- In 2021, Stark sold land to Panther for $113,200, recording a $20,000 gain.

- Stark has a $78,000 liability related to the land sale.

**Consolidated Financial Statements:**

- **Revenues**: Panther, Inc. ($893,400), Stark ($398,000)

- **Net Income**: Panther, Inc. ($382,725), Stark ($99,800)

- **Retained Earnings (12/31/21)**: Panther, Inc. ($658,125), Stark ($385,500)

- **Assets**: Panther, Inc. total ($2,269,300), Stark total ($930,100)

- **Liabilities**: Panther, Inc. total ($875,375), Stark total ($318,650)

**Key Assets and Liabilities:**

- **Cash and Receivables**: Panther ($146,000), Stark ($198,000)

- **Inventory**: Panther ($444,500), Stark ($140,800)

- **Investment in Stark**: $765,900

- **Trademarks**: Stark ($74,100)

- **Patented Technology**: Stark ($159,600)

**Equity and Retained Earnings Adjustments:**

- Introduce how Panther computed its $64,125 equity in Stark's earnings:

- Recognize intercompany profits and adjustments for accurate consolidation.

This consolidation aims to merge financial reports effectively, reflecting accurate valuation increases and inventory profits between Panther, Inc. and Stark Corporation.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Calculate the total cost, proceeds, and gain (or loss) (in $) for the stock market transaction. Company Number ofShares PurchasePrice SellingPrice Commissions TotalCost Proceeds Gain(or Loss) Buy Sell Odd Lot an audio and video products manufacturer 800 $27.37 $33.25 3% 3% $ $ $arrow_forwardQuestion: Prepare a statement of profit or loss and other comprehensive income for the year ended 31 December 2021 Below is the list of nominal ledger balances of Tonson Plc at 31 December 2021. Tonson’s financial year end is at 31 December. Nominal ledger closing balances at 31 December 2021 The following information is relevant. 1. Closing inventory at 31 December 2021 is £45,000 On further investigation of the suspense account in the trial balance above, it was discovered that: An expense of £8,250 for legal services had been posted to the suspense account and a cash receipt of £15,750 had been posted to the suspense account. This represented the disposal proceeds from selling equipment, which had been purchased on 1 March 2017 at a cost of £48,000. Tonson depreciates non-current assets as follows: buildings at 1 per cent on a straight-line basis plant and equipment at 10 per cent on a straight-line basis motor vehicles at 20 per cent on a reducing balance basis.…arrow_forwardRakesharrow_forward

- Caesar Limited The Statement of Comprehensive Income of Caesar Limited for the year to 31st December 2021 is shown below. The company's statement of financial position as of that date (with comparative figures for 2020) is also shown. Caesar LimitedStatement of Comprehensive Income for the year to 31st December 2021 2021 £'000 Sales 4,450 Cost of sales (2,738) Gross profit 1,712 Administration and distribution expenses (980) Interest payable (740) Dividend received 649 Profit before tax 641 Taxation (200) Profit after tax 441 Caesar Limited Statements of Financial Position as at 31 December 2021 and 2020 2021 2020 £'000 £'000 ASSETS: Non-current assets Property, plants and equipment 3,450 3,340 Investments 840 840 4,290 4,180 Current assets Inventories 790 588 Trade receivables 423 541 Cash at bank 621 1,834 --- 1,129 6,124…arrow_forwardDo not give answer in imagearrow_forwardQuestion 1 The following are financial statements of Crane Company. Crane CompanyIncome StatementFor the Year Ended December 31, 2022 Net sales $2,192,500 Cost of goods sold 1,010,500 Selling and administrative expenses 900,500 Interest expense 78,000 Income tax expense 62,500 Net income $ 141,000 Crane CompanyBalance SheetDecember 31, 2022 Assets Current assets Cash $ 55,100 Debt investments 89,000 Accounts receivable (net) 168,400 Inventory 236,500 Total current assets 549,000 Plant assets (net) 572,500 Total assets $ 1,121,500 Liabilities and Stockholders’ Equity Current liabilities Accounts payable $ 152,000 Income taxes payable 31,000 Total current liabilities 183,000 Bonds payable 220,740 Total liabilities 403,740 Stockholders’ equity Common stock 345,000 Retained earnings 372,760…arrow_forward

- The trial balance of Kroeger Incorporated included the following accounts as of December 31, 2024: Sales revenue Interest revenue Gain on sale of investments Gain on debt securities Loss on projected benefit obligation Cost of goods sold Selling expense Goodwill impairment loss Interest expense General and administrative expense Debits $ 160,000 6,100,000 600,000 500,000 30,000 500,000 Credits $ 8,200,000 60,000 120,000 140,000 The gain on debt securities represents the increase in the fair value of debt securities and is classified a component of other comprehensive income. Kroeger had 300,000 shares of stock outstanding throughout the year. Income tax expense has not yet been recorded. The effective tax rate is 25%. Required: Prepare a 2024 single, continuous statement of comprehensive income for Kroeger Incorporated. Use a multiple-step income statement format. Note: Round earnings per share answer to 3 decimal places.arrow_forwardHandwriting not allow pleasearrow_forwardX Print Item Liabilities and Stockholders' Equity Current liabilities Long-term liabilities Common stock Retained earnings Total liabilities and stockholders' equity Sales Cost of goods sold Gross margin Income Statement Operating expenses Interest expense Net income a. 2.8% b. 1.4% c. 11.3% d. 5.6% $67,366 89,760 79,299 63,350 $299,775 $93,016 37,206 $55,810 (21,965) (4,651) $29,194 Number of shares of common stock outstanding Market price of common stock Total dividends paid Cash provided by operations What is the return on total assets for Diane Company? 6,335 $26 $9,000 $30,000 All work saved. MacBookarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education