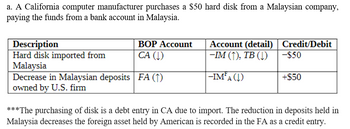

Show how each of the following would affect the U.S. balance of payments. Include a description of the debit and credit items, and in each case identify which specific account is affected (e.g., imports of goods and services, IM; exports of assets, EXA; and so on.

a) A U.S. citizen buys a newly issued stock share in England, paying for his order with a check, which the British company deposits in its own U.S. bank account in New York.

b) An American buys a Japanese car, paying by writing a check on an account with a New York bank.

d) A French firm sells defense equipment to the British government for 250 million pounds in bank deposits.

Please draw a table like i have shown in the sample image (including the arrows indicate the increase or decrease) and explain a bit (if possible can u elaborate a little bit more because i want to understand)

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

- Show how each of the following would affect the U.S. balance of payments. Include a description of the debit and credit items, and in each case identify which specific account is affected (e.g., imports of goods and services, IM; exports of assets, EXA; and so on. a)A U.S. automobile manufacturer imports $200000 in parts from a German firm. It uses U.S. bank account to pay for the parts. b) The bank in Switzerland buys $2 million in U.S. Treasury bonds from an American securities firm. c) A French tourists charges $500 to his Mastercard for a hotel stay in Atlanta Please draw a table like the sample image (including arrows which indicate the increase or decrease) and explain a bit under the table (if possible, please elaborate a bit more because i want to understand). Thank you so much.arrow_forwardWhat conditions have contributed to Interest Rate Parity not holding in the market during the past few years?arrow_forwardIf one U.S. dollar is traded on the foreign exchange market for about 0.89 euros, then one euro can purchase about U.S. dollars. a) 0.75 b) 1.12 c) 1.75 d) 0.89arrow_forward

- How does the federal reserve regulate the flow and creation of U.S currency?arrow_forwardA. Canada produces natural resources (coal, natural gas, and others), the demand for which has increased rapidly as China and other emerging economies expand. i. Explain how growth in the demand for Canada's natural resources would affect the demand for Canadian dollars in the foreign exchange market. Explain how the supply of Canadian dollars would change. ii. iii. Explain how the value of the Canadian dollar would change. iv. Illustrate your answer with a graphical analysis. 1arrow_forwardIf Interest Rate Parity doesn’t hold, how can a trader take advantage of the mispricing to earn a profit.arrow_forward

- Use the table below to answer the next two questions. You will need to fill in the blanks. Currency South African Rand Singapore Dollar Swiss Franc Euro Danish Krone Foreign Currency to 1$ = U.S. Dollars $0.14 1.30 0.72 $1.01 $0.19 Which of the following below ranks the currencies from most valuable to least valuable? Rand, Singapore Dollar; Franc; Euro; Krone; U.S. Dollar Rand; Krone; Singapore Dollar; U.S. Dollar; Franc; Euro Krone: Dand: Euro: US Dollar: Singapore Dollar Francarrow_forwardIf the European euro were to depreciate relative to the U.S. dollar in the foreign exchange market, would it be easier or harder for the French to sell their wine in the United States? Suppose you were planning a trip to Paris. How would depreciation of the euro change the dollar cost of your trip?arrow_forward6arrow_forward

- Use the excel file above to answer the following question. Which countries have a premium value of the dollar?arrow_forwardFind the U.S. dollar value of each of the following currencies at the given exchange rates: a. $1=C$.96(Canadian dollars) b.$1= 81 yen (Japanese Yen) c. $1=A$.95(Australian dollars) d. $1= SKR 6 (Swedish kronor) e. $1=SF .90 (Swiss francs)arrow_forward

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education