FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

None

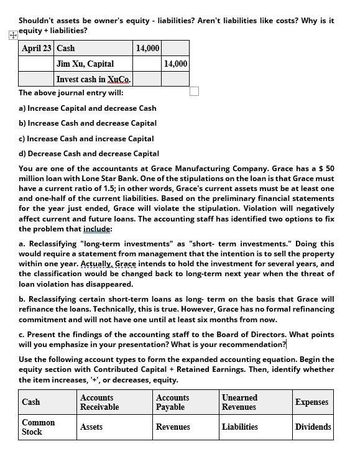

Transcribed Image Text:Shouldn't assets be owner's equity - liabilities? Aren't liabilities like costs? Why is it

equity+ liabilities?

April 23 Cash

Jim Xu, Capital

Invest cash in XuCo.

The above journal entry will:

14,000

14,000

a) Increase Capital and decrease Cash

b) Increase Cash and decrease Capital

c) Increase Cash and increase Capital

d) Decrease Cash and decrease Capital

You are one of the accountants at Grace Manufacturing Company. Grace has a $ 50

million loan with Lone Star Bank. One of the stipulations on the loan is that Grace must

have a current ratio of 1.5; in other words, Grace's current assets must be at least one

and one-half of the current liabilities. Based on the preliminary financial statements

for the year just ended, Grace will violate the stipulation. Violation will negatively

affect current and future loans. The accounting staff has identified two options to fix

the problem that include:

a. Reclassifying "long-term investments" as "short-term investments." Doing this

would require a statement from management that the intention is to sell the property

within one year. Actually, Grace intends to hold the investment for several years, and

the classification would be changed back to long-term next year when the threat of

loan violation has disappeared.

b. Reclassifying certain short-term loans as long-term on the basis that Grace will

refinance the loans. Technically, this is true. However, Grace has no formal refinancing

commitment and will not have one until at least six months from now.

c. Present the findings of the accounting staff to the Board of Directors. What points

will you emphasize in your presentation? What is your recommendation?

Use the following account types to form the expanded accounting equation. Begin the

equity section with Contributed Capital + Retained Earnings. Then, identify whether

the item increases, '+', or decreases, equity.

Cash

Accounts

Receivable

Common

Stock

Assets

Accounts

Payable

Unearned

Revenues

Expenses

Revenues

Liabilities

Dividends

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education