FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

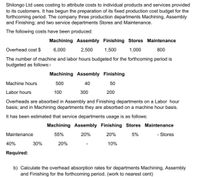

Transcribed Image Text:Shilongo Ltd uses costing to attribute costs to individual products and services provided

to its customers. It has begun the preparation of its fixed production cost budget for the

forthcoming period. The company three production departments Machining, Assembly

and Finishing; and two service departments Stores and Maintenance.

The following costs have been produced:

Machining Assembly Finishing Stores Maintenance

2,500 1,500 1,000

Overhead cost $

6,000

800

The number of machine and labor hours budgeted for the forthcoming period is

budgeted as follows:-

Machining Assembly Finishing

Machine hours

500

40

50

Labor hours

100

300

200

Overheads are absorbed in Assembly and Finishing departments on a Labor hour

basis; and in Machining departments they are absorbed on a machine hour basis.

It has been estimated that service departments usage is as follows:

Machining Assembly Finishing Stores Maintenance

Maintenance

55%

20%

20%

5%

- Stores

40%

30%

20%

10%

Required:

b) Calculate the overhead absorption rates for departments Machining, Assembly

and Finishing for the forthcoming period. (work to nearest cent)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A company identified the following partial list of activities, costs, and activity drivers expected for the next year: Budgeted Costs $ 83,600 $ 8,800 $ 40,500 Activity Extrusion costs Handling costs Packaging costs Production volume Batches made Orders filled Product A 750,000 units 200 batches 75 Cost Driver Number batches made Number of orders filled Number of units made Product B 600,000 units 750 batches 200 Calculate activity rates for each of the three activities using activity-based costing (ABC). 4arrow_forwardWildhorse Corp. reported the following detail for its budgeted MOH costs, broken into three key activities. Activity Material handling Machining Inspections Total Plant-wide MOH rate Material handling Budgeted Cost $50,000 100,000 36,000 4,000 Machining Inspections $ (a) Calculate Wildhorse's plant-wide MOH rate if allocations are based on machine hours. (Round answer to 2 decimal places, e.g. 15.25.) (b) Calculate activity rates for each key activity. $ $186,000 $ SA Budgeted Quantity of Cost Driver $ 2,000 10,000 material moves Activity rate machine hours inspections /machine hour /material move /machine hour /inspectionarrow_forwardA manufacturer uses activity-based costing to assign overhead cost to products. Budgeted cost information for its activities follows. Budgeted Cost $ 210,600 Activity Cost Driver Purchase orders Square feet Budgeted Activity Usage 5,400 purchase orders 5,900 square feet 50 Setups Factory services 104,250 Setup 67,750 Setups Compute an activity rate for each activity. (Round your answers to 2 decimal places.) Activity Purchasing Activity Purchasing Factory services Setup Budgeted Cost 210,600 104,250 67,750 $ $ $ Budgeted Activity Usage Activity Ratearrow_forward

- Are the answers correct?arrow_forwardPalladium Inc. produces a variety of household cleaning products. Palladium's controller has developed standard costs for the following four overhead items: Overhead Item Total Fixed Cost Variable Rate per Direct Labor Hour Maintenance Power Indirect labor Rent $86,000 140,000 $0.20 0.45 2.10 35,000 Next year, Palladium expects production to require 88,000 direct labor hours Exercise 9-63 Flexible Budget for Various Levels of Activity Refer to the information for Palladium Inc. above. Required: 1. Prepare an overhead budget for the expected level of direct labor hours for the coming year. 2. Prepare an overhead budget that reflects production that is 15% higher than expected and for production that is 15% lower than expected.arrow_forwardTannin Products Inc. prepared the following factory overhead cost budget for the Trim Department for July of the current year, during which it expected to use 12,000 hours for production: Variable overhead cost: Indirect factory labor $31,200 Power and light 9,120 Indirect materials 20,400 Total variable overhead cost $ 60,720 Fixed overhead cost: Supervisory salaries $45,600 Depreciation of plant and equipment 12,000 Insurance and property taxes 22,400 Total fixed overhead cost 80,000 Total factory overhead cost $140,720 Tannin has available 16,000 hours of monthly productive capacity in the Trim Department under normal business conditions. During July, the Trim Department actually used 11,000 hours for production. The actual fixed costs were as budgeted. The actual variable overhead for July was as follows: Actual variable factory overhead cost: Indirect factory labor $27,890 Power and…arrow_forward

- Packaging Solutions Corporation manufactures and sells a wide variety of packaging products. Performance reports are prepared monthly for esch deportment. The planning budget and flexible budget for the Production Department are based on the following formulas, where q is the number of labor-hours worked in a month: Cost Formulas Direct labor Indirect labor Utilitics Supplies Equipment depreciation Factory rent Ргopсrty tакеs Factory adninistration $15.88g $8, 280 + $1.68g $6,400 + $e.seg $1,180 + $e.48g $23,0ee + $3.78g $8,400 $2,100 $11,700 + $1.9eg The Production Department planned to work 8,000 lebor-hours in March; however, it octually worked 8,400 lobor-hours during the month. Its actual costs incurred in March are listed below: Actual Cost Incurred in March $134,738 $ 19,860 $ 14,578 $ 4,988 $ 54, 88e $ 8,700 $ 2,100 $ 26,470 Direct labor Indirect labor lities Supplies Equipment depreciation Factory rent Property taxes Factory administration Required: 1. Prepare the Production…arrow_forwardPackaging Solutions Corporation manufactures and sells a wide variety of packaging products. Its Production Department's planning budget and flexible budget are based on the following formulas, where q is the number of labor-hours worked in a month: Direct labor Indirect labor Utilities Supplies Equipment depreciation Factory rent Property taxes Factory administration Direct labor Indirect labor Utilities Supplies Equipment depreciation Cost Formulas $16.309 $4,200+ $1.809 $5,800+ $0.909 $1,800+ $0.109 The Production Department planned to work 4,200 labor-hours in March; however, it actually worked 4,000 labor-hours during the month. Its actual costs incurred in March are listed below: Factory rent Property taxes Factory administration $18,600 + $2.609 $8,100 $2,800 $13,300 + $0.709 Actual Cost Incurred in March $ 66,780 $ 10,940 $ 9,970 $ 2,430 $ 29,000 $ 8,500 $ 2,800 $ 15,470 Required: 1. Prepare the Production Department's planning budget for the month.arrow_forwardA company reports the following budgeted overhead costs and budgeted cost driver activity. Activity (Cost driver) Quality (number of units inspected) Factory services (square feet) Purchasing (number of orders) Activity Quality Factory services Purchasing Budgeted Cost $ 52,116 $ 123,216 $ 17,472 Use activity-based costing to compute the activity rate for each activity. Note: Round your "Activity Rate" to 2 decimal places. Budgeted Cost $ 52,116 123,216 17,472 Budgeted Activity of Cost Driver Standard Deluxe Total 3,180 860 3,820 2,220 188 228 Budgeted Activity Usage Activity Rate 4,040 6,040 416arrow_forward

- S Craftmore Machining reports the following budgeted overhead cost and related data for this year. Budgeted Activity Usage Budgeted Cost $ 555,750 85,500 28,500 Activity Cost Driver Direct labor hours (DLH) Engineering hours (EH) Machine hours (MH) 13,000 1,500 11,400 570 71,250 Setups $ 741,000 Activity Assembly Product design Electricity Setup Total Required: 1. Compute a single plantwide overhead rate assuming the company allocates overhead cost based on 13,000 direct labor hours. 2. Job 31 used 320 direct labor hours and Job 42 used 680 direct labor hours. Allocate overhead cost to each job using the single plantwide overhead rate from part 1. 3. Compute an activity rate for each activity using activity-based costing. 4. Allocate overhead costs to Job 31 and Job 42 using activity-based costing. Activity Cost Driver Direct labor hours (DLH) Engineering hours (EH) Machine hours (MH) Setups Required 1 Required 2 Activity Usage Job 31 Required 3 320 43 56 6 Complete this question by…arrow_forwardHanung Corp has two service departments, Maintenance and Personnel. Maintenance Department costs of $370,000 are allocated on the basis of budgeted maintenance-hours. Personnel Department costs of $120,000 are allocated based on the number of employees. The costs of operating departments A and B are $196,000 and $294,000, respectively. Data on budgeted maintenance-hours and number of employees are as follows: Production Departments Budgeted costs $370,000 Budgeted maintenance- hours Number of employees Maintenance Personnel Department Department 200 Support Departments 90 870 A $120,000 $196,000 $294,000 15 B 1,260 670 280 680 Using the direct method, what amount of Personnel Department costs will be allocated to Department B? (Do not round any intermediary calculations.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education