FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

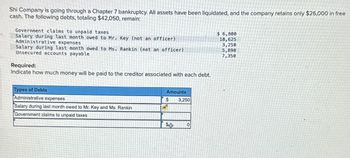

Transcribed Image Text:Shi Company is going through a Chapter 7 bankruptcy. All assets have been liquidated, and the company retains only $26,000 in free

cash. The following debts, totaling $42,050, remain:

Government claims to unpaid taxes

Salary during last month owed to Mr. Key (not an officer)

Administrative expenses

Salary during last month owed to Ms. Rankin (not an officer)

Unsecured accounts payable

Required:

Indicate how much money will be paid to the creditor associated with each debt.

Types of Debts

Administrative expenses

Amounts

$

3,250

Salary during last month owed to Mr. Key and Ms. Rankin

Government claims to unpaid taxes

0

$ 6,800

18,625

3,250

5,890

7,350

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Write double entry? On 7 November 2021 there was a fire in the warehouse, in which inventory valued at $12,000 was destroyed. Under the terms of the insurance contract, the insurance company has stated that it will only pay out the first $3,000 of the claim. No entries have yet been made to record this.arrow_forwardFinley Roofing is involved with several situations that possibly involve contingencies. Each is described below. Finley's fiscal year ends December 31, and the 2023 financial statements are issued on March 20, 2024. 1. Finley is involved in a lawsuit resulting from a dispute with a customer. On January 25, 2023, judgment was rendered against Finley in the amount of $10 million plus interest, a total of $11 million. Finley plans to appeal the judgment, but does not expect the appeal to succeed. 2. At March 20, 2023, the EPA is in the process of investigating possible environmental violations at one of Finley's work sites, but has not proposed a deficiency assessment. Management feels an assessment is probable, and if an assessment is made an unfavorable settlement between $15 million to $23 million is probable. 3. Finley is the plaintiff in a $41 million lawsuit filed against AA Asphalt for damages due to lost profits from rejected contracts and for unpaid receivables. The case is in…arrow_forwardPayable to Company Founder Jensen Inc. has a $500,000 note payable due to its founder, Jen Jensen. Ms. Jensenis recently deceased and has no heirs that Jensen Inc.’s executive team is aware of. The company has asked for yourhelp to determine whether it is appropriate to derecognize the liability from its financial statements.Required:1. Respond to Jensen Inc. Describe the applicable guidance requirements, including excerpts as needed to supportyour response.2. Next, explain how you located the relevant guidance, including the search method used and which section yousearched within the appropriate topicarrow_forward

- On April 15, 2018 Mike’s Framing Co., declared Chapter 11 bankruptcy, owing James Wholesalers $375.00. James will immediately write off Mike’s account as uncollectible. Prepare the appropriate journal entry for James.arrow_forwardlota Corporation has suffered losses for several years, and its debts total $495,000; lota's assets are valued at only $410,000. lota's creditors agree to reduce lota's debts by one-half in order to permit the corporation to continue to operate. lota's NOL carryover is $165,000. Requirements a. What impact does the reduction in debt have on lota's NOL? b. Is lota required to report any income? Requirement a. What impact does the reduction in debt have on lota's NOL? The total debt reduction is The debt reduction due to insolvency is The NOL carryover The NOL carryover after the debt reduction will be Requirement b. Is lota required to report any income? Old will report income of This is becausearrow_forwardAssume that the business has received notification on 15 April 2020 that a debtor owing $1,850 has declared bankruptcy. On 22 August 2020 the debtor unexpectedly remits full payment for the previously written-off account. Prepare the general journal entry to re-establish this debt and record payment under each of the following methods: (i) The direct write-off method (ii) The allowance methodarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education