FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

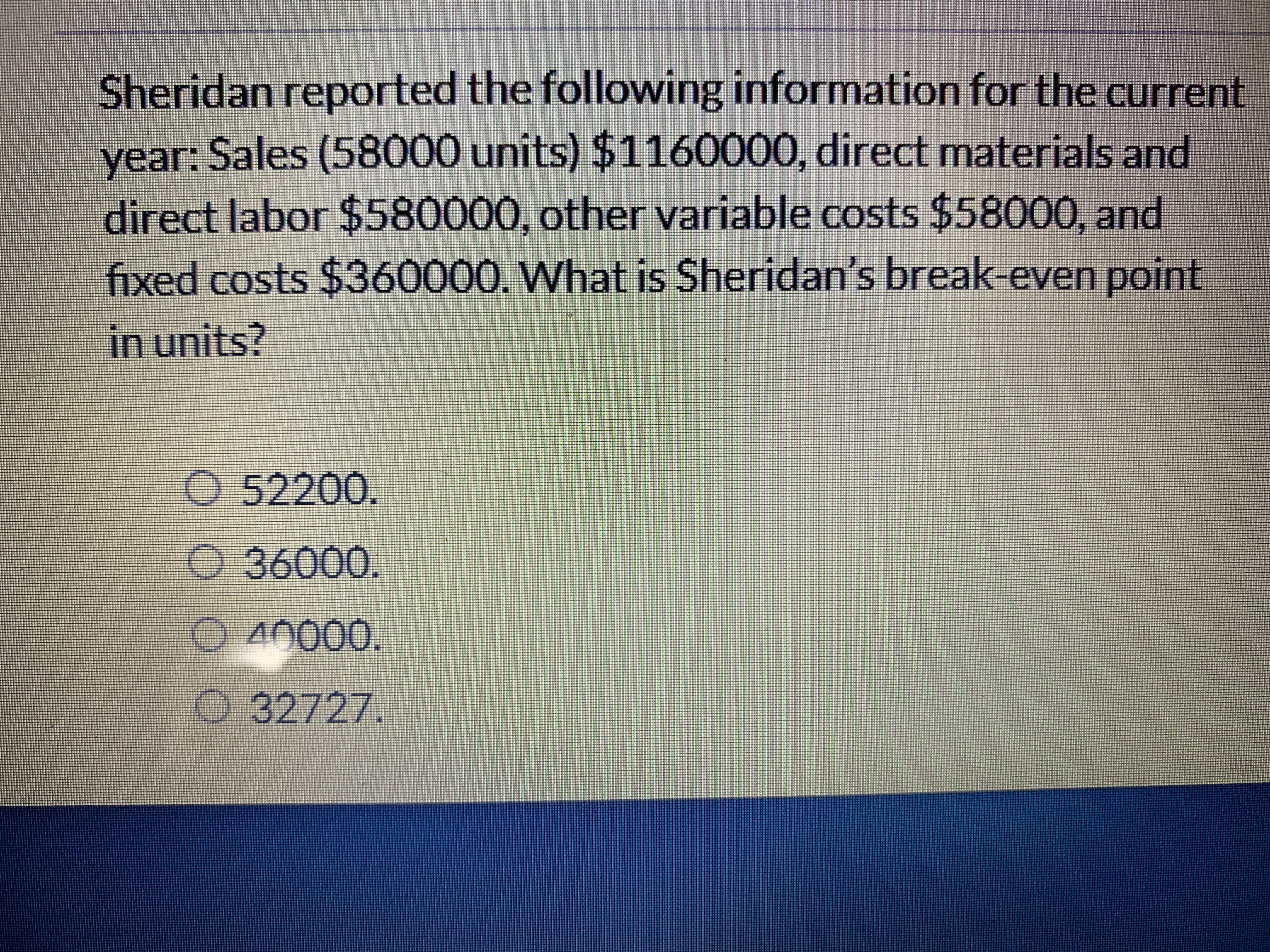

Transcribed Image Text:Sheridan reported the following information for the current

year: Sales (58000 units) $1160000, direct materials and

direct labor $580000, other variable costs $58000, and

fixed costs $360000. What is Sheridan's break-even point

in units?

O 52200.

o 36000.

O 40000.

O 32727.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- APPLY THE CONCEPTS: Calculate the break-even point in sales dollars for Starr Productions Further analysis of Starr Productions's fixed costs revealed that the company actually faces annual fixed overhead costs of $4,200 and annual fixed selling and administrative costs of $1,800. Variable cost estimates are correct: direct materials cost, $12.00 per unit; direct labor costs, $15.00 per unit; and variable overhead costs, $3.00 per unit. At this time, the selling price of $40 will not change. Complete the following formulas for the revised fixed costs. Enter the ratio as a percentage. Contribution Margin per Unit Contribution Margin Ratio % Now complete the formulas for (1) the break-even point in sales dollars and (2) the units sold at the break-even point. To calculate this, divide the break-even point in sales dollars by the unit selling price. Break-Even Point in Sales Dollars % Units Sold at Break-Even Point units Assume that the number of units that Starr sold exceeded the…arrow_forwardSheffield Corp. sells 200000 units for $14 a unit. Fixed costs are $350000 and net income is $250000. What should be reported as variable expenses in the CVP income statement? $2200000. $2550000. $600000. $2450000.arrow_forward[The following Information applies to the questions displayed below.] Alden Company's monthly data for the past year follow. Management wants to use these data to predict future variable and fixed costs. 2234 in Month 1 Units Sold 315,000 Total Cost $ 152,500 160,000 96,250 260,000 200,600 200,000 95,000 5 285,000 196,500 6 185,000 107,000 7 365,000 314,800 8 265,000 146,750 9 77,000 70,000 10 145,000 125,625 11 89,000 89,000 12 95,000 86,650 2. Predict future total costs when sales volume is (a) 370,000 units and (b) 410,000 units. 370,000 units 410,000 units Total costarrow_forward

- At the break-even point of 2000 units, variable costs are $70400, and fixed costs are $40960. How much is the selling price per unit? $14.72 $20.48 $55.68 $35.20arrow_forwardFor the current year ended March 31, Kadel Company expects fixed costs of $365,400, a unit variable cost of $43, and a unit selling price of $64. a. Compute the anticipated break-even sales (units).fill in the blank 1 of 1 units b. Compute the sales (units) required to realize operating income of $84,000.fill in the blank 1 of 1 unitsarrow_forwardManjiarrow_forward

- Manufacturing costs for product X include direct materials $18 per unit, direct labor $4 per unit, variable overhead $2 per unit, and fixed overhead $3 per unit, for a total of $27 per unit. If production volume is increased by 10 units, how much will total manufacturing costs change in the short term? Assume that the new production volume is in the relevant range. (hint: the total cost equation might be useful here) increase by $240 not enough information need to know the original volume increase by $220 increase by $250 O increase by $270arrow_forwardIf fixed costs are $1,260,000, the unit selling price is $202, and the unit variable costs are $110, the break-even sales (units) if fixed costs are increased by $43,800 is a.14,172 units b.17,006 units c.11,337 units d.21,258 unitsarrow_forwardHow do I find the dollar sales volume to produce an income of 864,000 before taxes when the maximum capacity with present facilities = 40,000 units, total fixed costs per period = 468,000, variable cost per unit = 128, and sales price per unit = 212?arrow_forward

- Please show the solution on how to get the answer.arrow_forwardSheridan Company had the following operating data for the year for its computer division: sales, $700000; contribution margin, $171000; total fixed costs (controllable), $119000; and average total operating assets, $300000. What is the controllable margin for the year? O $171000. O 57%. O $52000. O 17.3%.arrow_forwardVaughn's CVP income statement included sales of 5000 units, unit selling price of $300, unit variable cost of $180, and fixed expenses of $150000. Contribution margin is ○ $600000. ○ $900000. O $1500000. O $450000.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education