FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

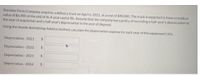

Transcribed Image Text:Sheridan Pants Company acquires a delivery truck on April 6, 2021, at a cost of $40,000. The truck is expected to have a residual

value of $6,400 at the end of its 4-year useful life, Assume that the company has a policy of recording a half-year's depreciation in

the year of acquisition and a half-year's depreciation in the year of disposal.

Using the double diminishing-balance method, calculate the depreciation expense for each year of the equipment's life.

Depreciation- 2021

$4

Depreciation - 2022

%24

Depreciation - 2023

24

Depreciation - 2024

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Muscat chocolates Company purchases equipment on January 1, 2017, at a cost of OMR 100000. The asset is expected to have a service life of 4 years and a residual value of OMR 20000. Instructions: (a) Calculate the annual rate of depreciation. Amount of depreciation for each from 2017 to 2019 using the straight-line depreciation method. (b) Calculate the amount of depreciation for each from 2017 to 2019 using the reducing balance method. (c) What would be the difference in the depreciation expense for the year ending 31st December 2019 based on using either the straight-line method or the reducing-balance method?arrow_forwardBurger Chef acquired a delivery truck on March 1, 2021, for $31,600. The company estimates a residual value of $2,400 and a six-year service life. It expects to drive the truck 73,000 miles. Actual mileage was 10,700 miles in 2021 and 14,600 miles in 2022. Calculate depreciation expense using the activity-based method for 2021 and 2022, assuming a December 31 year-end. (Do not round intermediate calculations.) Depreciation Expense Year 2021 2022arrow_forwardAdkins Bakery uses the modified half-month convention to calculate depreciation expense in the year an asset is purchased or sold. Adkins has a calendar year accounting period and uses the straight-line method to compute depreciation expense. On March 17, 2024, Adkins acquired equipment at a cost of $120,000. The equipment has a residual value of $40,000 and an estimated useful life of 3 years. What amount of depreciation expense will be recorded for the year ending December 31, 2024? (Round any intermediate calculations to two decimal places, and your final answer to the nearest dollar.) OA. $22,222 OB. $13,333 O C. $20,000 OD. $26,667arrow_forward

- Visahnoarrow_forwardGwynedd Industries uses straight-line depreciation on all of its depreciable assets. The company records annual depreciation expense at the end of each calendar year. On January 1, 2020, the company purchased a machine costing $170,000, and it has an estimated useful life of 15 years and an estimated residual value of $26,000. Depreciation for partial years is rounded to the nearest full month. In 2024, management decided to revise its estimated life from 18 years to 25 years. No change was made in the estimated residual value. The revised estimate of the useful life was decided prior to recording annual depreciation expense for the year ended December 31, 2024. Instructions: a) Prepare journal entries in chronological order for the given events, beginning with the purchase of machinery on January 1, 2020. Record depreciation expense separately for each year 2020 through 2024 (5 separate entries for each year's depreciation) (Hint: record the purchase and annual depreciation for each…arrow_forwardTasty Subs acquired a delivery truck on October 1, 2021, for $25,800. The company estimates a residual value of $2,400 and a six- year service life. Required: Calculate depreciation expense using the straight-line method for 2021 and 2022, assuming a December 31 year-end. 2021 2022 Depreciation expensearrow_forward

- Nevertire Ltd purchased a delivery van costing $52,000. It is expected to have a residual value of$12,000 at the end of its useful life of 4 years or 200,000 kilometres. Ignore GST.Required:a) Assume the van was purchased on 1 July 2019 and that the accounting period ends on 30 June.Calculate the depreciation expense for the year 2019–20 using each of the following depreciationmethods (6 marks) straight-line diminishing balance (depreciation rate has been calculated as 31%) units of production (assume the van was driven 78,000 kilometres during the financial year)b) Record the adjusting entries for the depreciation at 30 June 2021 using diminishing balancemethod. c) Show how the van would appear in the balance sheet prepared at the end of year 2 using Straightline method.arrow_forwardOn April 1, 2021, Metro Co. purchased machinery at a cost of $42,000. The machinery is expected to last 10 years and to have a residual value of $6,000. Required: Compute depreciation for 2021 (for 9 months, 4/1/21 ~ 12/31/21) assuming the sum-of-the-years'-digits method is used. No credit if no computation is shown.arrow_forwardCalculate depreciation. A machine cost $165,000 on April 28, 2021. Its estimated salvage value is $5,000 and its expected life is eight years. Instructions Prepare a depreciation schedule for each year using each of the following methods, showing the figures used. These schedules should have formulas in the cells referencing the "input section" that was discussed previously. (a) Straight-line (b) Double-declining-balance (c) Sum-of-the-years'-digitsarrow_forward

- Tasty Subs acquired a delivery truck on October 1, 2021, for $21,500. The company estimates a residual value of $2,500 and a six-year service life. It expects to drive the truck 100,000 miles. Actual mileage was 5,000 miles in 2021 and 19,000 miles in 2022.Required:Calculate depreciation expense using the activity-based method for 2021 and 2022, assuming a December 31 year-end.arrow_forwardStorm Delivery Company purchased a new delivery truck for $69,000 on April 1, 2019. The truck is expected to have a service life of 10 years or 150,000 miles and a residual value of $3,000. The truck was driven 8,000 miles in 2019 and 20,000 miles in 2020. Storm computes depreciation expense to the nearest whole month. Required: Compute depreciation expense for 2019 and 2020 using the following methods: (Round your answers to the nearest dollar.) Straight-line method 2019 $ fill in the blank 2020 $ fill in the blank Sum-of-the-years'-digits method 2019 $ fill in the blank 2020 $ fill in the blankarrow_forwardVita Water purchased a used machine for $117,200 on January 2, 2020. It was repaired the next day at a cost of $4,900 and installed on a new platform that cost $1,700. The company predicted that the machine would be used for six years and would then have a $32,720 residual value. Depreciation was to be charged on a straight-line basis to the nearest whole month. A full year’s depreciation was recorded on December 31, 2020. On September 30, 2025, it was retired.Required:1. Prepare journal entries to record the purchase of the machine, the cost of repairing it, and the installation. Assume that cash was paid. 2. Prepare entries to record depreciation on the machine on December 31 of its first year and on September 30 in the year of its disposal. (Round intermediate calculations to the nearest whole dollar.) 3. Prepare entries to record the retirement of the machine under each of the following unrelated assumptions: a. It was sold for $35,000. b. It was sold for $38,000. c.…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education