Individual Income Taxes

43rd Edition

ISBN: 9780357109731

Author: Hoffman

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Can someone please help me with this question?

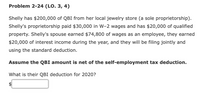

Transcribed Image Text:Problem 2-24 (LO. 3, 4)

Shelly has $200,000 of QBI from her local jewelry store (a sole proprietorship).

Shelly's proprietorship paid $30,000 in W-2 wages and has $20,000 of qualified

property. Shelly's spouse earned $74,800 of wages as an employee, they earned

$20,000 of interest income during the year, and they will be filing jointly and

using the standard deduction.

Assume the QBI amount is net of the self-employment tax deduction.

What is their QBI deduction for 2020?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Shelly has 200,000 of QBI from her local jewelry store (a sole proprietorship). Shellys proprietorship paid 30,000 in W-2 wages and has 20,000 of qualified property. Shellys spouse earned 74,400 of wages as an employee, they earned 20,000 of interest income during the year, and they will be filing jointly and using the standard deduction. What is their QBI deduction for 2019?arrow_forwardDarrell is an employee of Whitneys. During the current year, Darrells salary is 136,000. Whitneys net self-employment income is also 136,000. Calculate the Social Security and self-employment taxes paid by Darrell and Whitney. Write a letter to Whitney in which you state how much she will have to pay in Social Security and self-employment taxes and why she owes those amounts.arrow_forwardLO.2 In 2019, Chaya Corporation, an accrual basis, calendar year taxpayer, provided services to clients and earned 25,000. The clients signed notes receivable to Chaya that have a fair market value of 22,000 at year-end. In addition, Chaya sold a 36-month service contract on June 1, 2019, and received payment in full of 12,000. How much gross income does Chaya report from these transactions in 2019?arrow_forward

- Linda is an employee of JRH Corporation. Which of the following would be included in Lindas gross income? a. Premiums paid by JRH Corporation for a group term life insurance policy for 50,000 of coverage for Linda. b. 1,000 of tuition paid by JRH Corporation to State University for Lindas masters degree program. c. A 2,000 trip given to Linda by JRH Corporation for meeting sales goals. d. 1,200 paid by JRH Corporation for an annual parking pass for Linda.arrow_forwardLO2 Fatima inherits a rental property with a fair market value of 90,000 from her aunt on April 30. On May 15, the executor of the estate sends her a check for 7,000. A letter accompanying the check states that the 7,000 comes from the rent received on the property since her aunts death. Fatima receives 6,600 in rent on the property during the remainder of the year and pays allow able expenses of 4,200 on the property. How much gross income does Fatima have from these transactions?arrow_forwardWhich of the following will result in the recognition of gross income? Gail's employer allows her to set aside $ 4,000 from her wages to cover the cost of daycare for Gail's four-year-old daughter. Gail's daycare costs are $ 4,300 for the year. Hannah purchases a new sofa from her employer, Sofas-R-Us, for $ 1,200. The cost of the sofa to the furniture store is $ 1,100 and the sofa normally sells for $ 1,700. Jayden's employer purchases her commuting pass for the subway at a cost of $ 225 per month. Havana is a lawyer. The law firm she works for pays for her subscription to Lawyer's Weekly, a trade magazine for attorneys. None of the above will result in recognition of gross income.arrow_forward

- Problem 15-24 (LO. 3, 4) Shelly has $200,000 of QBI from her local jewelry store (a sole proprietorship). Shelly's proprietorship paid $30,000 in W-2 wages and has $20,000 of qualified property. Shelly's spouse earned $75,100 of wages as an employee, they earned $20,000 of interest income during the year and have no other income or deductions. Shelly and her spouse will file jointly and use the standard deduction. Assume the QBI amount is net of the self-employment tax deduction. What is their QBI deduction for 2021?arrow_forwardAa.54.arrow_forward11. Gordon participates in his employer's HSA/HDHP. On a monthly basis, Gordon contributes $100 to his account; his employer made a lump-sum contribution of $500 to each participating employee's account at the beginning of the year. If Gordon leaves the employer mid-year, what happens to the $500 employer contribution? Oa. Gordon must pay back the full $500 to his employer. Ob. Gordon must pay back a pro-rated share of the $500 to his employer. OC. Gordon keeps the full $500. Od. The employer may, at its option, deduct up to $500 from Gordon's final paycheck.arrow_forward

- How do you solve for taxable social security benefits?arrow_forward2:Kevin Bird's filing status is single, and he has earned gross pay of $3,250. Each period he makes a 403(b) contribution of 11% of gross pay and makes a contribution of 1.75% of gross pay to a cafeteria plan. His current year taxable earnings for Social Security tax and Medicare tax, to date, are $198,650.Social Security tax = $Medicare tax = $ 3:Daniel Higgs' filing status is married filing jointly, and he has earned gross pay of $3,670. Each period he makes a 401(k) contribution of 12% of gross pay and contributes $200 to a dependent care flexible spending account. His current year taxable earnings for Social Security tax and Medicare tax, to date, are $143,200.Social Security tax = $Medicare tax = $ 4:Bruce Miller's filing status is married filing separately, and he has earned gross pay of $3,200. Each period he makes a 403(b) contribution of 10% of gross pay and contributes $100 to a cafeteria plan. His current year taxable earnings for Social Security tax and Medicare tax, to…arrow_forward2arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT