ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

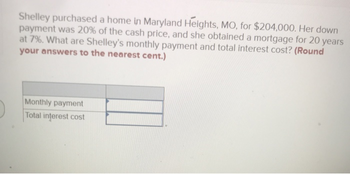

Transcribed Image Text:Shelley purchased a home in Maryland Heights, MO, for $204,000. Her down

payment was 20% of the cash price, and she obtained a mortgage for 20 years

at 7%. What are Shelley's monthly payment and total interest cost? (Round

your answers to the nearest cent.)

Monthly payment

Total interest cost

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Please give me the exact solution of problem below You have $25,000 in an account that pays 6% interest compounded annually. You want to make equal annual withdrawals so that the money lasts 8 years exactly. (i) Find the amount of each withdrawal. (ii) Find the amount of each withdrawal if the money must last 12 years.arrow_forwardHelp ( economics) not financearrow_forwardYou borrow $6,000 for 90 days at 6.5% interest. The lender uses a 365-day year. You make a payment of $1,400 on day 36 (36 days after getting the loan). Calculate your balance after the $1,400 payment is applied.arrow_forward

- You buy a car for $27000. You get a loan at 7% interest compounded yearly. You will have 60 equal monthly payments of 5543.63 each month. How much total interest will you have payed on the car loan once all of your payments are complete..arrow_forwardSuppose you borrow $5,000 at 7.25% interest for 14 months. What is the maturity value?arrow_forwardLia wishes to have $3000 after 3 years in an account that draws 6% nominal interest compounded monthly. How much must he deposit each month, starting in 1 month?arrow_forward

- You want $12,000 in your IRA in 6 years. Assuming you get 8% compounded quarterly, how much will you need to put in each quarter?arrow_forwardCalculate the simple interest due on a 58-day loan of $1300 if the interest rate is 5%. (Round your answer to the nearest cent.)$arrow_forwardJohn has started a new job and wants to open a retirement account. He is now 26 years old and plans to retire when he turns 65. For this, he plans to deposit $ 2815 annually in retirement accounts. Take the annual interest yield is as 9%. a) Calculate how much money he has saved when he retired by drawing a cash flow diagram.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education