FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

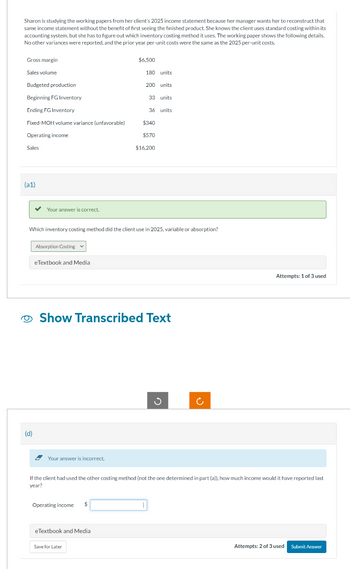

Transcribed Image Text:Sharon is studying the working papers from her client's 2025 income statement because her manager wants her to reconstruct that

same income statement without the benefit of first seeing the finished product. She knows the client uses standard costing within its

accounting system, but she has to figure out which inventory costing method it uses. The working paper shows the following details.

No other variances were reported, and the prior year per-unit costs were the same as the 2025 per-unit costs.

Gross margin

Sales volume

Budgeted production

Beginning FG Inventory

Ending FG Inventory

Fixed-MOH volume variance (unfavorable)

Operating income

Sales

(a1)

✓ Your answer is correct.

(d)

Absorption Costing

eTextbook and Media

Your answer is incorrect.

Which inventory costing method did the client use in 2025, variable or absorption?

$6,500

180 units

Operating income $

200 units

eTextbook and Media

33 units

Save for Later

36 units

Show Transcribed Text

$340

$570

$16.200

G

If the client had used the other costing method (not the one determined in part (a)), how much income would it have reported last

year?

(

Attempts: 1 of 3 used

Attempts: 2 of 3 used Submit Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Maria is studying the working papers from her client's 2025 income statement because her manager wants her to reconstruct that same income statement without the benefit of first seeing the finished product. She knows the client uses standard costing within its accounting system, but she has to figure out which inventory costing method it uses. The working paper shows the following details. No other variances were reported, and the prior year per-unit costs were the same as the 2025 per-unit costs. Gross margin Sales volume Budgeted production Beginning FG Inventory Ending FG Inventory Fixed-MOH volume variance (unfavorable) Operating income Sales $726 220 units 250 units 27 units 40 units $374 $640 $13,420arrow_forwardJeremy Costa, owner of Costa Cabinets Inc., is preparing a bid on a job that requires $2,160 of direct materials, $2,160 of direct labor, and $1,080 of overhead. Jeremy normally applies a standard markup based on cost of goods sold to arrive at an initial bid price. He then adjusts the price as necessary in light of other factors (e.g., competitive pressure) Last year's income statement is as follows: Sales Cost of goods sold Gross margin Selling and administrative expenses Operating income Required: $136,500 77,805 $58,695 46,300 $12,395 1. Calculate the markup that Jeremy will use. Round your answer to one decimal place. 75 X % 2. What is Jeremy's initial bid price? Round your answer to the nearest dollar. Feedback ✓ Check My Work 1. Markup Percentage = Gross margin/Cost of Goods Sold 2. Add costs, Direct Material, Direct Labor and Overhead. Price using Markup = Cost per Unit+ (Cost per Unit x Markup Percentage)arrow_forwardCosting methods and variances, comprehensive. Rob Kapito, the controller of Blackstar Paint Supply Company, has been exploring a variety of internal accounting systems. Rob hopes to get the input of Blackstar’s board of directors in choosing one. To prepare for his presentation to the board, Rob applies four different cost accounting methods to the rm’s operating data for 2017. The four methods are actual absorption costing, normal absorption costing, standard absorption costing, and standard variable costing. With the help of a junior accountant, Rob prepares the following alternative income statements:arrow_forward

- Yohan Company has the following balances in its direct materials and direct labor variance accounts at year-end: Direct Materials Price Debit Credit Variance $1,000 Direct Materials Quantity $2,000 Variance $500 Direct Labor Rate Variance $3,000 Direct Labor Efficiency Variance Unadjusted Cost of Goods Sold equals $200,000. Which of the following would be FALSE when the year-end closing entry is made? O The Cost of Goods Sold account will be debited. O Adjusted Cost of Goods Sold will be $198,500. The Direct Labor Rate Variance account will be debited. O The Direct Materials Price Variance account will be credited.arrow_forwardYour company management wants you to compare the list of materials for HML and ABC analysis. For ABC classification they set the following criteria; Items below SR 100000 annual consumption shall be considered as C-items, items between SR 100000 and SR 150000 shall be considered as B-items, and items above SR 150000 shall be considered as A- items For HML classification they set the following criteria; Items below unit price SR 50 shall be considered as L-items, items between SR 50 and SR 100 unit price shall be considered as M-items, and items above SR 100 unit price shall be considered as H-items. Based upon your analysis suggest which classification shall be better for the company so that inventory can be optimized. Justify your answer. Item Consumption (Units) Annual Price/unit SR H/M/L Consumption (SR) Annual A/B/C A 2000 40 B 3000 65 C 2500 90…arrow_forwardRussell and Sons, a CPA firm, established the following standard labor cost data for completing what the firm referred to as a Class 2 tax return. Russell expected each Class 2 return to require 3.3 hours of labor at a cost of $39 per hour. The firm actually completed 650 Class 2 returns. Actual labor hours averaged 2.9 hours per return and actual labor cost amounted to $49 per hour. Required a. Determine the total labor variance and indicate whether it is favorable (F) or unfavorable (U). b. Determine the labor price variance and indicate whether it is favorable (F) or unfavorable (U). c. Determine the labor usage variance and indicate whether it is favorable (F) or unfavorable (U). Note: For all requirements, do not round intermediate calculations and select "None" if there is no effect (i.e., zero variance). a. Total labor variance b. Total labor price variance c. Total labor usage variancearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education