Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Senior management of Nancy's Nooks (NN) has determined there is a 30 percent chance EPS will be $5.50 next year, there is a 60 percent chance EPS will be $3.00, and there is a 10 percent chance EPS will be -$3.40. Calculate the expected value, standard deviation, and coefficient of variation for NN's

Expected value: $

Standard deviation: $

Coefficient of variation:

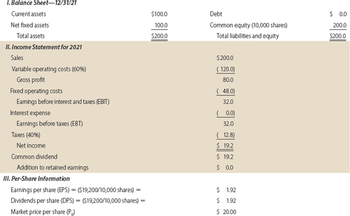

Transcribed Image Text:1. Balance Sheet-12/31/21

Current assets

Net fixed assets

Total assets

II. Income Statement for 2021

Sales

Variable operating costs (60%)

Gross profit

Fixed operating costs

Earnings before interest and taxes (EBIT)

Interest expense

Earnings before taxes (EBT)

Taxes (40%)

Net Income

Common dividend

Addition to retained earnings

III. Per-Share Information

Earnings per share (EPS) = ($19,200/10,000 shares)

Dividends per share (DPS)

($19,200/10,000 shares) =

Market price per share (P)

$100.0

100.0

$200.0

Debt

Common equity (10,000 shares)

Total liabilities and equity

$200.0

(120.0)

80.0

(48.0)

32.0

(0.0)

32.0

(12.8)

$ 19.2

$19.2

$ 0.0

$ 1.92

$ 1.92

$ 20.00

$ 0.0

200.0

$200.0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You are going to invest in Asset J and Asset S. Asset J has an expected return of 13.6 percent and a standard deviation of 54.6 percent. Asset S has an expected return of 10.6 percent and a standard deviation of 19.6 percent. The correlation between the two assets is 0.50. What are the standard deviation and expected return of the minimum variance portfolio? Note: Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places. Expected return Standard deviation % %arrow_forwardYour current portfolio is 100% invested in the market. You are considering investing some of your money in a portfolio run by Big Alpha Asset Management (BAAM). BAAM's returns have been quite good over the last five years. In order to understand by how much you could improve the Sharpe Ratio of your current portfolio by putting some of your money in BAAM, you run the following regression using past annualized returns on both the market and BAAM: RBAAM, Rft = a₁ + Bi (RM₁t - Rft) + €₁,t You estimate the following coefficients, which are all statistically significant: a=0.09; 3= 1.2 Additionally, you estimate the volatility of the residuals from the cove regression (idiosyncratic volatility) to be 0.14. In that same period the market's annualized volatility was 0.2078. Additionally, you expect the market's excess return to be 0.05 over the coming year. If you believe that the above estimates are representative of what will happen in the coming year, what is the maximum Sharpe Ratio you…arrow_forwardJerry Allen graduated from the University of Arizona with a degree in Finance in 2011 and took a job with an investment banking firm as a financial analyst. One of his first assignment is to investigate the investor-expected rate of return for technology firms: Apple (APPL), Dell (DELL) and Hewlett Packard (HPQ). Jerry’s supervisor suggested that he make his estimates using CAPM where the risk-free rate is 4.5%. the expected return on the market is 10.5% 1. Calculate the risk premium of the market show all the working formula where applicable/ 2. Calculate the expected return using CAPM equation using a beta coefficient of 2.00 3. Solve the expected return for Apple using the beta from Yahoo and the beta from MSN and a risk-free rate of 4.5% and a market risk premium of 6% yield 4. Calculate the expected return with the CAPM equation using each of the following beta estimates for the three technology firms. Present the information in a tabulated formatarrow_forward

- Consider a client with a 10% return objective. A financial adviser creates a policy statement for that client, identifies relevant financial securities that fit the risk return profile for this client, and drafts an optimal asset allocation using specialized optimization techniques. After one year, the financial adviser's recommendations produce a return of 10%. Question: Is this client satisfied with the performance of the portfolio?arrow_forwardYear End Index Realized Return 2000 23.6% 2001 24.7% 2002 30.5% 2003 9.0% 2004 -2.0% 2005 -17.3% 2006 -24.3% 2007 32.2% 2008 4.4% 2009 7.4%arrow_forwardWoodpecker, Inc., stock has an annual return mean and standard deviation of 12.6 percent and 44 percent, respectively. What is the smallest expected loss in the coming month with a probability of 16.0 percent? (A negative value should be indicated by a minus sign. Do not round intermediate calculations. Round the z-score value to 3 decimal places when calculating your answer. Enter your answer as a percent rounded to 2 decimal places.) Smallest expected loss %arrow_forward

- Need typed answer only.Please give answer within 45 minutesarrow_forwardTwo risky assets: A and B. The expected return for A is 15% and for B 30%. The variance for returns for A is 200(%2) and for B is 800(%2). The covariance between A and B returns is -0.05. T-bills give a return of 5% with a standard deviation of 0%. The investor has a risk aversion index, A=5.0. Show all work. 1. calculate the correlation between A and B 2. calculate portfolio return / standard deviation for global mvp 3. optical risky portfolio, P (expected return and SD) 4. slope of CAL 5. how much will the investor invest (A=4) in T-bills, assets A and B?arrow_forwardSenior management of Nancy's Nooks (NN) has determined there is a 20 percent chance EPS will be $7.50 next year, there is a 60 percent chance EPS will be $3.00, and there is a 20 percent chance EPS will be -$3.70. Calculate the expected value, standard deviation, and coefficient of variation for NN's forecasted EPS. Do not round intermediate calculations. Round your answers for the expected value and standard deviation to the nearest cent and for the coefficient of variation to two decimal places. Expected value: $ Standard deviation: $ Coefficient of variation:arrow_forward

- Rahularrow_forwardThe following table..shows the one-year return distribution of Startup, Inc. Calculate: a. The expected return. b. The standard deviation of the return. Data table (Click on the following icon in order to copy its contents into a spreadsheet.) 40% Probability Return - 80% 20% -65% 20% - 40% 10% -20% 10% 1,000%arrow_forwardIf Company A has a PE ratio of 20 and Company B has a PE ratio of 80, investors expect Company A to grow more in the future than Company B. True Falsearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education