FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Calculating income and cost per unit for a merchandising company

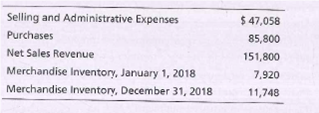

Conway Brush Company sells standard hair brushes. The following information summarizes Conway’s operating activities for 2018:

Requirements

- Calculate the operating income for 2018.

- Conway sold 6,600 brushes in 2018. Compute the unit cost for one brush.

Transcribed Image Text:Selling and Administrative Expenses

Purchases

Net Sales Revenue

Merchandise Inventory, January 1, 2018

Merchandise Inventory, December 31, 2018

$ 47,058

85,800

151,800

7,920

11,748

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Perreth Drycleaners has capacity to clean up to 5,000 garments per month. Requirements 1. Complete the schedule below for the three volumes shown. 2. Why does the average cost per garment change? 3. Suppose the owner, David Perreth, erroneously uses the average cost per unit at full capacity to predict total costs at a volume of 2,000 garments. Would he overestimate or underestimate his total costs? By how much? Requirement 1. Complete the following schedule for the three volumes shown. (Round all unit costs to the nearest cent and all total costs to the nearest whole dollar.) 2,000 3,500 5,000 Garments Garments Garments Total variable costs Total fixed costs Total operating costs Variable cost per garment Fixed cost per garment Average cost per garment $ 1,750 2.00arrow_forwardPetrov Drycleaners has capacity to clean up to 6,000 garments per month. Requirements 1. Complete the schedule below for the three volumes shown. 2. Why does the average cost per garment change? 3. Suppose the owner, Dennis Petrov, erroneously uses the average cost per unit at full capacity to predict total costs at a volume of 3,000 garments. Would he overestimate or underestimate his total costs? By how much? ♥ Requirement 1. Complete the following schedule for the three volumes shown. (Round all unit costs to the nearest cent and all total costs to the nearest whole dollar.) Total variable costs Total fixed costs Total operating costs Variable cost per garment Fixed cost per garment Average cost per garment 3,000 Garments $ $ 4,500 Garments 3,600 2.00 6,000 Garmentsarrow_forwardFlounder Corp. had 2,000 units of part T on hand April 1, 2017, costing $ 8 each. During April, Flounder made the following purchases of part T. Unit Units Cost April 4 3,000 $ 8.25 10 4,000 8.40 19 1,000 29 2,900 9.90 A physical count at April 30, 2017 showed 4,100 units of Part T on hand. Using the FIFO method, what is the cost of part T inventory at April 30, 2017? Using the LIFO method, what is the inventory cost? Using the average-cost method, what is the inventory cost? (Round average cost per unit to 2 decimal places, e.g. 15.25 and final answers to 0 decimal places, e.g. 1,620.) FIFO LIFO Average Cost Inventory Cost %24 %24 %24arrow_forward

- Rahularrow_forwardManjiarrow_forwardCalculate the Return on Investment from the following responsibility report data using total revenue as the base: Responsibility report data Account Actual Revenues Clothing revenue $473,158 Clothing accessories revenue 18,757 Expenses Associates wages $41,704 Managers wages 22,906 Cost of clothing sold 254,631 Cost of accessories sold 5,969 Equipment/fixture repairs 960 Utilities 1,539 Round to two decimal places. Be sure to enter the answer as a percentage but do not include the % sign.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education