ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:**Text:**

Because Carlos has deviated from the cartel agreement and increased his output of water to 35 gallons more than the cartel amount, Deborah decides that she will also increase her production to 35 gallons more than the cartel amount.

After Deborah increases her production, Carlos's profit becomes $ ______, Deborah’s profit becomes $ ______, and total profit (the sum of the profits of Carlos and Deborah) is now $ ______.

**True or False:** Based on the fact that both Carlos and Deborah increased production from the initial cartel quantity, you know that the output effect was larger than the price effect at that quantity.

- ○ True

- ○ False

Carlos and Deborah have each cheated on their cartel agreement and increased production by 35 gallons more than the cartel amount. However, they both realize that if they continue to increase output beyond this amount, they'll each suffer a decrease in profit. (To see this for yourself, consider Carlos's profit when he produces 70 gallons more than the cartel amount compared to his profit when he produces 35 gallons more than the cartel amount.)

Neither Carlos nor Deborah has an incentive to increase output further, nor does either have an incentive to decrease output. This outcome is an example of ______.

**Explanation of Concepts:**

1. **Cartel Agreement:** An arrangement among competing firms to control prices or limit production with the aim of increasing profits. Deviating from such an agreement typically involves increasing production to gain a larger market share.

2. **Output Effect vs. Price Effect:** The balance between increasing production (output effect) and the impact on market prices (price effect) is crucial. If the output effect is larger, increasing production can increase profits despite some reduction in prices.

3. **Profit Calculation:** Understanding how changes in production affect individual and total profit helps comprehend strategic decisions.

4. **Incentive Analysis:** Evaluates factors that influence decision-making in an economic setting, like a cartel, where maintaining certain production levels maximizes profits under given circumstances.

This activity encourages evaluating the strategic interactions within a cartel and understanding economic principles like competition, incentives, and market effects.

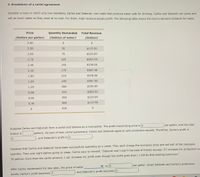

Transcribed Image Text:**Breakdown of a Cartel Agreement**

Consider a town in which only two residents, Carlos and Deborah, own wells that produce water safe for drinking. Carlos and Deborah can pump and sell as much water as they want at no cost. For them, total revenue equals profit. The following table shows the town's demand schedule for water.

| Price (Dollars per gallon) | Quantity Demanded (Gallons of water) | Total Revenue (Dollars) |

|----------------------------|-------------------------------------|-------------------------|

| 3.60 | 0 | 0 |

| 3.30 | 35 | 115.50 |

| 3.00 | 70 | 210.00 |

| 2.70 | 105 | 283.50 |

| 2.40 | 140 | 336.00 |

| 2.10 | 175 | 367.50 |

| 1.80 | 210 | 378.00 |

| 1.50 | 245 | 367.50 |

| 1.20 | 280 | 336.00 |

| 0.90 | 315 | 283.50 |

| 0.60 | 350 | 210.00 |

| 0.30 | 385 | 115.50 |

| 0 | 420 | 0 |

Suppose Carlos and Deborah form a cartel and behave as a monopolist. The profit-maximizing price is $____ per gallon, and the total output is ____ gallons. As part of their cartel agreement, Carlos and Deborah agree to split production equally. Therefore, Carlos's profit is $____, and Deborah's profit is $____.

Suppose that Carlos and Deborah have been successfully operating as a cartel. They each charge the monopoly price and sell half of the monopoly quantity. Then one night before going to sleep, Carlos says to himself, "Deborah and I aren't the best of friends anyway. If I increase my production to 35 gallons more than the cartel amount, I can increase my profit even though her profit goes down. I will do that starting tomorrow."

After Carlos implements his new plan, the price of water ▼ to $____ per gallon. Given Deborah and Carlos's production levels,

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Similar questions

- Problem 03-06 (algo) You are the manager of a firm that receives revenues of $40,000 per year from product X and $80,000 per year from product Y. The own price elasticity of demand for product X is -1.5, and the cross-price elasticity of demand between product Yand X is -1.8. How much will your firm's total revenues (revenues from both products) change if you increase the price of good X by 1 percent? Instructions: Enter your response rounded to the nearest dollar. If you are entering a negative number, be sure to use a (-) sign. GAarrow_forward8.4 Price-Volume Pricing (Figures 8-23 to 8-25) The price elasticity for personal computers is estimated to be –2. For the PC manufacturer shown, evaluate the sales and profit impact of a 10% price increase and a 10% price decrease. For each pricing strategy, determine the break-even market share and discuss the profit risk associated with it.arrow_forwardWorldwide annual sales on smart phones over a two year period were approximately q=-5p+3090 million phones at the selling price of $p per phone. (a) obtain a formula for the price elasticity of demand E. E=______ (b) in one of the years the actual selling price was $355 per phone. What was the corresponding price elasticity of demand? E=______ The demand is going (up/down) by about _____% per 1% increase in that price level.arrow_forward

- For distract drivingarrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward2. PR sells phones for £400 and has observed a recent drop in sales from 1,500 units a month, reducing its revenue by £120,000. This has occurred because a competitor has just reduced its price by 20%. PR wants to restore its sales volume to its previous level, and has estimated its price and cross elasticities at -1.4 and 0.8 respectively. The phones have a marginal cost of £280. a) Calculate the sales level of PR after the reduction in the competitor's price, assuming PR maintains its price. b) Calculate the necessary price for PR to charge to achieve its objective, assuming the competitor's price reduction. c) Calculate the effects of the decisions in a) and b) above on profit compared with the original profit before the drop in sales. Which is the better decision?arrow_forward

- Please calculate the price elasticity of supply for a book when: Quantity of supply increases from 100 to 120 and price fallsfrom 10 to 8.a) 5b) 0c) 3d) 1arrow_forward(a) Consider a firm that is particularly interested in estimates of elasticities. It discovers that its cross-price elasticity of demand between good A, which it sells and good B, which another firm sells is +5.3. Its price elasticity of demand for good A is estimated as -2.5 and its income elasticity of demand is +2.5, while the price elasticity of supply is +0.3. Comment on the implication of these figures for the firm. Discuss the information that this provides to the firm and how it can use this to develop its product, pricing and overall strategy.arrow_forwardDerive the following with complete solution Price elasticity of demand:a. from a to bb. from e to farrow_forward

- Take care of plagiarism. 1.A 10% increase in price that leads to a 12% decrease in the amount purchased indicates a price elasticity of more than 1 (in absolute value). True False 2. A 10% increase in price that leads to a 2% decrease in total expenditures (or total revenue) indicates a price elasticity of more than 1 (in absolute value). True False 3. If the percentage change in price is less than the resultant percentage change in quantity demanded, demand is__________ .(elastic/inelastic/unit elastic)arrow_forwardQD ($) 16 3,000 2,800 20 18 2,600 2,400 2,200 2,000 22 24 26 28 1,800 30 1,600 Above is the demand schedule for tickets to a Carnegie Hall performance of the Grateful Dead. Carnegie Hall seats 2,200 people. What is the equilibrium price and quantity for a concert of the Grateful Dead at Carnegie Hall? If tickets were sold for $18, what would happen (bearrow_forwardPlease no written by hand the demand function for a manufacturer's product is p = f(g) = - 0.20g + 500, where p is the price (in dollars) per unit when q units are demanded (per day). Find the level of production that maximizes the manufacturer's total revenue and determine this revenue. what quantity will maximize the revenue. q = blank unitsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education