FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

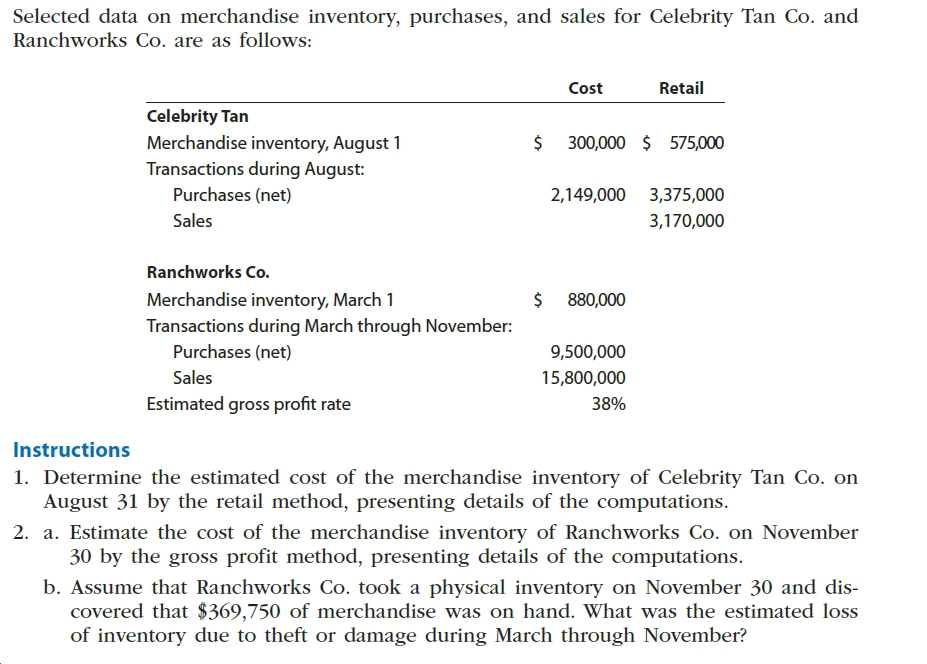

Transcribed Image Text:Selected data on merchandise inventory, purchases, and sales for Celebrity Tan Co. and

Ranchworks Co. are as follows:

Cost

Retail

Celebrity Tan

$ 300,000 $ 575,000

Merchandise inventory, August 1

Transactions during August:

Purchases (net)

3,375,000

2,149,000

Sales

3,170,000

Ranchworks Co.

Merchandise inventory, March 1

$ 880,000

Transactions during March through November:

Purchases (net)

9,500,000

Sales

15,800,000

Estimated gross profit rate

38%

Instructions

1. Determine the estimated cost of the merchandise inventory of Celebrity Tan Co. on

August 31 by the retail method, presenting details of the computations.

2. a. Estimate the cost of the merchandise inventory of Ranchworks Co. on November

30 by the gross profit method, presenting details of the computations.

b. Assume that Ranchworks Co. took a physical inventory on November 30 and dis-

covered that $369,750 of merchandise was on hand. What was the estimated loss

of inventory due to theft or damage during March through November?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 5 images

Knowledge Booster

Similar questions

- Selected data on inventory, purchases, and sales for Celebrity Tan Co. and Ranchworks Co. are as follows: Cost Retail Celebrity Tan Co. Inventory, August 1 $ 300,000 $ 575,000 Transactions during August: Purchases (net) 2,021,900 3,170,000 Sales 3,250,000 Ranchworks Co. Inventory, March 1 $880,000 Transactions during March through November: Purchases (net) 9,500,000 Sales 15,800,000 Estimated gross profit rate 38% Required: 1. Determine the estimated cost of the inventory of Celebrity Tan Co. on August 31 by the retail method.* Enter all ratios as percents, rounded to one decimal place. 2. a. Estimate the cost of the inventory of Ranchworks Co. on November 30 by the gross profit method.* b. Assume that Ranchworks Co. took a physical inventory on November 30 and discovered that $369,750 of inventory was on hand. What was the estimated loss of inventory due to theft or damage during March…arrow_forwardThe records of Culver's Boutique report the following data for the month of April. Sales revenue $103,800 Purchases (at cost) $43,800 Sales returns 1,900 Purchases (at sales price) 92,200 Markups 9,300 Purchase returns (at cost) 1,900 Markup cancellations 1,600 Purchase returns (at sales price) 2,800 Markdowns 9,600 Beginning inventory (at cost) 26,550 Markdown cancellations 2,700 Beginning inventory (at sales price) 44,400 Freight on purchases 2,300 Compute the ending inventory by the conventional retail inventory method. (Round ratios for computational purposes to 0 decimal places, e.g. 78% and final answer to 0 decimal places, e.g. 28,987.) Ending inventory using conventional retail inventory method %24arrow_forwardMultiple-Step Income Statement Use the following information to prepare a multiple-step income statement, including the revenue section and the cost of goods sold section, for Sauter Office Supplies for the year ended December 31, 20--. Sales $159,700 Sales Returns and Allowances 2,070 Sales Discounts 4,171 Interest Revenue 424 Merchandise Inventory, January 1, 20-- 27,500 Estimated Returns Inventory, January 1, 20-- 500 Purchases 110,000 Purchases Returns and Allowances 4,540 Purchases Discounts 2,710 Freight-In 885 Merchandise Inventory, December 31, 20-- 33,900 Estimated Returns Inventory, December 31, 20-- 1,100 Wages Expense 27,000 Supplies Expense 800 Phone Expense 900 Utilities Expense 7,000 Insurance Expense 1,200 Depreciation Expense—Equipment 3,900 Miscellaneous Expense 590 Interest Expense 4,600arrow_forward

- The records of Vaughn's Boutique report the following data for the month of April. Sales revenue $97,100 Purchases (at cost) $47,800 Sales returns 2,100 Purchases (at sales price) 86,100 Markups 10,400 Purchase returns (at cost) 2,100 Markup cancellations 1,500 Purchase returns (at sales price) 3,100 Markdowns 10,200 Beginning inventory (at cost) 24,251 Markdown cancellations 2,900 Beginning inventory (at sales price) 44,800 Freight on purchases 2,500 Compute the ending inventory by the conventional retail inventory method. (Round ratios for computational purposes to 0 decimal places, eg. 78% and final answer to 0 decimal places, eg. 28,987.) Ending inventory using conventional retail inventory method %$4arrow_forwardA company has the following information for the current year's operations: Beginning inventory Purchases Net markups Net markdowns Net sales Multiple Choice O Average cost. Management calculates the cost-to-retail percentage as 57.9%, equal to cost of $440,000 ($40,000+ $400,000) divided by retail of $760,000 ($60,000+ $660,000+ $50,000 $10,000). Which application of the retail inventory method is the company using? O O LIFO. Conventional. Cost $ 40,000 400,000 Dollar-value LIFO. Retail $60,000 660,000 50,000 10,000 580,000arrow_forwardThe following information is available for the past year for a retail store: Sales $121,000 Sales Returns $1,000 Markups $11,000 Markup cancellations $1,000 Markdowns $9,000 Purchases (at cost) $40,000 Purchases (at retail) $90,000 Beginning inventory (at cost) $30,000 Beginning inventory (at retail) $40,000 What is the cost-to-retail ratio to estimate the cost of ending inventory using the conventional retail method? (Round cost-to-retail ratios to four decimal places.) Group of answer choices 53.85% 75% 58.33% 50%arrow_forward

- Multiple-Step Income Statement Use the following information to prepare a multiple-step income statement, including the revenue section and the cost of goods sold section, for Sauter Office Supplies for the year ended December 31, 20--. Sales $160,000 Sales Returns and Allowances 2,300 Sales Discounts 4,175 Interest Revenue 425 Merchandise Inventory, January 1, 20-- 28,400 Estimated Returns Inventory, January 1, 20-- 600 Purchases 109,000 Purchases Returns and Allowances 4,560 Purchases Discounts 2,670 Freight-In 895 Merchandise Inventory, December 31, 20-- 30,100 Estimated Returns Inventory, December 31, 20-- 900 Wages Expense 27,400 Supplies Expense 800 Phone Expense 800 Utilities Expense 8,000 Insurance Expense 1,200 Depreciation Expense—Equipment 3,900 Miscellaneous Expense 590 Interest Expense 4,700 Sauter Office Supplies Income Statement For Year Ended December 31, 20-- Revenue from sales: $ $…arrow_forwardThe records of Heese Stores provided the following data for the year: Cost Retail (Base inventory) Inventory, January 1 $150,000 $ 250,000 Net purchases 830,800 1,318,000arrow_forward9arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education