FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

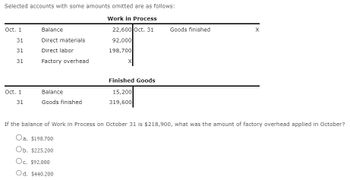

Transcribed Image Text:Selected accounts with some amounts omitted are as follows:

Work in Process

22,600 Oct. 31

92,000

198,700

Oct. 1

31

31

31

Oct. 1

31

Balance

Direct materials

Direct labor

Factory overhead

Balance

Goods finished

Finished Goods

15,200

319,600

Goods finished

X

If the balance of Work in Process on October 31 is $218,900, what was the amount of factory overhead applied in October?

Oa. $198.700

Ob. $225,200

Oc. $92,000

Od. $440,200

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Selected accounts with some amounts omitted are as follows Work in Process Oct. 1 Balance 24,100 Oct. 31 Finished goods X 31 Direct materials 91,500 31 Direct labor 177,600 31 Factory overhead X Finished Goods Oct. 1 Balance 12,700 31 Goods finished 350,900 If the balance of Work in Process on October 31 is $196,800, what was the amount of factory overhead applied in October? a.$91,500 b.$177,600 c.$254,500 d.$398,500arrow_forwardvd subject-Accountingarrow_forwardSubject: acountingarrow_forward

- Selected accounts with a credit amount omitted are as follows Work in Process Apr. 1 Balance 7,000 Apr. 30 Goods finished X 30 Direct materials 61,300 30 Direct labor 190,800 30 Factory overhead 57,240 Finished Goods Apr. 1 Balance 16,000 30 Goods finished 307,800 What was the balance of Work in Process as of April 30?arrow_forwardSelected accounts with some amounts omitted are as follows: Work in Process Oct. 1 Balance 24,100 Oct. 31 Goods finished 31 Direct materials 90,700 31 Direct labor 160,500 31 Factory overhead Finished Goods Oct. 1 Balance 12,000 31 Goods finished 333,200 If the balance of Work in Process on October 31 is $199,000, what was the amount of factory overhead applied in October? Oa. $160,500 b. $256,900 Oc. $383,600 Od. $90,700arrow_forwardQuestion 1 Zulfiqar Inc. has provided the following data for the month of September. There were no beginning inventories; consequently, the direct materials, direct labor, and manufacturing overhead applied listed below are all for the current month. Work in Process Finished Goods Cost of Goods Sold Total Direct materials 4,020 12,810 22,890 39,720 Direct labor 4,760 17,080 30,520 52,360 Manufacturing overhead applied 3,220 7,130 12,650 23,000 Total 12,000 37,020 66,060 115,080 Manufacturing overhead for the month was underapplied by Rs. 4,000. The company allocates any underapplied or overapplied manufacturing overhead among work in process, finished goods, and cost of goods sold at the end of the month on the basis of the overhead applied during the month in those accounts. Calculate amount of work in process inventory at the end of September after allocation of any underapplied or overapplied manufacturing…arrow_forward

- Selected accounts with some amounts omitted are as follows: Work in Process Date Transaction Debit amount Date Transaction Credit amount Aug. 1 Balance 279, 100 Aug. 31 Goods finished 190, 700 31 Direct materials X 31 Direct labor 47, 400 31 Factory overhead X Factory Overhead Date Transaction Debit amount Date Transaction Credit amount Aug. 1-31 Costs incurred 113,000 Aug. 1 Balance 12, 100 31 Applied X If the balance of Work in Process on August 31 is $196, 400, what was the amount debited to Work in Process for factory overhead in August, assuming a factory overhead rate of 30% of direct labor costs? a. $190, 700 b. $12, 100 c. $113, 000 d. $14, 220arrow_forwardSelected accounts with some amounts omitted are as follows: Work in Process Aug. 1 Balance 260,440 Aug. 31 Goods finished 164,150 31 Direct materials X 31 Direct labor 34,700 31 Factory overhead Factory Overhead Aug. 1-31 Costs incurred 97,500 Aug. 1 31 Balance Applied (30% of direct labor cost) 13,840 X If the balance of Work in Process on August 31 is $208,070, what was the amount debited to Work in Process for direct materials in August? a. $339,060 b. $87,070 c. $66,670 Od. $503,210arrow_forwardIf the balance of Work in Process on August 31 is $220,000, what was the amount debited to Work in Process for direct materials in August? a.$390,000 b.$525,000 c.$580,000 d.$170,000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education