FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

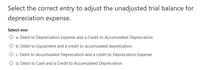

Transcribed Image Text:Select the correct entry to adjust the unadjusted trial balance for

depreciation expense.

Select one:

O a. Debit to Depreciation Expense and a Credit to Accumulated Depreciation

O b. Debit to Equipment and a credit to accumulated depreciation

O c. Debit to Accumulated Depreciation and a credit to Depreciation Expense

O d. Debit to Cash and a Credit to Accumulated Depreciation

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- J. To record cash payment of a prepaid expense. Explanation Insurance Expense Journal Entries Prepaid Insurance Interest Receivable Interest Revenue Interest Expense Interest Payable Accounts Payable Cash Cash Accounts Receivable (from services) Prepaid Rent Cash Unearned Revenue Cash Services Revenue Unearned Revenue Depreciation Expense Accumulated Depreciation Salaries Expense Salaries Payable ma Dobit 3,180 3,300 2,208 1,700 12,300 500 19,250 4,200 38,217 13,280 Credit 3,180 3,300 2,208 1,700 12,300 500 19,250 4,200 38,217 13,280arrow_forwardwhat type of account accumulated depreciation? and depreciation expense is and on what statement each account goes?arrow_forwardWhich method of the matching principle is used when a company recognizes depreciation expense on the income statement? Group of answer choices A. Installment method B. Systematic and rational allocation C. Immediate recognition D. Associating cause and effectarrow_forward

- true or false questionsarrow_forwardWhat does the credit balance in the Accumulated Depreciation account represent?arrow_forward41. Realization of revenue occurs when a. the item is formally recorded and reported in the financial statements b. noncash resources are converted into cash or rights to cash c. the actual exchange of noncash resources into cash С. d. when a transaction is both realized and realizable 42.A revenue recognition method that recognizes revenue before the time of sale is a. percentage-of-completion b. installment c. cost recovery d. point of sale С.arrow_forward

- Which of the following accounts would not be included in the closing entries?a. Service Revenueb. Depreciation Expensec. Retained Earningsd. Accumulated Depreciationarrow_forwardFailure to record the typical balance day adjustment to the Unearned Revenue account would: Select one: a. result in Liabilities being overstated. b. result in Assets being overstated. c. result in Revenues being overstated. O d. result in Net Profit being overstated.arrow_forwardPlease check my work For journal entries 1 through 12, indicate the explanation that most closely describes it. You can use explanations more than once. To record receipt of unearned revenue. To record this period's earning of prior unearned revenue. To record payment of an accrued expense. To record receipt of an accrued revenue. To record an accrued expense. To record an accrued revenue. To record this period's use of a prepaid expense. To record payment of a prepaid expense. To record this period's depreciation expense.arrow_forward

- The following is an example of a contra account: Select one: Equipment Equipment expense Accounts payable Accumulated depreciationarrow_forwardThe accumulated depreciation account is closed to the depreciation expense account. True Falsearrow_forwardRecording depreciation for a plant asset conforms to which accounting principle/assumption? OA. Matching Principle B. Time Period Assumption OC. Full Disclosure Principle OD. Revenue Recognition Principle***arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education