FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

help s

Transcribed Image Text:**Transcription for Educational Website**

**Security Technology Incorporated (STI) Overview:**

STI is a manufacturer of electronic control systems used in the production of special-duty auto transmissions, primarily for police and military use. The components sell for $61 per unit. In 2021, STI sold 24,300 units. The company began 2021 with no inventory and projects sales of 26,900 units in 2022. The production level is set at 25,600 units for both 2021 and 2022.

- **Variable Manufacturing Costs:** $22 per unit

- **Variable Selling Costs:** $0.40 per unit

- **Fixed Manufacturing Costs:** $128,000 per year

- **Fixed Selling Costs:** $560 per year

**Requirements:**

1. Prepare an income statement for each year using full costing.

2. Prepare an income statement for each year using variable costing.

3. Prepare a reconciliation of the difference each year in operating income from using full and variable costing methods.

**Instructions:**

Complete the tasks by entering answers in the provided tabs.

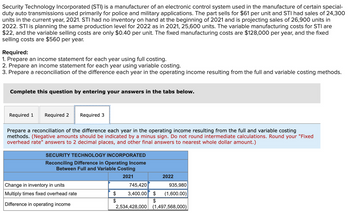

**Reconciliation Task:**

Prepare a reconciliation of the difference each year in operating income from the full and variable costing methods.

- Use a minus sign for negative amounts.

- Do not round intermediate calculations.

- Round "Fixed overhead rate" answers to two decimal places.

- Round other final answers to the nearest whole dollar amount.

**Table Summary:**

**SECURITY TECHNOLOGY INCORPORATED**

_Reconciling Difference in Operating Income Between Full and Variable Costing_

- **2021:**

- Change in Inventory in Units: 745,420

- Multiply Times Fixed Overhead Rate: $3,400.00

- Difference in Operating Income: $2,534,428,000

- **2022:**

- Change in Inventory in Units: 935,980

- Multiply Times Fixed Overhead Rate: $(1,600.00)

- Difference in Operating Income: $(1,497,568,000)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Similar questions

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education