FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Strikethrough

Calculator

Scratch Pad

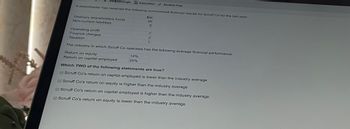

A shareholder has received the following summarised financial results for Scruff Co for the last year:

Sm

Ordinary shareholders funds

25

Non-current liabilities

6

Operating profit

Finance charges

2

Taxation

1

The industry in which Scruff Co operates has the following average financial performance:

Return on equity

14%

25%

Return on capital employed

Which TWO of the following statements are true?

Scruff Co's return on capital employed is lower than the industry average

Scruff Co's return on equity is higher than the industry average

Scruff Co's return on capital employed is higher than the industry average

Scruff Co's return on equity is lower than the industry average

7

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Provide Answer Fast With Correct Answerarrow_forwardThe most recent financial statements for Mandy Company are shown here: Income Statement Balance Sheet $ 11,940 Debt 31,500 Equity Sales Costs Taxable income Taxes (21%) Net income $ 20,100 Current assets 13,800 Fixed assets Internal growth rate $ 6,300 1,323 $ 4,977 Total $ 43,440 % $ 16,420 27,020 Assets and costs are proportional to sales. Debt and equity are not. The company maintains a constant 45 percent dividend payout ratio. What is the internal growth rate? (Do not round intermediate calculations and enter your answer as a percent rounded 2 decimal places, e.g., 32.16.) Total $ 43,440arrow_forwardssubject :-Accountingarrow_forward

- provide both answer pleasearrow_forwardUramilabenarrow_forwardSix Measures of Solvency or Profitability The following data were taken from the financial statements of Loveseth Inc. for the current fiscal year. Property, plant, and equipment (net) $982,500 Liabilities: Current liabilities $131,000 Note payable, 6%, due in 15 years 655,000 Total liabilities $786,000 Stockholders' equity: Preferred $2 stock, $100 par (no change during year) $471,600 Common stock, $10 par (no change during year) 471,600 Retained earnings: Balance, beginning of year $504,000 Net income 254,000 $758,000 Preferred dividends $9,432 Common dividends 119,768 129,200 Balance, end of year 628,800 Total stockholders' equity $1,572,000 Sales $11,035,200 Interest expense $39,300 Assuming that total assets were $2,240,000 at the beginning of the current fiscal year, determine the…arrow_forward

- A company's year-end selected financial data is shown below. Year 2 Year 1 Current assets $250,000 $175,000 Total assets 600,000 500,000 Total liabilities 300,000 225,000 Net sales 200,000 150,000 Net income 75,000 60,000 The company's rate of return on assets and rate of return on equity for Year 2 are: a. 12% and 22%, respectively. Ob. 13% and 25%, respectively. Oc. 14% and 26%, respectively. Od. 36% and 25%, respectively.arrow_forwardThe most recent financial statements for Mandy Company are shown below: Balance Sheet $ 32,000 Debt 93,200 Equity $ 125,200 Total Income Statement Sales Costs Taxable income Tax (218) Net Income $91,200 Current assets 66,150 Fixed assets $ 25,050 5,261 Total $ 19,789 Sustainable growth rate Assets and costs are proportional to sales. Debt and equity are not. The company maintains a constant 35 percent dividend payout ratio. No external equity financing is possible. What is the sustainable growth rate? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. $ 42,000 83,200 $ 125,200 %arrow_forwardThe most recent financial statements for Mandy Company are shown here: Income Statement Balance Sheet $ 11,760 27,450 $ 39,210 Sales Costs Taxable income Taxes (24%) Net income $19,200 13,050 $ 6,150 Sustainable growth rate 1,476 $4,674 Current assets Fixed assets Total Debt Equity % Total Assets and costs are proportional to sales. Debt and equity are not. The company maintains a constant 45 percent dividend payout ratio. What is the sustainable growth rate? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) $ 15,880 23,330 $ 39,210arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education