Advanced Engineering Mathematics

10th Edition

ISBN: 9780470458365

Author: Erwin Kreyszig

Publisher: Wiley, John & Sons, Incorporated

expand_more

expand_more

format_list_bulleted

Question

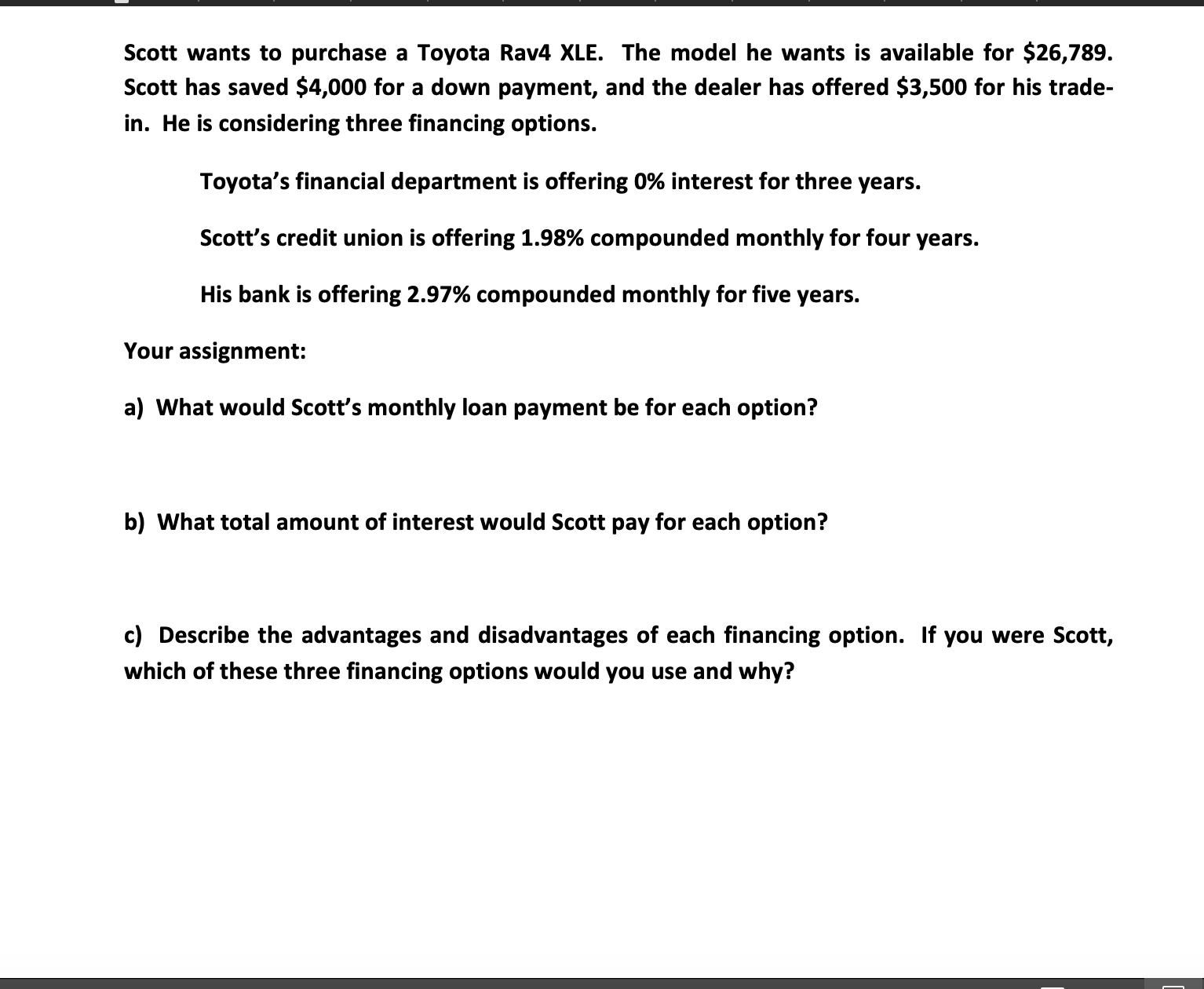

Transcribed Image Text:Scott wants to purchase a Toyota Rav4 XLE. The model he wants is available for $26,789.

Scott has saved $4,000 for a down payment, and the dealer has offered $3,500 for his trade-

in. He is considering three financing options.

Toyota's financial department is offering 0% interest for three years.

Scott's credit union is offering 1.98% compounded monthly for four years.

His bank is offering 2.97% compounded monthly for five years.

Your assignment:

a) What would Scott's monthly loan payment be for each option?

b) What total amount of interest would Scott pay for each option?

c) Describe the advantages and disadvantages of each financing option. If you were Scott,

which of these three financing options would you use and why?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Similar questions

- Sandra buys a new car for $18,600. She puts 15% down and obtains a simple interest amortized loan for the balance at6. 25% for 5 years. Find her monthly payment and the total interest paid.arrow_forwardJoe secured a loan of $10,000 three years ago from a bank for use toward his college expenses. The bank charges interest at the rate of 3%/year compounded monthly on his loan. Now that he has graduated from college, Joe wishes to repay the loan by amortizing it through monthly payments over 13 years at the same interest rate. Find the size of the monthly payments he will be required to make.arrow_forwardJoe and his partners have contracted to purchase the franchise rights, worth $66,000, to open and operate a specialty pizza restaurant called Pepperoni's. With a renewable agreement, the partners have agreed to make payments at the beginning of every three months for two years. To accommodate the renovation period, Pepperoni's corporate office has agreed to allow the payments to start in one year, with interest at 9.84% compounded annually. What is the amount of each payment? www The amount of each payment is s (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.)arrow_forward

- Karim Soltan is shopping for a new vehicle, and has noticed that many vehicle manu-facturers are offering special deals to sell off the current year’s vehicles before the new models arrive. Karim’s local Ford dealership is advertising 3.9% financing for a full 48 months (i.e., 3.9% compounded monthly) or up to $4000 cash back on selected vehicles. The vehicle that Karim wants to purchase costs $24 600 including taxes, delivery, licence, and dealer preparation. This vehicle qualifies for $1800 cash back if Karim pays cash for the vehicle. Karim has a good credit rating and knows that he could arrange a vehicle loan at his bank for the full price of any vehicle he chooses. His other option is to take the dealer financing offered at 3.9% for 48 months. Karim wants to know which option requires the lower monthly payment. He knows he can use annuity formulas to calculate the monthly payment.QUESTIONS Suppose Karim buys the vehicle on July 1. What monthly payment must Karim make if he…arrow_forwardMayfair Fashions has a $90,000 line of credit from the Bank of Montreal. Interest at prime plus 2% is deducted from Mayfair’s chequing account on the twenty-fourth of each month. Mayfair initially drew down $40,000 on March 8 and another $15,000 on April 2. On June 5, $25,000 of principal was repaid. If the prime rate was 5.25% on March 8 and rose by 0.25% effective May 13, what were the first four interest deductions charged to the store’s account? (Round your answers to the nearest cent.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Advanced Engineering MathematicsAdvanced MathISBN:9780470458365Author:Erwin KreyszigPublisher:Wiley, John & Sons, Incorporated

Advanced Engineering MathematicsAdvanced MathISBN:9780470458365Author:Erwin KreyszigPublisher:Wiley, John & Sons, Incorporated Numerical Methods for EngineersAdvanced MathISBN:9780073397924Author:Steven C. Chapra Dr., Raymond P. CanalePublisher:McGraw-Hill Education

Numerical Methods for EngineersAdvanced MathISBN:9780073397924Author:Steven C. Chapra Dr., Raymond P. CanalePublisher:McGraw-Hill Education Introductory Mathematics for Engineering Applicat...Advanced MathISBN:9781118141809Author:Nathan KlingbeilPublisher:WILEY

Introductory Mathematics for Engineering Applicat...Advanced MathISBN:9781118141809Author:Nathan KlingbeilPublisher:WILEY Mathematics For Machine TechnologyAdvanced MathISBN:9781337798310Author:Peterson, John.Publisher:Cengage Learning,

Mathematics For Machine TechnologyAdvanced MathISBN:9781337798310Author:Peterson, John.Publisher:Cengage Learning,

Advanced Engineering Mathematics

Advanced Math

ISBN:9780470458365

Author:Erwin Kreyszig

Publisher:Wiley, John & Sons, Incorporated

Numerical Methods for Engineers

Advanced Math

ISBN:9780073397924

Author:Steven C. Chapra Dr., Raymond P. Canale

Publisher:McGraw-Hill Education

Introductory Mathematics for Engineering Applicat...

Advanced Math

ISBN:9781118141809

Author:Nathan Klingbeil

Publisher:WILEY

Mathematics For Machine Technology

Advanced Math

ISBN:9781337798310

Author:Peterson, John.

Publisher:Cengage Learning,