FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

dont give me answer in image format

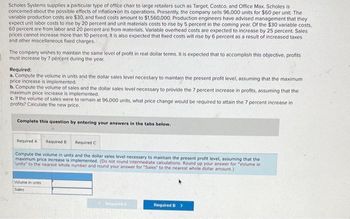

Transcribed Image Text:Scholes Systems supplies a particular type of office chair to large retailers such as Target, Costco, and Office Max. Scholes is

concerned about the possible effects of inflation on its operations. Presently, the company sells 96,000 units for $60 per unit. The

variable production costs are $30, and fixed costs amount to $1,560,000. Production engineers have advised management that they

expect unit labor costs to rise by 20 percent and unit materials costs to rise by 5 percent in the coming year. Of the $30 variable costs.

60 percent are from labor and 20 percent are from materials. Variable overhead costs are expected to increase by 25 percent. Sales

prices cannot increase more than 10 percent. It is also expected that fixed costs will rise by 6 percent as a result of increased taxes

and other miscellaneous fixed charges.

The company wishes to maintain the same level of profit in real dollar terms. It is expected that to accomplish this objective, profits

must increase by 7 percent during the year.

Required:

a. Compute the volume in units and the dollar sales level necessary to maintain the present profit level, assuming that the maximum

price increase is implemented.

b. Compute the volume of sales and the dollar sales level necessary to provide the 7 percent increase in profits, assuming that the

maximum price increase is implemented.

c. If the volume of sales were to remain at 96,000 units, what price change would be required to attain the 7 percent increase in

profits? Calculate the new price.

Complete this question by entering your answers in the tabs below.

Required A

Required B Required C

Compute the volume in units and the dollar sales level necessary to maintain the present profit level, assuming that the

maximum price increase is implemented. (Do not round intermediate calculations. Round up your answer for "Volume in

units to the nearest whole number and round your answer for "Sales" to the nearest whole dollar amount.)

Volume in units

Sales

Required A

Required B >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education