FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

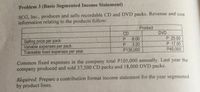

Transcribed Image Text:Problem 3 (Basic Segmented Income Statement)

SCG, Inc., produces and sells recordable CD and DVD packs. Revenue and cost

information relating to the products follow:

Product

CD

DVD

P 25.00

P 17.50

P45,000

P.

8.00

Selling price per pack

Variable expenses per pack

Traceable fixed expenses per year

P.

3.20

P138,000

Common fixed expenses in the company total P105,000 annually. Last year the

company produced and sold 37,500 CD packs and 18,000 DVD packs.

Required: Prepare a contribution format income statement for the year segmented

by product lines.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- answer in text form please (without image), Note: .Every entry should have narration pleasearrow_forwardMarwik Pianos. Inc purchases pianos from a large manufacturer for an average cost of $1,482 per unit and then sells them to retail Customers for an average price or S2,100 each. The company's selling and administrative costs for a typical month are presented below Costs Cost Formuala Selling $965 per month Advertising $4,793 per month plus 5% of Sales Sales Salaries and commissions $57 per piano sold Delivery of Pianos to customers $670 per month Utilities $4,903 per month Depreciaiton of Sales Facilities Administrative Executive Salaries $13,506 per month Insurance $701 per month Clerical $2,480 per month,plus $ 37 per piano sold Depreciation of Office Equipment $916 per month During August, Marvik Pianos sold and delivered 63 pianos. Prepare Traditional Income Statement and also prepare contribution format income statement for cost(Show costs and revenues on both a total and a per unit basis down through contribution margin)arrow_forwardTodrick Company is a merchandiser that reported the following information based on 1,000 units sold: Sales $ 300,000 Beginning merchandise inventory $ 20,000 Purchases $ 200,000 Ending merchandise inventory $ 7,000 Fixed selling expense ?question mark Fixed administrative expense $ 12,000 Variable selling expense $ 15,000 Variable administrative expense ?question mark Contribution margin $ 60,000 Net operating income $ 18,000 3. Calculate the selling price per unit. 4. Calculate the variable cost per unit. 5. Calculate the contribution margin per unit.arrow_forward

- ABC Co. is selling its products to customers A, B and C. The following information is given for the year 2018-19. Customer A Customer B Customer C Sales in Lakhs (?) 15.90 20.0 15.0 Number of deliveries (including rush deliveries) 100 40 50 Number of orders 120 50 60 1.2 Average number of hours per delivery (for verification of goods | before loading for delivery) 1 1.30 Number of rush deliveries 2 1 2 Sales commission (% to sales) 4 5 Normal delivery cost is ? 1,250 per delivery. Order processing cost is ? 1,84,000. Verification cost of goods before loading is ? 5,32,500. Rush delivery cost is 180% of normal delivery cost. Variable cost is 75 percent of sales. (i) Present a customer wise profitability statement.arrow_forwardSisyphus Inc. records total sales of $657,500 in the current period, with a cost of goods sold of $389,000 . Sisyphus expects 4% of sales to be returned. How much in net sales will Sisyphus recognize for the current period? Group of answer choices $373,400 $268,500 $631,200 $657,500 $257,760 The Sisyphus Inc’s (SSY) Company’s annual statement of cash flows reported the following (in millions): Net cash from financing activities $63,864 Net cash from investing activities -62,512 Cash at the beginning of the year 13,152 Cash at the end of the year 18,948 What did SSY report for “Net cash from operating activities” during the year? Group of answer choices $71,220 million cash inflow None of the above $4,444 million cash outflow $4,444 million cash inflow $71,220 million cash outflowarrow_forwardPlanet Ltd produces fridges and freezers, which are sold to retailers. The financial statements for the last three years are as follows: Income statements for the year ending 31st December 2021 2022 £000 £000 Revenue 336,250 427,038 Cost of sales (126,675) (190,012) Gross profit 209,575 237,025 Administration expenses (73,290) (95,795) Distribution expenses (14,678) (8,720) Operating profit 121,407 121,931 Interest (8,750) (11,250) Profit before tax 118,142 166,326 Tax (22,531) (22,136) Profit for the year 90,126 88,545 Statements of financial position as at 31st December 2021 2022 £000 £000 Non-current assets Property, plant and equipment 286,250 327,650 Current assets Inventories 37,000 28,000 Trade receivables 42,000 43,500 Cash 19,632 24,570 98,632 96,070 Total assets 384,882…arrow_forward

- Hagrid Gardening Corporation manufactures gardening products. The following information relates to the current period: DM Purchased $14,900 DM Inventory, Jan 1 $12,700 DM Inventory, Dec 31 $16,100 DL $6,400 MOH $16,700 Period Costs $10,500 WIP Inventory, Jan 1 $2,500 WIP Inventory, Dec 31 $8,000 FG Inventory, Jan 1 $19,500 FG Inventory, Dec 31 $4,800 A total of 5,000 products were sold for $25 each. Based on this information, please calculate the following: Cost of Goods Sold?arrow_forwardPle'egrea Pte Ltd. sells books in Madagascar. They have supplied the following data: • Units sold: 3,291 • Sales revenue: $4,710,350 • Variable manufacturing expense: $2,107,995 • Fixed manufacturing expense: $1,207,163 . Variable selling and administrative expense: $437,696 Fixed selling and administrative expense: $334,084 • Net operating income: $623,412 Ple'egrea's contribution margin ratio is closest to: ● Select one: O A. 29.6% OB. 13.2% O C. 83.6% O D. 46.0% OE. 67.3%arrow_forwardNike company sells 80,000 units for $9 a unit. The fixed cost is $120,000 and the Net Income is $360,000. What should be reported as variable expenses in the CVP income statementarrow_forward

- Pharoah Beauty Corporation manufactures cosmetic products that are sold through a network of sales agents. The agents are paid a commission of 22% of sales. The income statement for the year ending December 31, 2025, is as follows. PHAROAH BEAUTY CORPORATION Income Statement For the Year Ended December 31, 2025 Sales | Cost of goods sold Variable Fixed Gross profit Selling and marketing expenses Commissions Fixed costs Operating income $30,760,000 8,580,000 $16,918,000 10,070,400 $76,900,000 39,340,000 $37,560,000 26,988,400 $10,571,600 (a) ✓ Your answer is correct. Under the current policy of using a network of sales agents, calculate the Pharoah Beauty Corporation's break-even point in sales dollars for the year 2025. (b) Break-even point $ eTextbook and Media Calculate the company's break-even point in sales dollars for the year 2025 if it hires its own sales force to replace the network of agents. Break-even point $ eTextbook and Media Save for Later Attempts: 1 of 2 used The…arrow_forwardCheertime Company produces three lines of greeting cards scented, musical, and regular. There are common fixedexpenses of $7,500 (meaning this expense is applied only 1 time no matter if the company produces one line or allthree lines). The additional financial information for all three lines is below:Scented:Sales $ 10,000Variable expenses $ 7,000Advertising $ 4,000Musical:Sales $ 15,000Variable expenses $ 12,000Advertising $ 5,000Regular:Sales $ 25,000Variable expenses $ 12,500Advertising $ 3,000With the current financial information, Cheertime's current operating income is a loss of $1,000. For 2022, thepresident of Cheertime is considering two alternatives to cut down on losses: 1) completely eliminating thescented and musical card lines which she projects will decrease the sales and variable expenses of the regulargreeting card line by 20%. Or 2) Increasing advertising by $250 for the scented line and $750 for the musical linewhich she projects will increase the sales and variable…arrow_forwardSimple Accounting - CPV. The unit price for towel is $18.59 and the variable cost is $7.11. If the fixed cost for the retailer is $22,853.71 and the targeted operating income is $40,500.00, how many units should be sold (round to the nearest unit)? O a. 5,519 O b. 8,911 O c. 3,408 O d. 2,465arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education