ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

The last four questions, not the first four.

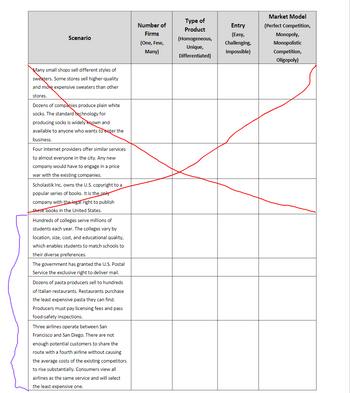

Transcribed Image Text:Scenario

Many small shops sell different styles of

sweaters. Some stores sell higher-quality

and more expensive sweaters than other

stores.

Dozens of companies produce plain white

socks. The standard technology for

producing socks is widely known and

available to anyone who wants to enter the

business.

Four Internet providers offer similar services

to almost everyone in the city. Any new

company would have to engage in a price

war with the existing companies.

Scholastik Inc. owns the U.S. copyright to a

popular series of books. It is the only

company with the legal right to publish

these books in the United States.

Hundreds of colleges serve millions of

students each year. The colleges vary by

location, size, cost, and educational quality,

which enables students to match schools to

their diverse preferences.

The government has granted the U.S. Postal

Service the exclusive right to deliver mail.

Dozens of pasta producers sell to hundreds

of Italian restaurants. Restaurants purchase

the least expensive pasta they can find.

Producers must pay licensing fees and pass

food-safety inspections.

Three airlines operate between San

Francisco and San Diego. There are not

enough potential customers to share the

route with a fourth airline without causing

the average costs of the existing competitors

to rise substantially. Consumers view all

airlines as the same service and will select

the least expensive one.

Number of

Firms

(One, Few,

Many)

Type of

Product

(Homogeneous,

Unique,

Differentiated)

Entry

(Easy,

Challenging,

Impossible)

Market Model

(Perfect Competition,

Monopoly,

Monopolistic

Competition,

Oligopoly)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- For distract drivingarrow_forwardGame Theory / Economicsarrow_forward38. Consider the following game. There are ten churches in town: nine are Catholic and one is Eastern Orthodox. All churches conduct their divine services at 10am on Sunday morning. You and your friend, without communication, agree to meet at a church service. If you fail to meet at the same church, then you are sad and become a Doomer. What is this game's focal point? Remember that you cannot communicate about this. (A) You meet at any of the Catholic churches. (B) You meet at any of the churches – denomination does not matter. We're all the same bro. (C) You meet at the Orthodox church. (D) There is no focal point. 39. Consider a fractional-reserve banking system in which an initial deposit of $1,000 can generate up to $4,000 in money. What is the reserve ratio? (A) 4 percent. (B) 5 percent. (C) 25 percent. (D) 75 percent.arrow_forward

- Dynamic Game: US Tax No Tax Fiji Fiji Tax No Tax Tax No Tax 10,000,10 9900,-9989 10,100,-89.990 Sub-game_1 10,000,-99,989 Sub-game_2 Sub-game_3 1. Is there a Nash Equilibrium of this game in which Fiji improves its payoffs relative to the Sub-game Perfect Nash equilibrium? If there is, explain carefully why this strategy profile is not a Sub-game Perfect Nash equilibrium.arrow_forwardConsider the following situation: five individuals are participating in an auction for an old bicycle used by a famous cyclist. The table below provides the bidders' valuations of the cycle. The auctioneer starts the bid at an offer price far above the bidders' values and lowers the price in increments until one of the bidders accepts the offer. Bidder Value ($) Roberto 750 Claudia 700 Mario 650 Bradley 600 Michelle 550 What is the optimal strategy of each player in this case? Who will win the auction if each bidder places his or her optimal bid? If Claudia wins the auction, how much surplus will she earn?arrow_forwardThe question is intermediate microeconomicsarrow_forward

- Up Down Up Down Player 1 In the game above, what is/are the sub-game perfect Nash equilibrium? (up,up) (up,down) (down, up) (down, down) No equilibrium exists Up Down Player 2 eLearning Help P1 gets $45 P2 gets $155 P1 gets $100 P2 gets $10 P1 gets $85 P2 gets $85 P1 gets $95 P2 gets $95arrow_forwardQUESTION 12 This is a HOT SPOT question. You will need to evaluate the picture of the game below, and answer the question by clicking on a specific area (the hot spot) of the picture. Question: Are there any dominant strategies in this game? If there are, click on the box that corresponds to that dominant strategy (either UP, DOWN, LEFT, or RIGHT). If there aren't any anywhere outside of these boxes. If there are dominant strategies for both players, clicking on only one of them will suffice. Player 1 Player 2 Selected Coordinates Clear UP DOWN LEFT 45, 80 70, 100 RIGHT 50, 150 60, 60arrow_forwardMike and Sophie are splitting up and need to decide who will get the car they purchased together. Using the method of sealed bids, Mike bids $5,000 and Sophie bids $4,500 for the car. Since Mike's bid is higher, he gets the car, and has to compensate Sophie with cash. How much will he have to pay Sophie in order to keep the division fair?arrow_forward

- Table 1.3: Erica and Fred's game. Fred Testify Remain silent Testify (-14, –14) (0, – 15) Erica Remain silent (-15,0) (-1, –1) What is the best global outcome, and how many years total prison time does it lead to? Both confess, 14 years in prison Both confess, 28 years in prison Both silent, 15 years in prison Both silent, 2 years in prisonarrow_forwardA "Prisoner's Dilemma" is a situation in which both parties: a) have an incentive to cooperate(meaning working with the other criminal by keeping one's mouth shut) even without communication b) have an incentive to not cooperate(meaning working with other criminal by keeping one's mouth shut) even through cooperation would be mutually benefical. c)have no incentives to cooperate or not cooperate because either way they lose.arrow_forwardProblem: Imagine you have two competing athletes who have the option to use an illegal and dangerous drug to enhance their performance (i.e., dope). If neither athlete dopes, then neither gain an advantage. If only one dopes, then that athlete gains a massive advantage over their competitor, reduced by the medical and legal risks of doping (the athletes believe the advantage over their competitor outweighs the risks from doping ). However, if both athletes dope, the advantages cancel out, and only the risks remain, putting them both in a worse position than if neither had been doping. What outcome do we expect from these two athletes? Please use ideas like concepts of monopolies, Oligopolies and Game Theory and Factor markets for this scenario.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education