FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

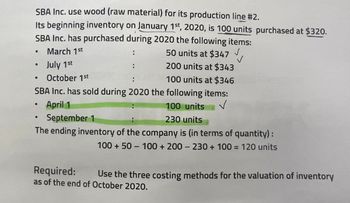

Transcribed Image Text:SBA Inc. use wood (raw material) for its production line #2.

Its beginning inventory on January 1st, 2020, is 100 units purchased at $320.

SBA Inc. has purchased during 2020 the following items:

March 1st

50 units at $347 ✓

July 1st

200 units at $343

October 1st

100 units at $346

SBA Inc. has sold during 2020 the following items:

✓

●

●

●

.

:

●

:

April 1

100 units

September 1

230 units

The ending inventory of the company is (in terms of quantity) :

100 + 50 100 + 200 230 + 100 = 120 units

:

Required:

as of the end of October 2020.

Use the three costing methods for the valuation of inventory

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- tps://ezto.mheducation.com/ext/map/index.h Saved Required information [The following information applies to the questions displayed below.] Scavenger Company, a manufacturer of recycling bins, began operations on January 1 of the current year. During this time the company produced 60,000 units and sold 55,000 units at a sales price of $15 per unit. Cost information for this year is shown in the following table: Production costs $ 2.50 per unit Direct materials Direct labor $ 3.00 per unit $ Variable overhead Fixed overhead 0.75 per unit $240,000 in total Non-production costs Variable selling and administrative Fixed selling and administrative $ 10,000 in total $50,000 in total Given the Scavenger Company data, what is net income using absorption costing? Multiple Choice < Prev 5 of 7 #arrow_forward[The following Information applies to the questions displayed below.] Laker Company reported the following January purchases and sales data for Its only product. Date Activities Units Acquired at Cost 225 units @ $15.e0 = $ 3,375 Units sold at Retail Jan. 1 Beginning inventory Jan. 10 sales 175 units @ $24.00 Jan. 20 Purchase 180 units @ $14.ee - 2,520 Jan. 25 Sales 210 units e $24.00 Jan. 30 Purchase 350 units @ $13.50 = 4,725 Totals 755 units $18,620 385 units The Company uses a perpetual Inventory system. For specific lidentification, ending Inventory consists of 370 units, where 350 are from the January 30 purchase, 5 are from the January 20 purchase, and 15 are from beginning Inventory. Requlred: 1. Complete the table to determine the cost assigned to ending Inventory and cost of goods sold using specific Identification. 2. Determine the cost assigned to ending Inventory and to cost of goods sold using welghted average. 3. Determine the cost assigned to ending Inventory and to…arrow_forwardHow to do this. Please explain. Thank you.arrow_forward

- Dinesh bhaiarrow_forwardHagrid Gardening Corporation manufactures gardening products. The following information relates to the current period: DM Purchased $14,900 DM Inventory, Jan 1 $12,700 DM Inventory, Dec 31 $16,100 DL $6,400 MOH $16,700 Period Costs $10,500 WIP Inventory, Jan 1 $2,500 WIP Inventory, Dec 31 $8,000 FG Inventory, Jan 1 $19,500 FG Inventory, Dec 31 $4,800 A total of 5,000 products were sold for $25 each. Based on this information, please calculate the following: Cost of Goods Sold?arrow_forward1arrow_forward

- 6. Required information Skip to question [The following information applies to the questions displayed below.]Ferris Company began January with 4,000 units of its principal product. The cost of each unit is $8. Merchandise transactions for the month of January are as follows: Purchases Date of Purchase Units Unit Cost* Total Cost Jan. 10 3,000 $ 9 $ 27,000 Jan. 18 4,000 10 40,000 Totals 7,000 67,000 * Includes purchase price and cost of freight. Sales Date of Sale Units Jan. 5 2,000 Jan. 12 1,000 Jan. 20 3,000 Total 6,000 5,000 units were on hand at the end of the month. 5. Calculate January's ending inventory and cost of goods sold for the month using Average cost, perpetual system. (Round average cost per unit to 4 decimal places. Enter sales with a negative sign.)arrow_forwardCurrent Attempt in Progress Marigold Corp. had 290 units of product A on hand at January 1, 2020, costing $19 each. Purchases of product A during January were as follows: Date Units Unit Cost Jan. 10 380 $20 18 540 21 28 180 22 A physical count on January 31, 2020 shows 410 units of product A on hand. The cost of the inventory at January 31, 2020 under the LIFO method is O $7910. O $7610. O $8790. O $8310. Save for Later Attempts: 0 of 2 used Submit Answerarrow_forward3. Required information Skip to question [The following information applies to the questions displayed below.]Ferris Company began January with 4,000 units of its principal product. The cost of each unit is $8. Merchandise transactions for the month of January are as follows: Purchases Date of Purchase Units Unit Cost* Total Cost Jan. 10 3,000 $ 9 $ 27,000 Jan. 18 4,000 10 40,000 Totals 7,000 67,000 * Includes purchase price and cost of freight. Sales Date of Sale Units Jan. 5 2,000 Jan. 12 1,000 Jan. 20 3,000 Total 6,000 5,000 units were on hand at the end of the month.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education