FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

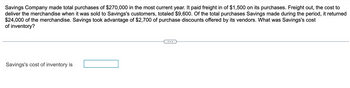

Transcribed Image Text:Savings Company made total purchases of $270,000 in the most current year. It paid freight in of $1,500 on its purchases. Freight out, the cost to

deliver the merchandise when it was sold to Savings's customers, totaled $9,600. Of the total purchases Savings made during the period, it returned

$24,000 of the merchandise. Savings took advantage of $2,700 of purchase discounts offered by its vendors. What was Savings's cost

of inventory?

Savings's cost of inventory is

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The Nyameye Manufacturing Company increased its merchandise inventory by GH¢17,000 over the year. The company also granted its customers more liberal credit terms which increased the accounts receivable by GH¢37,500. Sales were GH¢975,000, and the accounts payable decreased by GH¢27,500. The gross profit on sales is 45%. Marketing and administrative expenses were GH¢145,000; this included depreciation expense of GH¢4,000. What were the cash disbursements for the year?arrow_forwardBlossom Corporation shipped $21,900 of merchandise on consignment to Cullumber Company. Blossom paid freight costs of $2,100. Cullumber Company paid $550 for local advertising, which is reimbursable from Blossom. By year-end, 65% of the merchandise had been sold for $21,900. Cullumber notified Blossom, retained a 10% commission, and remitted the cash due to Blossom. Prepare Blossom's journal entry when the cash is received. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Account Titles and Explanation (To record the cash remitted to Blossom.) (To record the cost of inventory sold on consignment.) Debit 11 Credit 1arrow_forwardA sole proprietorship firm has taxable income of $128,200. Assume this is the sole source of income for the owner. Taxable Tax Rate Income 9,525 10 % %$4 9,526 38,700 12 38,701 82,500 22 82,501 157,500 24 157,500 – 200,000 32 The marginal tax rate is percentarrow_forward

- In its first year of operations, Dulany Company, a clothing store, purchased $18,000 of merchandisefrom a supplier on account, terms 2/10, n 30. Dulany Company returned $3,000 of defectivemerchandise, and then paid the amount due within the discount period. During the year, the companysold merchandise inventory costing $12,000 to its customers. What would be the balance in Dulany’sCompany’s Merchandise Inventory account at the end of the year?A. $2,700B. $3,200C. $3,300D. $2,640arrow_forwardMarigold Corporation uses a perpetual inventory system and had inventory worth $73,500 at the beginning of the year. Purchases were made during the year for $323,000; however, 10% of these goods were returned to the supplier, and a 3% discount was taken on the remaining balance owing. Marigold paid $2,500 cash for freight to ship the inventory to its location during the year. Marigold reported cost of goods sold for the year of $245,000. Marigold has a calendar year end. What is the balance in the inventory account at the end of the year? Balance $arrow_forwardSara’s Market recorded the following events involving a recent purchase of merchandise: Received goods for $150,000, terms 2/10, n/40. Returned $3,000 of the shipment for credit. Paid $750 freight on the shipment. Paid the invoice within the discount period. As a result of these events, the company’s merchandise inventory increased by $147,750. increased by $144,810. increased by $144,795 increased by $144,060.arrow_forward

- The ABC merchandise Company has the following transactions: May 01: The Company purchased 5 units of inventory on account at a costof $500 each.May 04: sold 4 units of inventory on account at a price of $800 each.May 05: Purchased an additional 6 units on account at a cost of $500.May 07: Paid $2500 against purchases to supplier of inventory.May 08: Sold 5 units of inventory for cash at a sale price of $850.May 10: Collected $3200 from the customer against the credit sales onMay 04.Requirement: Prepare the journal entries to record the above transactions byusing the following:1. Perpetual inventory system2. Periodic inventory system check_circle Expert Answer Step 1 Under the perpetual inventory system, the cost of goods sold are recorded immediately at the time of the sale and it is kept updated in the books. Under this system, there is no physical count of inventory on regular basis. Under periodic inventory system, the physical count of inventory is taken from time to time.…arrow_forwardSilk Enterprises operates a small retail store that makes all merchandise inventory purchases on account. During the current year, Silk's cost of goods sold is $193,000 and its cash payments to suppliers of inventory are $179,000. Which combination of changes to the inventory and accounts payable balances during the year are consistent with the difference between cost of goods sold and cash payments to suppliers of inventory? O Inventory increased by $28,000 and accounts payable increased by $42,000 O Inventory decreased by $28,000 and accounts payable decreased by $42,000 Inventory increased by $28,000 and accounts payable decreased by $42,000 Inventory decreased by $28,000 and accounts payable increased by $42,000 None of the abovearrow_forwardRice Co. sold for $12,000 inventory that had cost $8,000. Freight terms for the sale were FOB destination and payment terms were 1/10, n/30. Rice records sales transactions at the gross amount. Rice paid freight costs of $400 in cash. The receivable was collected within the discount period. Based on this information alone, the amount of gross margin would be: a. $3,480 b. $3,880 c. $3,600 d. $4,000arrow_forward

- Northwest Fur Co. started the year with S93,000 of merchandise inventory on hand. During the year, $450,000 in merchandise was purchased on account with credit terms of 1/15, n/45. All discounts were taken. Northwest paid freight-in charges of $8,000. Merchandise with an invoice amount of $4,800 was returned for credit. Cost of goods sold for the year was $378,000. What is ending inventory? $153,743. $168,200. S163,748. S72,000.arrow_forwardGermo Company started business at the beginning of the current year. The entity established an allowance for doubtful accounts estimated at 5% of credit sales. During the year, the entity wrote off P50,000 of uncollectible accounts. Further analysis showed that the merchandise purchased amounted to P9,000,000 and ending merchandise inventory was P1,500,000. Goods were sold at 40% above cost. The total sales comprised 80% sales on account and 20% cash sales. Total collections from customers, excluding cash sales, amounted to P6,000,000. What is the amount of sales on account?arrow_forwardGood Buy Company made total purchases of $270,000 in the most current year. It paid freight in of $1,000 on its purchases. Freight out, the cost to deliver the merchandise when it was sold to Good Buy's customers, totaled $7,200. Of the total purchases Good Buy made during the period, it returned $24,000 of the merchandise. Good Buy took advantage of $2,300 of purchase discounts offered by its vendors. What was Good Buy's cost of inventory?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education