Chemistry

10th Edition

ISBN: 9781305957404

Author: Steven S. Zumdahl, Susan A. Zumdahl, Donald J. DeCoste

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all working

Transcribed Image Text:Saved

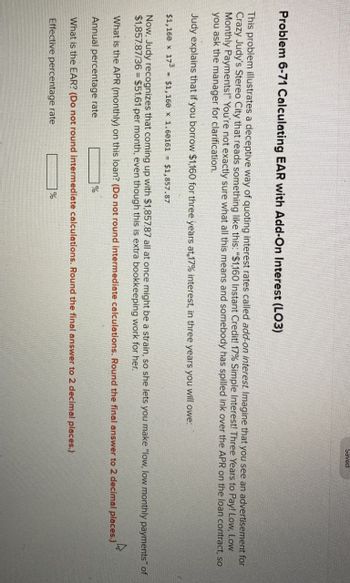

Problem 6-71 Calculating EAR with Add-On Interest (LO3)

This problem illustrates a deceptive way of quoting interest rates called add-on interest. Imagine that you see an advertisement for

Crazy Judy's Stereo City that reads something like this: "$1,160 Instant Credit! 17% Simple Interest! Three Years to Pay! Low, Low

Monthly Payments!" You're not exactly sure what all this means and somebody has spilled ink over the APR on the loan contract, so

you ask the manager for clarification.

Judy explains that if you borrow $1,160 for three years at 17% interest, in three years you will owe:

$1,160 x 173

$1,160 x 1.60161

$1,857.87

Now, Judy recognizes that coming up with $1,857.87 all at once might be a strain, so she lets you make "low, low monthly payments" of

$1,857.87/36 $51.61 per month, even though this is extra bookkeeping work for her.

=

What is the APR (monthly) on this loan? (Do not round intermediate calculations. Round the final answer to 2 decimal places.)

Annual percentage rate

%

What is the EAR? (Do not round intermediate calculations. Round the final answer to 2 decimal places.)

Effective percentage rate

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Hello, I hope you are doing well on this fine day. For the following quetion please read carefully the question and instruction. PLEASE ANSWER QUESTION IN 20 MINTUES NOT MORE PLEASE AND THANK YOU. If you do answer the question correctly and post it in the next 20 minutes, NO NEED TO SHOW ALL THE WORK, I JUST WOULD LIKE THE CORRECT ANSWER AS SOON AS POSSIBLE. I will write a wonderful and generous feedback/review/rating about you.arrow_forwardW AutoSave O Search (Alt+Q) Off ASSIGNMENT 24.docx - raghav grover RG File Home Insert Draw Design Layout References Mailings Review View Help P Comments A Share O Find Lato v 18 - A A Aa v A No Spacing Heading 1 Heading : E Replace Normal Paste I U ab x, x A - Dictate Editor Reuse A Select v Files Undo Clipboard Font Paragraph Styles Editing Voice Editor Reuse Files Question 18 Consider the following reaction mechanism: CH3OH(ag) + H*(ag) – CH3OH2*(ag) CH;OH2*(ag) + Br(ag) → CH3Br(ag) + H2O(1) Identify each species appropriately from the list below. Question 18 options: CH;Br(ag) CH;OH(ag) 1. reactant H2O(1) 2. product H*(ag) 3. intermediate Br(ag) 4. catalyst CH;OH2*(ag) Question 19 * Accessibility: Investigate D'Focus 0% 11 Page 2 of 16 1271 words English (Canada) ENG 4:32 PM O Type here to search 0°C Sunny W US 2022-04-26 11 近arrow_forwardHi I am not sure if my answer is correct nor if my explanations are correct.... can you please take a look? thank you!arrow_forward

- Answer 5 to 10 plsarrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardAnswers are in atom/b-cm (I will rate helpful) just do what you knowarrow_forward

- Content Google Do google slid X Dr. Ortiz a ☑ Certificate ☑ > Course EX Cengage L ☑ OWLv2 | O ✓ Search res ChatGPT ✓ + C prod03-cnow-owl.cengagenow.com/ilrn/takeAssignment/takeCovalentActivity.do?locator-assignment-take New Chrome available : E4 CH 16 17 and 18 [References] Question 1 1 pt Question 2 2 pts "Heater Meals" are food packages that contain their own heat source. Just pour water into the heater unit, wait a few minutes, and voilà! You have a hot meal. Mg(s) + 2 H2O(l) → Mg(OH) 2 (s) + H2(g) Question 3 1 pt Species AH° (kJ/mol) S° (J/mol·K) AƒG° (kJ/mol) Question 4 2 pts Mg(s) 0 32.67 0 Question 5 1 pt Question 6 × 2 pts H2O(l) Mg(OH)2(s) -285.83 69.95 -237.15 -924.54 63.18 -833.51 H2(g) 0 130.7 0 Question 7 1 pt Question 8 2 pts Question 9 1 pt HEATER MEALS Question 10 2 pts Question 11 1 pt Question 12 1 pt Question 13 Charles D. Winters INCLUDES 34 ou b HEATER MEALS 1 pt Question 14 1 pt The heat for the heater unit is produced by the reaction of magne- sium with water.…arrow_forwardFind the value of xarrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forward

- 2+ d. 4H3O+ (aq) + 2Cl(aq) + MnO₂ (s) ⇒ Mn²+ (aq) + 6H₂O(1) + Cl₂ (9) Oke O Ke = = O Ke = 2+ [Mn²+ ][C1₂] [H3O+] * [CI-1² [Mn²+][H₂O][C1₂] 2+ [H³O+][CI¯]²[MnO₂2] [Mn²+ ] [H₂O1] [C1₂] 2+ [H3O+] * [CI-1²[MnO₂]arrow_forwardsession.masteringchemistry.com/myct/itemView?assignment ProblemID=190556628&offset=next Discussion Question 1: Chapter 6 Homework blem 6.20- Enhanced - with Feedback Enter the symbols for the ions and the correct formula for the onic compound formed by each of the following. esc Q A N F1 2 W S F2 X #3 20 E D F3 с S4 $ OOO 000 R Part E F4 F Enter the symbols for the ions of sodium and phosphorus. Enter the lons formed by these elements and separate your answers with a comma (e.g., Sr²+, As³-). cation, anion = Part F Complete previous part(s) Submit Part G cation, anion Submit Part H Complete previous part(s) 65° V Enter the symbols for the ions of calcium and sulfur. Enter the lons formed by these elements and separate your answers with a comma % Request Answer T Request Answer G 6 ΑΣΦ B ΑΣΦ MacBook Air F6 Y H 18⁰ h & 7 N F7 U * CO 8 J BUT RAS poddany ▶II ? F8 1 ? E 9 K F9 O L (e.g., Sr²+, As³-). 0 Ga3+ and 02-E L F10 P F11arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

ChemistryChemistryISBN:9781305957404Author:Steven S. Zumdahl, Susan A. Zumdahl, Donald J. DeCostePublisher:Cengage Learning

ChemistryChemistryISBN:9781305957404Author:Steven S. Zumdahl, Susan A. Zumdahl, Donald J. DeCostePublisher:Cengage Learning ChemistryChemistryISBN:9781259911156Author:Raymond Chang Dr., Jason Overby ProfessorPublisher:McGraw-Hill Education

ChemistryChemistryISBN:9781259911156Author:Raymond Chang Dr., Jason Overby ProfessorPublisher:McGraw-Hill Education Principles of Instrumental AnalysisChemistryISBN:9781305577213Author:Douglas A. Skoog, F. James Holler, Stanley R. CrouchPublisher:Cengage Learning

Principles of Instrumental AnalysisChemistryISBN:9781305577213Author:Douglas A. Skoog, F. James Holler, Stanley R. CrouchPublisher:Cengage Learning Organic ChemistryChemistryISBN:9780078021558Author:Janice Gorzynski Smith Dr.Publisher:McGraw-Hill Education

Organic ChemistryChemistryISBN:9780078021558Author:Janice Gorzynski Smith Dr.Publisher:McGraw-Hill Education Chemistry: Principles and ReactionsChemistryISBN:9781305079373Author:William L. Masterton, Cecile N. HurleyPublisher:Cengage Learning

Chemistry: Principles and ReactionsChemistryISBN:9781305079373Author:William L. Masterton, Cecile N. HurleyPublisher:Cengage Learning Elementary Principles of Chemical Processes, Bind...ChemistryISBN:9781118431221Author:Richard M. Felder, Ronald W. Rousseau, Lisa G. BullardPublisher:WILEY

Elementary Principles of Chemical Processes, Bind...ChemistryISBN:9781118431221Author:Richard M. Felder, Ronald W. Rousseau, Lisa G. BullardPublisher:WILEY

Chemistry

Chemistry

ISBN:9781305957404

Author:Steven S. Zumdahl, Susan A. Zumdahl, Donald J. DeCoste

Publisher:Cengage Learning

Chemistry

Chemistry

ISBN:9781259911156

Author:Raymond Chang Dr., Jason Overby Professor

Publisher:McGraw-Hill Education

Principles of Instrumental Analysis

Chemistry

ISBN:9781305577213

Author:Douglas A. Skoog, F. James Holler, Stanley R. Crouch

Publisher:Cengage Learning

Organic Chemistry

Chemistry

ISBN:9780078021558

Author:Janice Gorzynski Smith Dr.

Publisher:McGraw-Hill Education

Chemistry: Principles and Reactions

Chemistry

ISBN:9781305079373

Author:William L. Masterton, Cecile N. Hurley

Publisher:Cengage Learning

Elementary Principles of Chemical Processes, Bind...

Chemistry

ISBN:9781118431221

Author:Richard M. Felder, Ronald W. Rousseau, Lisa G. Bullard

Publisher:WILEY