FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

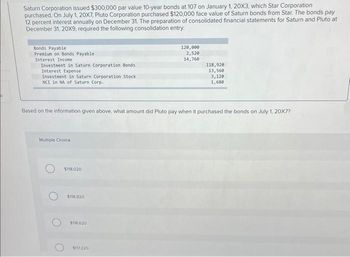

Transcribed Image Text:Saturn Corporation issued $300,000 par value 10-year bonds at 107 on January 1, 20X3, which Star Corporation

purchased. On July 1, 20X7, Pluto Corporation purchased $120,000 face value of Saturn bonds from Star. The bonds pay

12 percent interest annually on December 31. The preparation of consolidated financial statements for Saturn and Pluto at

December 31, 20X9, required the following consolidation entry:

Bonds Payable

Premium on Bonds Payable

Interest Income

Investment in Saturn Corporation Bonds

Interest Expense

Investment in Saturn Corporation Stock

NCI in NA of Saturn Corp.

Multiple Choice

Based on the information given above, what amount did Pluto pay when it purchased the bonds on July 1, 20X7?

$118.020

$118.920

$118.620

120,000

2,520

14,760

$117.220

118,920

13,560

3,120

1,680

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- ● Assume Sunset Company purchased this entire bond issue sold y Omar, i.e., 7% of $1,000,000 bonds, at $913,540 on January 1,2024. Market yield was 8% and interest is paid semiannually on June 30 and December 31. Sunset is holding the bond investment as trading securities. The fair value of the bonds on December 31, 2024 is $920,000. 1. At what amount will Sunset report this investment in the December 31, 2024 balance sheet? 2. What is the amount related to the bond investment that Sunset will report in its income statement for the year ended December 31, 2024? (Ignore income taxes.) 3. What is the amount related to the bond investment that Sunset will report in its statement of cash flows for the year ended December 31, 2024? Be sure to list the category of activity in which the cash flow is in. activities activitiesarrow_forwardIowa Corporation Issued $4,000,000 par value, 5% convertible bonds, at 101 for cash. If the bonds had not included the conversion feature, they would have sold for 99. Prepare the journal entry to record the issuance of the bonds for Iowa Corporation.arrow_forwardThe board of directors of Media Plus authorizes the issue of $8,000,000 of 7%, twenty-year bonds payable. The semi-annual interest dates are May 31 and November 30. The bonds are issued on May 31, 20X0, at par. Requirements 1. Journalize the following transactions: a. Issuance of half of the bonds on May 31, 20XO. b. Payment of interest on November 30, 20XO. c. Accrual of interest on December 31, 20X0. d. Payment of interest on May 31 , 20X1. Report interest payable and bonds payable as they would appear on the Media Plus balance sheet at December 31, 20xo. 2. Requirement 1. Journalize the transactions a through d. (Record debits first, then credits. Explanations are not required. Round all amounts to the nearest whole dollar.) a. Issuance of half of the bonds on May 31, 20X0. Journal Entry Date Accounts Debit Credit May 31arrow_forward

- Nonearrow_forwardDebt Investment Transactions, Available-for-Sale Valuation Rekya Mart Inc. is a general merchandise retail company that began operations on January 1, Year 1. The following transactions relate to debt investments acquired by Rekya Mart Inc., which has a fiscal year ending on December 31: Year 1 Apr. 1. Purchased $60,000 of Smoke Bay 7%, 10-year bonds at their face amount plus accrued interest of $700. The bonds pay interest semiannually on February 1 and August 1. May 16. Purchased $96,000 of Geotherma Co. 6%, 12-year bonds at their face amount plus accrued interest of $240. The bonds pay interest semiannually on May 1 and November 1. Aug. 1. Received semiannual interest on the Smoke Bay bonds. Sept. 1. Sold $24,000 of Smoke Bay bonds at 104 plus accrued interest of $140. Nov. 1. Received semiannual interest on the Geotherma Co. bonds. Dec. 31 Accrued $840 interest on Smoke Bay bonds. Dec. 31 Accrued $480 interest on Geotherma Co. bonds. Year 2 Feb. 1. Received…arrow_forwardI. Metro Company purchased $500,000, 10%, 5-year bonds on January 1, 20x1, with interest payable on July 1 and January 1. The market interest rate (yield) was 8% for bonds of similar risk and maturity. The market value on December 31, 20x1 was $555,000 and all bonds were sold for $507,500 on January 1, 20x2 after the second payment. Required: compute the bond price on January 1, 20x1, prepare the amortization schedule and record journal entries on January 1, 20x1, July 1, 20x1, December 31, 20x1 and January 1, 20x2 assuming the bond investment is classified as available-for-sale security.arrow_forward

- nkt.2 The Parent company issued $500,000 face value 5% 15-year bonds to an unaffiliated party for $515,000 on January 1st 2016. December 31, 2018 the Subsidiary company paid $485,000 to purchase all of the outstanding parent company’s bonds from 3rd parties. • Prepare the entries for the parent and the sub related to the bond transactions (to record the initial issuance, annual interest and the effective retirement)arrow_forwardEntries for Investment in Bonds, Interest, and Sale of Bonds Parilo Company acquired $204,000 of Makofske Company, 6% bonds on May 1, 20Y5, at their face amount. Interest is paid semiannually on May 1 and November 1. On November 1, 20Y5, Parilo sold $44,400 of the bonds for 96. Journalize the entries to record the following under the cost method: If an amount box does not require an entry, leave it blank. Questions are attached with image Needing answers for questions: B C Darrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education