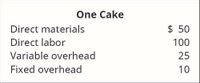

Sara makes wedding cakes from her home. A customer has requested two duplicate wedding cakes: one for the wedding and one to be frozen for their anniversary. The couple has offered $400 for both cakes instead of $500 ($250 each). The cost information to make one cake is shown in the image.

|

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

- Suppose Frances earns $825 per week working as a programmer for PC Pros. She uses $9 to buy a box of aspirin at Pillmart Pharmacy. Pillmart Pharmacy pays Dmitri $450 per week to work the cash register. Dmitri uses $175 to purchase software from PC Pros. Identify whether each of the following events in this scenario occurs in the factor market or the product market. Event Factor Market Product Market Frances spends $9 to buy a box of aspirin. Frances earns $825 per week working for PC Pros. Dmitri spends $175 to purchase software from PC Pros. Which of the elements of this scenario represent a flow from a firm to a household? This could be a flow of dollars, inputs, or outputs. Check all that apply. a. Frances's labor b. The $450 per week Dmitri earns working for Pillmart Pharmacy c. The aspirin Frances receives d. The $175 Dmitri spends to purchase software from PC Prosarrow_forwardes Kristen Lu purchased a used automobile for $28,600 at the beginning of last year and incurred the following operating costs: Depreciation ($28,600 + 5 years) Insurance Garage rent Automobile tax and license Variable operating cost Relevain ry The variable operating cost consists of gasoline, oil, tires, maintenance, and repairs. Kristen estimates that, at her current rate of usage, the car will have zero resale value in five years, so the annual straight-line depreciation is $5,720. The car is kept in a garage for a monthly fee. Average fixed cost per mile Variable operating cost per mile Average cost per mile $ 5,720 $ 3,000 $ 1,500 $780 $ 0.11 per mile Required: 1. Kristen drove the car 22,000 miles last year. Compute the average cost per mile of owning and operating the car. (Round your answers to 2 decimal places.)arrow_forwardDon is using the floor plans for his new home to help him purchas base molding for the place where the walls meet the floor. The plans are drawn using a scale in which 1/3 inch represents 1 foot. He measures the walls on the floor plan with a ruler and finds they total 24 inches. If the molding costs $3.12 per foot, how much will Don spend on molding?arrow_forward

- - After closing her beloved restaurant due to the pandemic, Kiki started to sell her signature sauces to consumers. The ingredients for a sauce bottle cost $1.25 and packaging costs another $0.50. A distribution company handles the storage and distribution of the sauce and charges $0.75 or each bottle. Kiki has calculated that the overhead cost is $5000 per month. She sells one sauce bottle at $5.00 to the customers. a. How many sauce bottles must Kiki sell to break-even? What is the total revenue for breakeven? b. If she can sell only 1000 bottles, what should be the selling price to break-even?arrow_forwardNicolas has purchased a streaming audio service for $8.00 per month. As he listens to more songs in a month he spread this fixed cost over a larger number of songs, and therefore his cost per song decreases the more songs he listens to. One if his friends says to Nicolas: “The more music you listen to, the less you pay per song so you should spend all your time listening to music.” Please explain what is wrong with the friend’s statement.arrow_forwardKim works at a sports store and needs to determine the selling price for running shoes. The running shoes have a cost of $120. The manager asked Kim to price the running shoes with a 60% target gross margin. Kim has priced the running shoes with a 60% markup percentage.Required:1. What selling price does the manager want? 2. What selling price has Kim calculated? 3. If there are 42 running shoes, how much will the store lose in sales if the price is not corrected?arrow_forward

- Bobby Reynolds, a new client of yours, is a self-employed caterer in Santa Fe, New Mexico. Bobby drives his personal van when delivering catered meals to customers. You have asked him to provide the amount of business miles driven using his vehicle. You are planning on using the standard mileage method to calculate Bobby’s deduction for transportation costs. Bobby has responded by saying, “Well, I don’t really keep track of my miles. I guess I drove around 3,000 miles last year for the business.” What would you say to Bobby? Please give a response as if you are a professional tax accountant.arrow_forwardJosé Ruiz starts a company that makes handcrafted birdhouses. Competitors sell a similar birdhouse for $275 each. Jose believes he can produce a birdhouse for a total cost of $235 per unit, and he plans a 20% markup on total cost. (a) Compute José's planned selling price. (b) Is José's price lower than competitors' price? Complete this question by entering your answers in the tabs below. Required A Required B Compute José's planned selling price. Selling price per unitarrow_forwardDuring the COVID-19 pandemic, many people decided to start making face masks and selling them on the Internet. Etsy, for example, sold face masks from many different sellers. Suppose that Mary decided to quit her job where she earned $3,600.00 per month. During the month of July 2020, Mary sold 1,100.00 masks at $7.00 per mask. The following table reports information for Mary's costs to make the face masks. Item Material Wages paid to one employee Utilities Internet advertising For the month of July 2020, Mary's revenue was $ Part 2 Mary's accounting profit was $ Part 3 Amount $3,300.00 $550.00 $110.00 $275.00 Mary's economic profit was $ . Make sure you include the negative sign if her profit is less than zero.arrow_forward

- Dogarrow_forwardJoey Bag-o-donuts owns an ice cream shop. Looking at last year's utility bills, the highest utility bill was $4000 for 2000 machine hours. The lowest utility bill was $2500 for 1200 machine hours. Calculate the variable rate per machine hour and the total fixed utility cost. Show the equation for determining total utility costs. If Joey plans on using 1500 machine hours, what will the total utility bill be using the equation in part 2.arrow_forwardLisa is considering upgrading the breakfast service to attract more business and increase prices. This will cost an additional $14 for food costs per person per night. She feels she can increase the room rate to $101.00 per person per night. Determine the quantity of rentals and the sales revenue Lisa needs to break even if the changes are made. (Round answers to O decimal places, e.g. 5,275.)arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education