Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

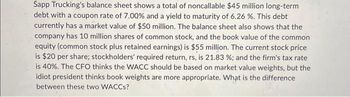

Transcribed Image Text:Sapp Trucking's balance sheet shows a total of noncallable $45 million long-term

debt with a coupon rate of 7.00% and a yield to maturity of 6.26 %. This debt

currently has a market value of $50 million. The balance sheet also shows that the

company has 10 million shares of common stock, and the book value of the common

equity (common stock plus retained earnings) is $55 million. The current stock price

is $20 per share; stockholders' required return, rs, is 21.83 % ; and the firm's tax rate

is 40%. The CFO thinks the WACC should be based on market value weights, but the

idiot president thinks book weights are more appropriate. What is the difference

between these two WACCS?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Simone's sweets is an all-equity firm that has 6700 shares of stock outstanding at a market price of $18 per share. The firm's management has decided to issue $56000 worth of debt at an interest rate of 6 percent. The funds will be used to repurchase shares of the outstanding stock. What are the earnings per share at the break--even EBIT?arrow_forwardSapp Trucking's balance sheet shows a total of noncallable $35 million long-term debt with a coupon rate of 7.00% and a yield to maturity of 6.00%. This debt currently has a market value of $45 million. The balance sheet also shows that the company has 10 million shares of common stock, and the book value of the common equity (common stock plus retained earnings) is $55 million. The current stock price is $29.00 per share; stockholders' required return, rs, is 14.00%; and the firm's tax rate is 25%. The CFO thinks the WACC should be based on market value weights, but the president thinks book weights are more appropriate. What is the difference between these two WACCs? a. 1.78% b. 2.04% c. 2.42% d. 1.15% e. 1.53%arrow_forwardWestern Electric has 34,000 shares of common stock outstanding at a price per share of $83 and a rate of return of 12.80 percent. The firm has 7,500 shares of 8.20 percent preferred stock outstanding at a price of $97.00 per share. The preferred stock has a par value of $100. The outstanding debt has a total face value of $416,000 and currently sells for 113 percent of face. The yield to maturity on the debt is 8.20 percent. What is the firm's weighted average cost of capital if the tax rate is 40 percent?arrow_forward

- XRT Infrastructure Corp. has 80,000 bonds outstanding that are selling at 90% of the par value (Bonds are selling at discount). Bonds with similar characteristics are yielding 10.8%. The company also has 4 million shares of common stock outstanding. The stock has a beta of 1.1 and sells for $50 per share. The common shareholder anticipates receiving a dividend that will growth at 0%, based on the fact they received $5 dividend last year. The capital market analysts predict that dividends will continue to grow at the same rate into the foreseeable future. The firm’s tax rate is 28 percent. What would be your estimate of the cost of common stock (cost of equity)? What would be the estimate cost of capital (WACC)?arrow_forwardSapp Trucking's balance sheet shows a total of noncallable $45 million long-term debt with a coupon rate of 7.00% and a yield to maturity of 6.00%. This debt currently has a market value of $50 million. The balance sheet also shows that the company has 10 million shares of common stock, and the book value of the common equity (common stock plus retained earnings) is $65 million. The current stock price is $24.50 per share; stockholders' required return, rs, is 14.00%; and the firm's tax rate is 25%. The CFO thinks the WACC should be based on market value weights, but the president thinks book weights are more appropriate. What is the difference between these two WACCs? a. 1.92% b. 2.28% c. 1.08% d. 1.68% e. 1.44%arrow_forwardABC Trucking's balance sheet shows a total of noncallable $30 million long-term debt with a coupon rate of 6.80% and a yield to maturity of 8.10%. This debt currently has a market value of $48 million. The balance sheet also shows that the company has 10 million shares of common stock, and the book value of the common equity is $213.00 million. The current stock price is $23.80 per share; stockholders' required return, rs, is 15.05%; and the firm's tax rate is 36.00%. The CFO thinks the WACC should be based on market value weights, but the president thinks book weights are more appropriate. What is the difference between the WACCs using market value and the book value?Work with at least 4 decimals and round your final answer to two decimal places. For example, if your answer is $345.6671 round as 345.67 and if your answer is .05718 or 5.7182% round as 5.72. Group of answer choices –0.46% –0.49% –0.44% –0.34% –0.36%arrow_forward

- Suppose Westerfield Co. has the following financial information: Debt: 900, 000 bonds outstanding with a face value of $1,000. The bonds currently trade at 85% of par and have 12 years to maturity. The coupon rate equals 7%, and the bonds make semiannual interest payments. Preferred stock: 600,000 shares of preferred stock outstanding; currently trading for $108 per share, paying a dividend of $9 annually. Common stock: 25,000,000 shares of common stock outstanding; currently trading for $185 per share. Beta equals 1.22. Market and firm information: The expected return on the market is 9%, the risk - free rate is 5%, and the tax rate is 21 %. Calculate the weight of debt in the capital structure. (Enter percentages as decimals and round to 4 decimals)arrow_forwardCMS Corporation's balance sheet as of today is as follows: Long-term debt (bonds, at par) Preferred stock Common stock ($10 par) Retained earnings Total debt and equity $10,000,000 2.000.000 10,000,000 4.000.000 $26.000,000 The bonds have a 6.6% coupon rate, payable semiannually, and a par value of $1,000. They mature exactly 10 years from today. The yield to maturity is 12%, so the bonds now sell below par. What is the current market value of the firm's debt? Select the correct answer. Oa. $6,900,480 Ob.$6,901,361 Oc$6,899,600 d. $6,903,121 Oe. $6,902,241arrow_forwardMcCann Catching, Inc. has 3.00 million shares of stock outstanding. The stock currently sells for $12.79 per share. The firm's debt is publicly traded and was recently quoted at 89.00% of face value. It has a total face value of $19.00 million, and it is currently priced to yield 10.00%. The risk free rate is 3.00% and the market risk premium is 8.00%. You've estimated that the firm has a beta of 1.20. The corporate tax rate is 34.00%. The firm is considering a $45.89 million expansion of their production facility. The project has the same risk as the firm overall and will earn $11.00 million per year for 7.00 years. What is the NPV of the expansion? (answer in terms of millions, so 1,000,000 would be 1.0000)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education