EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

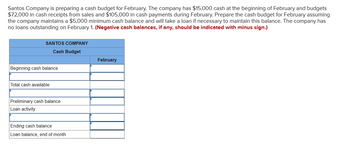

Transcribed Image Text:Santos Company is preparing a cash budget for February. The company has $15,000 cash at the beginning of February and budgets

$72,000 in cash receipts from sales and $105,000 in cash payments during February. Prepare the cash budget for February assuming

the company maintains a $5,000 minimum cash balance and will take a loan if necessary to maintain this balance. The company has

no loans outstanding on February 1. (Negative cash balances, if any, should be indicated with minus sign.)

SANTOS COMPANY

Cash Budget

Beginning cash balance

Total cash available

Preliminary cash balance

Loan activity

Ending cash balance

Loan balance, end of month

February

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- All Temps has a policy of always paying within the discount period, and each of its suppliers provides a discount of 2% if paid within 10 days of purchase. Because of the purchase policy, 80% of its payments are made in the month of purchase and 20% are made the following month. The direct materials budget provides for purchases of $23,812 in February, $23,127 in March, $21,836 in April, and $28,173 in May.What is the balance in accounts payable for April 30, and May 31?arrow_forwardSantos Company is preparing a cash budget for February. The company has $19,000 cash at the beginning of February and budgets $74,000 in cash receipts from sales and $106,000 in cash payments during February. Prepare the cash budget for February assuming the company maintains a $5,000 minimum cash balance and will take a loan if necessary to maintain this balance. The company has no loans outstanding on February 1. (Negative cash balances, if any, should be indicated with minus sign.)arrow_forwardSantos Company is preparing a cash budget for February. The company has $19,000 cash at the beginning of February and budgets $72 000 in cash receipts from sales and $100,000 in cash payments during February. Prepare the cash budget for February assuming the company maintains a $5,000 minimum cash balance and will take a loan if necessary to maintain this balance. The company has no loans outstanding on February 1. (Negative cash balances, if any, should be indicated with minus sign.) SANTOS CO. Cash Budget February Beginning cash balance Total cash available Preliminary cash balance Loan activity Ending cash balance Loan balance, end of montharrow_forward

- Santos Company is preparing a cash budget for February. The company has $16,000 cash at the beginning of February and budgets $65,000 in cash receipts from sales and $114,000 in cash payments during February. Prepare the cash budget for February assuming the company maintains a $5,000 minimum cash balance and will take a loan if necessary to maintain this balance. The company has no loans outstanding on February 1. (Negative cash balances, if any, should be indicated with minus sign.) SANTOS COMPANY Cash Budget February Beginning cash balance Total cash available Preliminary cash balance Loan activity Ending cash balance Loan balance, end of montharrow_forwardSantos Co. is preparing a cash budget for February. The company has $12,000 cash at the beginning of February and anticipates $67,000 in cash receipts and $119,000 in cash disbursements during February. What amount, if any. must the company borrow during February to maintain a $5,000 cash balance? The company has no loans outstanding on February 1. (Negative cash balances, if any, should be Indicated with minus sign.) SANTOS CO. Cash Budget For Month Ended February 28 Beginning cash balance Total cash available Preliminary cash balance Ending cash balancearrow_forwardSantos Co. is preparing a cash budget for February. The company has $14,000 cash at the beginning of February and anticipates $74,000 in cash receipts and $110,000 in cash payments during February. What amount, if any, must the company borrow during February to maintain a $5,000 cash balance? The company has no loans outstanding on February 1. (Negative cash balances, if any, should be indicated with minus sign.)arrow_forward

- Western Company is preparing a cash budget for June. The company has $10,400 in cash at the beginning of June and anticipates $31,600 in cash receipts and $37,700 in cash payments during June. Western Company has an agreement with its bank to maintain a minimum cash balance of $10,000. As of May 31, the company has no loans outstanding. To maintain the $10,000 required balance, during June the company must:arrow_forwardWestern Company is preparing a cash budget for June. The company has $10,300 in cash at the beginning of June and anticipates $31,700 in cash receipts and $37,900 in cash payments during June. Western Company has an agreement with its bank to maintain a minimum cash balance of $10,000. As of May 31, the company has no loans outstanding. To maintain the $10,000 required balance, during June the company must: Multiple Choice Repay $4,100. Borrow $10,000. Borrow $5,900. Borrow $6,200. Repay $5,900.arrow_forwardVargas Company is preparing a cash budget for April. The company has $27,000 cash at the beginning of April and anticipates $60,000 in cash receipts and $64,500 in cash disbursements during April. Vargas Company has an agreement with its bank to maintain a cash balance of at least $25,000. To maintain the $25,000 required balance, during April the company must: Borrow $2,500 from the owner. Borrow $5,000 from the owner. Borrow $7,500 from the owner. Borrow $4,500 from anyone other than the bank or the owner.arrow_forward

- Rogers Services, Inc., has $8,000 cash on hand on January 1. The company requires a minimum cash balance of $7,300. January cash collections are $548,380. Total cash payments for January are $565,830. Prepare a cash budget for January. How much cash, if any, will Rogers need to borrow by the end of January? Complete the cash budget below. (Use parentheses or a minus sign for negative ending cash balances or deficiencies.) Rogers Services, Inc. Combined Cash Budget For the Month Ended January 31 Beginning cash balance Plus: Cash collections Total cash available Less: Cash payments Ending cash balance before financing Minimum cash balance desired Cash excess (deficiency)arrow_forwardKarim Corporation requires a minimum $8,200 cash balance. Loans taken to meet this requirement cost 1% interest per month (paid at the end of each month). Any preliminary cash balance above $8,200 is used to repay loans at month-end. The cash balance on July 1 is $8,600, and the company has no outstanding loans. Budgeted cash receipts (other than for loans received) and budgeted cash payments (other than for loan or interest payments) follow. July August September Cash receipts $ 24,200 $ 32,200 $ 40,200 Cash payments 28,300 30,200 32,200 Prepare a cash budget for July, August, and September. (Negative balances and Loan repayment amounts (if any) should be indicated with minus sign. Round your final answers to the nearest whole dollar.)arrow_forwardCheyenne Company has budgeted the following information for June: Cash receipts Beginning cash balance Cash payments Desired ending cash balance If there is a cash shortage, the company borrows money from the bank. All cash is borrowed at the beginning of the month in $1,000 increments, and interest is paid monthly at 1% on the first day of the following month. The company had no debt before June 1. The amount of interest paid on July 1 would be: Multiple Choice $590. $ 339,000 22,000 382,000 42,000 $476.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning