Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:K

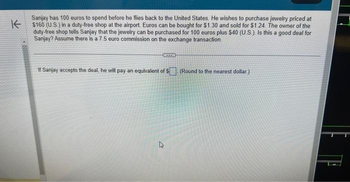

Sanjay has 100 euros to spend before he flies back to the United States. He wishes to purchase jewelry priced at

$160 (U.S.) in a duty-free shop at the airport. Euros can be bought for $1.30 and sold for $1.24. The owner of the

duty-free shop tells Sanjay that the jewelry can be purchased for 100 euros plus $40 (U.S.). Is this a good deal for

Sanjay? Assume there is a 7.5 euro commission on the exchange transaction.

If Sanjay accepts the deal, he will pay an equivalent of $ (Round to the nearest dollar.)

27

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- 33arrow_forwardHansel has been driving her Jaguar X-Type luxury car for many years and has now decided to sell her Jaguar and buy a new one. She puts an advertisement in the newspaper saying “Great condition X-Type Jaguar for sale - £3,000, Contact Number 012100000“. Wolfgang texts her and says that he is willing to buy the car from her for £3,000 and “unless he hears back from her by Saturday he will assume that the car is his”. Hansel is busy and does not respond. On Thursday, Rasputin reads the newspaper and calls Hansel. He offers to buy the car for £2,750. Hansel accepts the offer and sells the car to him. On Saturday Wolfgang finds out that Hansel has sold the car and he becomes furious as he feels he had entered into a contract with Hansel a) Discuss if there has been a contractual relationship between Hansel & Wolfgang b) Discuss the validity of the contract between Hansel & Rasputinarrow_forwardAbigail lives in the UK and earns 40,000 pounds sterling per year. Her friend Barry lives in Japan and earns 8 million Japanese yen per year. The cost of a standardised consumption basket is 400 pounds sterling in the UK and 100,000 yen in Japan. The nominal exchange rate is Xy/s = 200, that is, one pound sterling can be exchanged for 200 Japanese yen. Can Abigail or Barry buy the most standardised consumption baskets with their income? Calculate the purchasing power parity rate PPPRy/s and explain what it measures.arrow_forward

- James decided to work in Baie-James in northern Quebec for a few years. He wanted to earn some big bucks working up north after he graduated in December 2020. His plan was to save as much as he could, to then travel throughout Africa. He received a gross annual salary of $130,000 in 2021 and the same in 2022. He made a Tax-Free Savings Account contribution of $6,000 on January 1, 2022, and $6,500 on January 1, 2023. He also made a Registered Retirement Savings Plan contribution of $23,400 on January 1, 2023, which he plans to use on his 2022 personal income tax return. He is making great money and saving it all. What is James' average rate of tax in 2022? (ignore Non- Refundable Tax Credits, Quebec Abatement, and any employer withholdings) Tax bracket $46,295 and under $46,295- $50,197 $50,197- $92,580 $92,580- $100,392 $100,392- $112,655 $112,655- $155,625 $155,625- $221,708 over $221,708 Select one: a. 38% b. 34% C. 32% d. 41% e. 29% Tax rate 27.53% 32.53% 37.12% 41.12% 45.71% 47.46%…arrow_forwardThe COVID-19 pandemic is over, and you decide to celebrate by going on a vacation to Japan. The following quotes are provided by a Foreign Exchange (FX) dealer at the airport. BUY SELL YEN (Japan) 71 70 b) upon returning from the Japan, you have 75 000 YEN which you wish to convert back to AUD. How much will you receive? Show workings and a concluding statement in your response.arrow_forwardYour sister just bought a new car having a sticker price (manufacturer’s suggested retail price) of $36,000. She was crafty and was able to negotiate a sales price of $33,500 from the auto dealership. In addition, she received $4,500 for her old trade-in car under the U.S. government’s “Cash for Clunkers” program. If her new car will have a resale value of $3,500 after seven years when your sister will shop for a replacement car, what is the annual capital recovery cost of your sister’s purchase? The relevant interest rate is 8% per year, and your sister can afford to spend a maximum of $5,000 per year to finance the car (operating and other costs are extra).arrow_forward

- Tacurong, a resident citizen, won $1,000,000 from the US lottery. Is the lottery winning subject to final tax of 20%? Yes or No?arrow_forwardAhmed approaches the Islamic Bank of Arlington in the USA to finance the purchase of an industrial washer-dryer for his laundry business at USD10,000. The bank agrees to purchase the machine from the manufacturer and then sell it to Ahmed for USD12,000, which is to be paid by Ahmed in equal instalments over the next 3 years. What type of Islamic financing is being offered by the bank to Ahmed and how much is the monthly instalment?arrow_forwardYour friend from Netherlands is planning to visit you in the United States. You estimate the cost of her trip at $2,565. What is the cost to her in euros if 1 Euro = $1.6584?arrow_forward

- Ben Marino, a seaman, opened a joint bank account, under the expanded foreign currency deposit system, with his wife. A month after, the bank deposit earned interest in the amount of USD1,000 (foreign exchange rate is P50 for every USD1). The final tax due on the interest income is.arrow_forwardBefore boarding his flight to Zurich, Switzerland, Ian purchased CHF900 from his bank when the exchange rate was C$1 = CHF0.9753. However, Ian had to cancel the trip. Ian returned to the bank to convert the Swiss currency back into Canadian dollars. If the exchange rate changed to C$1 = CHF0.984, how many Canadian dollars would Ian have lost in these transactions? Assume the bank has a 1.00% commission on both the sale and the purchase of the funds. C Round to the nearest cent Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for surearrow_forwardA-2arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education