FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Sh3

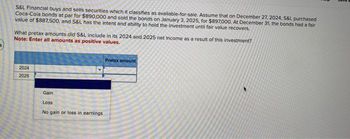

Transcribed Image Text:S&L Financial buys and sells securities which it classifies as available-for-sale. Assume that on December 27, 2024, S&L purchased

Coca-Cola bonds at par for $890,000 and sold the bonds on January 3, 2025, for $897,000, At December 31, the bonds had a fair

value of $887,500, and S&L has the intent and ability to hold the investment until fair value recovers.

What pretax amounts did S&L include in its 2024 and 2025 net income as a result of this investment?

Note: Enter all amounts as positive values.

2024

2025

Gain

Loss

No gain or loss in earnings

Protax amount

R

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Problem 9-25 Fudge factors An oil company executive is considering investing $10.1 million in one or both of two wells: well 1 is expected to produce oil worth $3.01 million a year for 10 years; well 2 is expected to produce $2.01 million for 15 years. These are real (inflation-adjusted) cash flows. The beta for producing wells is 0.91. The market risk premium is 9%, the nominal risk-free interest rate is 7%, and expected inflation is 3%. The two wells are intended to develop a previously discovered oil field. Unfortunately there is still a 21% chance of a dry hole in each case. A dry hole means zero cash flows and a complete loss of the $10.1 million investment. Ignore taxes and make further assumptions as necessary. a. What is the correct real discount rate for cash flows from developed wells? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Real discount rate b. The oil company executive proposes to add 20 percentage points to the…arrow_forwardPlease answer G part with explanationarrow_forwardWhat about requirement 4+5arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education