FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

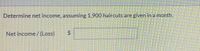

Transcribed Image Text:Determine net income, assuming 1,900 haircuts aregiven in a month.

Net income/(Loss)

Transcribed Image Text:Sandhill Diesel owns the Fredonia Barber Shop. He employs 5 barbers and pays each a base rate of $1,430 per month. One of the

barbers serves as the manager and receives an extra $600 per month, In addition to the base rate, each barber also receives a

commission of $6.00 per haircut

Other costs are as follows.

Advertising

$260

per month

Rent

$1.000

per month

Barber supplies

$0.50

per haircut

Utilities

$150

per month plus $0.10 per haircut

Magazines

$20

per month

Sandhill currently charges $12 per haircut.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please help me to solve this problemarrow_forwardMagnolia Manufacturing makes wing components for large aircraft. Kevin Choi is the production manager, responsible for manufacturing, and Michelle Michaels is the marketing manager. Both managers are paid a flat salary and are eligible for a bonus. The bonus is equal to 1 percent of their base salary for every 10 percent profit that exceeds a target. The maximum bonus is 6 percent of salary. Kevin's base salary is $330,000 and Michelle's is $390,000. The target profit for this year is $5 million. Kevin has read about a new manufacturing technique that would increase annual profit by 20 percent. He is unsure whether to employ the new technique this year, wait, or not employ it at all. Using the new technique will not affect the target. Required: a. Suppose that profit without using the technique this year will be $5 million. By how much will Kevin's and Michelle's bonus change if Kevin decides to employ the new technique? b. Suppose that profit without using the technique this year will…arrow_forwardJen and Barry's ice cream shop charges $1.45 for a cone. Variable expenses are $0.22 per cone, and fixed costs total $2,500 per month. A Valentine's Day promotion is being planned for the second week of February. During this week, a person buying a cone at the regular price would receive a free cone for a friend. It is estimated that 650 additional cones would be sold and that 850 cones would be given away. Advertising costs for the promotion would be $135. Required: a. Calculate the effect of the promotion on operating income for the second week of February. b. Do you think the promotion should occur? Complete this question by entering your answers in the tabs below. Required A Require B Do you think the promotion should occur?arrow_forward

- Fantastic Plastics manufactures plastic bottles that are used by other companies for packaging. The have four operating machines in the factory that operate at 80% capacity. One machine can produce 10 000 plastic bottles per month at full capacity. There are four weeks in a month and all bottles are sold in the month of manufacture. Bottles are sold at R5 each. The following costs are incurred on a monthly basis in the manufacturing of plastic bottles. Plastic purchased per week. R8 000. Wages of machine operators R2 000 per week. There are four operators on duty at any time. Monthly salary of factory supervisor R20 000. Deprecation of machines R6 000 per machine per annum. Water and electricity of R12 000 per month. Must be apportioned according to floor space. (Factory takes up 80% of total floor space). Q1)Calculate the variable cost per unit manufactured and the fixed cost per month.arrow_forwardBetsy's Gift Baskets sells gift baskets, on average, for $125; each gift basket costs, on average, $60. Betsy pays salaries each month of $1,300 and her store rent is $1,000 per month. She also pays sales commissions of 5% of the sales price. In May, 140 gift baskets were sold. Required: a. Prepare a traditional income statement for the month of May. b. Prepare a contributioarrow_forwardDogarrow_forward

- Jarvie loves to bike. In fact, he has always turned down better-paying jobs to work in bicycle shops where he gets an employee discount. At Jarvie's current shop, Bad Dog Cycles, each employee is allowed to purchase four bicycles a year at a discount. Bad Dog has an average gross profit percentage on bicycles of 25 percent. During the current year, Jarvie bought the following bikes: Description Retail Price Cost Employee Price Specialized road bike $ 7,200 $ 4,900 $ 5,040 Rocky Mountain mountain bike 5,200 3,750 4,160 Trek road bike 3,300 2,760 2,310 Yeti mountain bike 3,300 2,900 2,640 Required: What amount is Jarvie required to include in taxable income from these purchases? What amount of deductions is Bad Dog allowed to claim from these transactions?arrow_forwardIt costs Homer's Manufacturing $0.75 to produce baseballs and Homer sells them for $4.00 a piece. Homer pays a sales commission of 5% of sales revenue to his sales staff. Homer also pays $12,000 a month rent for his factory and store, and also pays $75,000 a month to his staff in addition to the commissions. Homer sold 67,500 baseballs in June. If Homer prepares a contribution margin income statement for the month of June, what would be his contribution margin? Select one: a. $205,875 b. $334,125 c. $64,125 d. $270,000 e. $50,625arrow_forwardRoe manufactures and sells cloth facial masks. Per unit direct material and direct labor costs are $1 and $2 respectively. Other than these costs, Roe pays $1,000 for rent, $1,500 for the floor manager's salary, and recognizes $300 depreciation on the equipment every month. Roe sells each mask at $10. If Roe sells 500 masks, what would be Roe's total revenue and total costs? Group of answer choices Total revenue: 5,000; Total costs: 1,500 Total revenue: 5,000; Total costs: 4,300 Total revenue: 3,500; Total costs: 1,500 Total revenue: 3,500; Total costs: 2,800arrow_forward

- 1. Alva Nunez is a punch press operator for Drummond Machine Company. She earns $1.10 for every molding she presses. What is her total pay for a week in which she presses 310 moldings? 2. Lei Kurokideliv R e News. vers a weekarrow_forwardOriole Horticulture provides and maintains live plants in office buildings. The company's 934 customers are charged $38 per month for this service, which includes weekly watering visits. The variable cost to service a customer's location is $19 per month. The company incurs $2,432 each month to maintain its fleet of four service vans and $3,330 each month in salaries. Oriole pays a bookkeeping service $2 per customer each month to handle all invoicing and accounting functions.arrow_forwardWilliam Diesel owns the Fredonia Barber Shop. He employs 5 barbers and pays each a base salary of $1,510 per month. One of the barbers serves as the manager and receives an extra $580 per month. In addition to the base salary, each barber also receives a commission of $8.40 per haircut. Other costs are as follows. Advertising Rent Barber supplies Utilities Magazines William currently charges $18.00 per haircut. (a) Determine the unit variable costs per haircut and the total monthly fixed costs. (Round variable costs to 2 decimal places, e.g. 2.25.) Your answer is correct.. Total unit variable cost per haircut Total fixed costs (b) $300 per month $1,020 per month $0.45 per haircut $150 per month plus $0.15 per haircut $30 per month eTextbook and Media (d) V Your answer is correct. Break-even point Break-even point sales $ Compute the break-even point in sales units and in sales dollars. eTextbook and Media Your answer is incorrect. $ Net income $ $ 1070 19260 9 9630 haircuts Determine…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education