FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

help please and show all work thanks

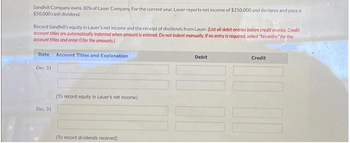

Transcribed Image Text:Sandhill Company owns 30% of Lauer Company. For the current year, Lauer reports net income of $250,000 and declares and pays a

$50,000 cash dividend.

Record Sandhill's equity in Lauer's net income and the receipt of dividends from Lauer. (List all debit entries before credit entries. Credit

account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the

account titles and enter O for the amounts)

Date Account Titles and Explanation

Dec. 31

Dec. 31

(To record equity in Lauer's net income)

(To record dividends received)

Debit

Credit

111

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Q:Write introduction 0% plagiarism please Not assignment just a service question. And huge thanks.arrow_forwardPlease also do parts 4 and 5 while showing work so that way I can understand better. Thank you.arrow_forwardHome * CengageNOWv2 | Online teachin x +. takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false eBook Show Me How E Print Item Flexible Budget for Selling and Administrative Expenses for a Service Company Digital Solutions Inc. uses flexible budgets that are based on the following data: Sales commissions 8% of sales Advertising expense 15% of sales Miscellaneous administrative expense $10,000 per month plus 4% of sales Office salaries expense $50,000 per month Customer support expenses $20,000 per month plus 30% of sales Research and development expense $75,000 per month Prepare a flexible selling and administrative expenses budget for October for sales volumes of $500,000, $750,000, and $1,000,000. (Use Exhibit 5 as a model.) Digital Solutions Inc. Flexible Selling and Administrative Expenses Budget For the Month Ending October 31 Total sales $500,000 $750.000 $1,000,000 Variable cost: Sales commissions Advertising expense Miscellaneous…arrow_forward

- Hi can you show how to input in excel using the pmt formula thank you so mucharrow_forwardAfter reading the relevant sections of E, Chapter 10: Define 'translation exposure'. Briefly discuss whether managers should focus on managing translation exposure, and why or why not.arrow_forwardI need help with B, C, D on the attached assignmentarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education